The Ultimate Guide to Client Invoicing: Steps & Best Tips

- What is Client Invoicing?

- Key Benefits of Client Invoicing

- How to Invoice a Client Smoothly and Accurately?

- When Should you Send Client Invoices?

- Advanced Client Invoicing Tips & Best Practices

- Maintain Professional Communication Throughout the Process

- Common Mistakes to Avoid in Client Invoicing

- Elevate Your Client Relationships with Seamless Invoicing

- FAQs about Client Invoicing

Key Highlights:

- Master client invoicing with clear templates, detailed service descriptions and company details for accurate as well as timely payments.

- Use automated payment reminders along with online payments to streamline billing, reduce delays and maintain strong client relationships.

- Avoid invoicing mistakes by understanding client preferences, reviewing invoices while leveraging billing tools for error-free processing.

Imagine waiting months for payment because your invoice lacked essential details or clients couldn’t understand your billing terms clearly.

Poor invoicing practices lead to awkward collection conversations and strained partnerships that could have been avoided with better preparation as well as systematic approaches.

Professional client invoicing transforms your billing process into a smooth systematic approach that ensures faster payments while strengthening business relationships. This comprehensive guide will teach you everything about creating effective invoices that protect your cash flow and showcase your professionalism.

What is Client Invoicing?

Client invoicing represents the formal process where businesses send detailed payment requests to their clients after delivering services or completing projects. Think of it as your professional way of saying “here’s what we accomplished together and here’s what you owe.”

The process begins when you complete work for a client and then create a detailed bill listing services provided along with associated costs. You send this document to your client through email or postal mail. The client reviews the invoice and processes payment according to the agreed terms as well as deadlines you established beforehand.

Key factors:

- Professional formatting: Your invoice should look clean and include all essential details like dates as well as payment terms.

- Clear payment terms: Specify exactly when payment is due and what methods you accept for settlement.

- Detailed service descriptions: List each service performed so clients understand exactly what they’re paying for.

- Accurate calculations: Double-check all math including subtotals and any applicable taxes or fees.

- Consistent follow-up system: Track which invoices remain unpaid and send polite reminders when necessary.

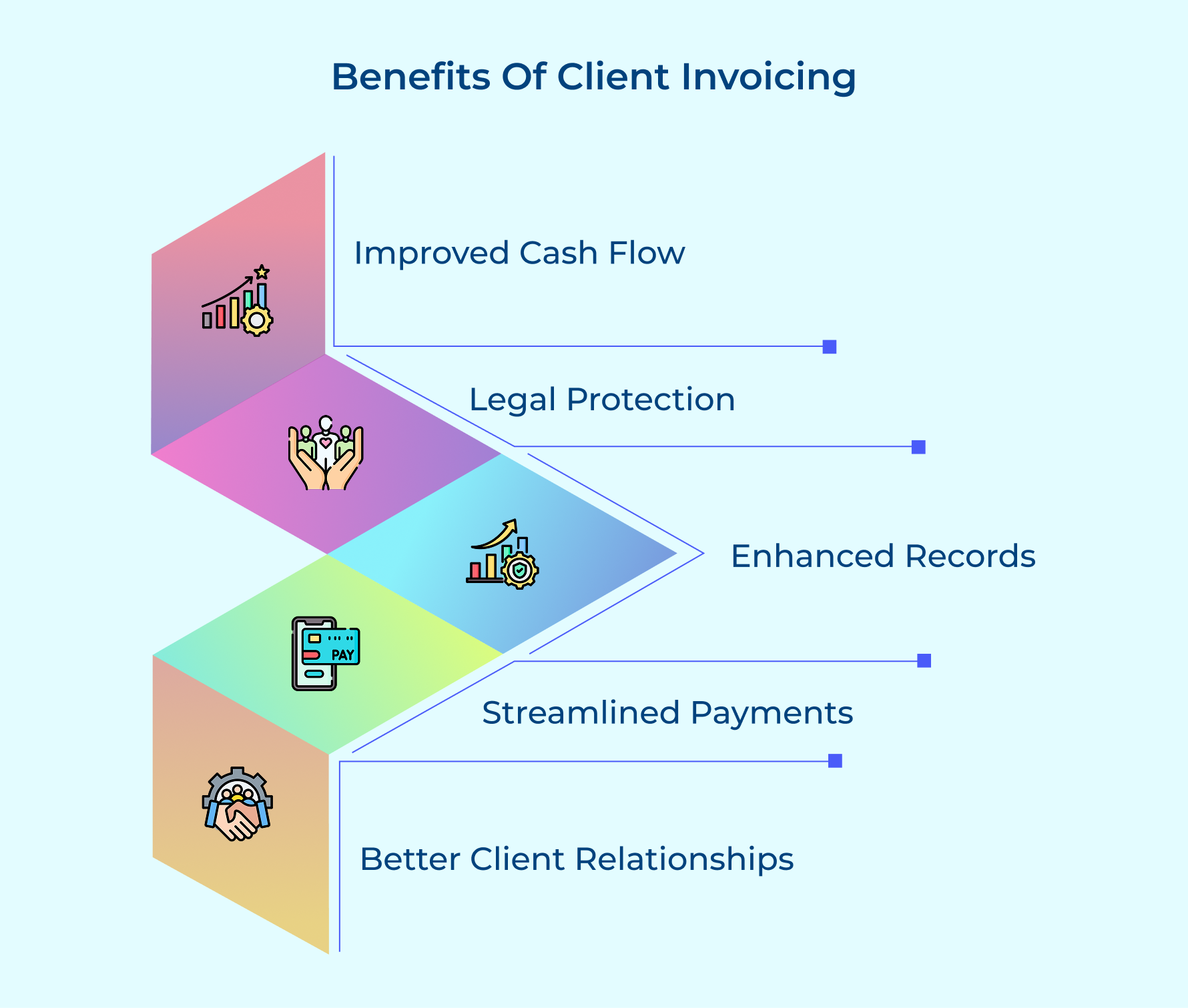

Key Benefits of Client Invoicing

Professional invoicing transforms how businesses manage their finances and build lasting relationships with clients. Let’s explore the key advantages that make it essential for any service-based business.

Improved Cash Flow Management

Small businesses that have structured invoicing makes cash flow far more predictable. Setting a clear invoice date for every project helps you forecast incoming revenue with accuracy. That visibility makes it easier to plan expenses, manage investments and keep operations steady throughout the month.

Legal Protection and Documentation

Invoices aren’t just paperwork, they’re legally binding records that protect small businesses in disputes. Documented terms, agreed services and tax rate details provide solid proof that courts recognize if payment issues arise.

Enhanced Record Keeping

Consistent invoicing builds a clear transaction history that simplifies tax season and financial reviews. Small businesses can easily track revenue sources, identify payment patterns and spot growth opportunities across client accounts.

Streamlined Payment Processing

Modern invoicing tools allow you to add a direct payment link, making online payments quick and hassle-free. Clear amounts, due dates and tax rate details reduce back-and-forth questions.

Better Client Relationship Management

Regular invoicing gives small businesses a consistent way to stay connected with clients beyond project delivery. Each invoice date acts as a touchpoint that keeps your services top of mind. Over time, this consistent communication can build stronger relationships that lead to repeat projects and referrals.

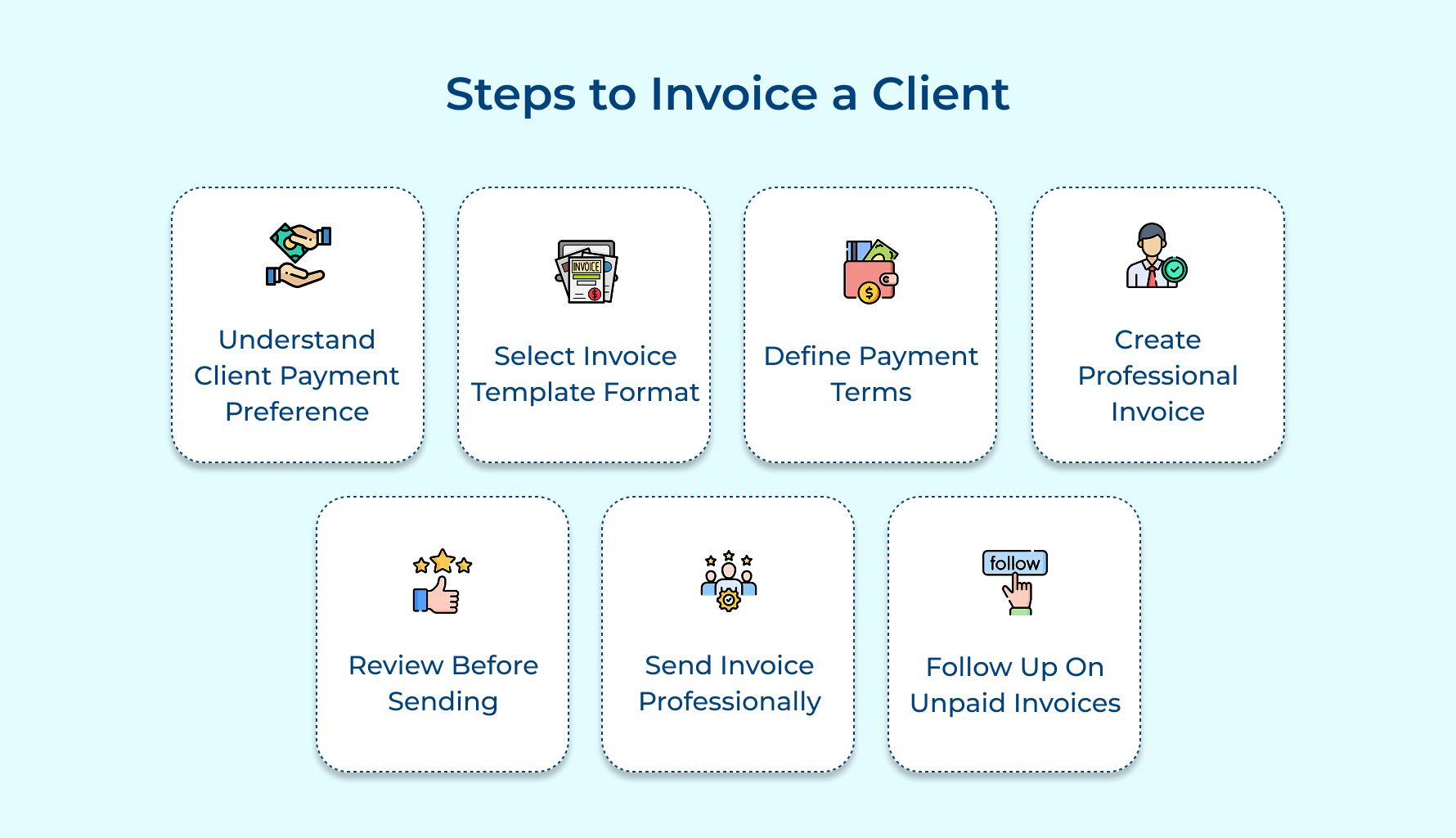

How to Invoice a Client Smoothly and Accurately?

Explore these seven straightforward steps to correctly invoice a client and watch your financial management become more efficient than ever before.

1. Gather All Essential Information

Getting your invoices right starts with having all the key information in one place. Missing company details or project records can delay payments and frustrate clients. That’s why organizing data upfront makes invoice generation smoother and error-free.

Here’s what you should always collect before creating an invoice:

- Company details: Full legal business name and the main billing contact person.

- Billing address: Complete mailing or office address to avoid delivery issues.

- Project scope: Clear description of services and deliverables.

- Time records: Accurate log of hours worked and dates for transparency.

- Rate agreement: Pre-approved hourly rates or project fees from the contract.

A simple folder system or digital billing tools can help you store contracts, project notes and client preferences. This way, every invoice you generate includes correct as well as complete information. Consistency here saves you from disputes later and makes the payment cycle far more predictable.

2. Understand How Clients Prefer Payment

Sending an invoice that doesn’t match your client’s process is one of the easiest ways to delay payment. Before you dive into invoice generation, take time to understand how their accounting system works. A quick chat upfront saves weeks of back-and-forth later.

Here are four key questions to ask:

- What billing tools or platforms does your accounting department already use?

- Do you prefer online payments (like bank transfers or cards) or paper checks?

- Are there specific formats or approval steps your team requires?

- What company details must be included to ensure smooth processing?

Having these answers lets you customize invoices so they fit seamlessly into your client’s workflow. For example, some may need a tax rate breakdown or a purchase order number before processing.

Being proactive shows your professionalism and respect for their systems. Plus, when invoices are easy to approve, clients are more likely to pay on time without reminders.

3. Choose Your Invoice Template Format

The way your invoice looks says a lot about your business. A clear, professional design not only speeds up approvals but also shows that you value accuracy and detail. The right invoice generation template ensures your documents meet legal requirements while staying easy for clients to read and process.

Here are five things to check when selecting a template:

- Visual branding: Include your logo, colors and key company details to look consistent and credible.

- Required elements: Make space for invoice numbers, tax rate and payment link.

- Readability: Use clean layouts where services, costs and payment terms are easy to find.

- Digital compatibility: Ensure your template works across email, PDFs and billing tools.

- Customization: Pick formats you can tweak for different client needs.

A cluttered or confusing invoice often delays approvals, but a clean format with the right details makes payments faster. Good design isn’t about looking pretty, it’s about getting paid on time.

4. Set Clear Payment Terms

Getting paid on time starts with setting expectations early. If your payment terms aren’t clear, clients may delay or dispute invoices simply because they don’t know when money is due. Adding terms directly into your contracts and every invoice generation ensures there’s no room for confusion.

Here’s what to include:

- Invoice date and due date (e.g., Net 15 or Net 30).

- Accepted payment methods, such as bank transfers, cards, or online payments.

- Any late fees or interest that apply after the grace period.

- Discounts for early payments if you want to encourage faster cash flow.

Modern billing tools also let you automate reminders, so clients get notified before due dates. This keeps things professional without constant manual follow-up.

Having consistent payment terms across all documents creates clarity and sets clear financial boundaries that protect your business. Clear rules make transactions smoother, reduce awkward conversations and strengthen client trust.

5. Create Professional Invoice Documents

An invoice isn’t just a bill, it’s a reflection of your professionalism. Clean, detailed invoice generation shows clients you take accuracy and transparency seriously. A well-prepared invoice reduces questions, speeds up approvals and keeps payments flowing smoothly.

Here are three essentials to include:

- Service breakdowns: Itemized descriptions of work completed, dates and costs. This prevents confusion and gives accounting teams clarity.

- Invoice numbers: A simple tracking system that helps both you and your client reference payments later.

- Company details & branding: Add your logo, contact info and tax rate for a polished look that stands out in their inbox.

Using modern billing tools makes this process easier, ensuring every invoice is consistent and error-free. You can even include a payment link to speed up online payments.

6. Review Before Sending Invoice Out

Before hitting send, give your invoice a final check. Even small mistakes (like a wrong tax rate or missing company details) can delay payments and hurt your credibility. A quick review ensures your invoice generation process stays smooth and professional.

Here’s a simple checklist to follow:

- Math accuracy: Double-check calculations, subtotals and tax amounts.

- Client information: Confirm names, addresses and billing contacts are up to date.

- Service details: Make sure descriptions, dates and rates match what was agreed.

- Presentation: Check formatting so the document looks clean and easy to read.

Using billing tools helps reduce errors since many automate calculations and track invoice dates for you. Still, a human review adds that extra layer of assurance.

When invoices go out error-free, they not only get processed faster but also show clients that your business values precision. That’s the kind of professionalism that builds trust and keeps payments coming on time.

7. Send Invoice to Client Professionally

How you deliver an invoice is just as important as creating it. A sloppy email or missing company details can make your invoice look unprofessional and slow down payment. Professional delivery shows you value the client relationship and makes the payment process effortless.

Here are three smart ways to send invoices:

- Email with polish: Send invoices as PDFs with clear subject lines (e.g., “Invoice #105 – [Your Company Name]”). Always include your logo and professional signature.

- Personalized cover message: Add a short note thanking the client and referencing the project. This small touch turns a bill into friendly communication.

- Receipt confirmation: Follow up within 24–48 hours to ensure the invoice was received and to answer any questions.

Modern billing tools make this easier with built-in delivery options and payment links for quick online payments. This smooth process builds trust and helps clients pay on time without confusion.

8. Follow Up on Outstanding Invoices

Even with clear terms and polished invoice generation, some payments still slip through the cracks. That’s where follow-ups come in. A structured approach keeps your cash flow healthy while showing clients you’re serious about timely payments.

Here’s how to make it work:

- Set a timeline: Send a friendly reminder a few days after the due date, then increase urgency if delays continue.

- Use automatic payment reminders: Most modern billing tools can handle this for you, so you’re not chasing clients manually.

- Keep it professional: Stay polite and solution-focused, most late payments are oversights, not refusals.

- Reference details: Include the invoice date, number and a direct payment link so clients can act quickly.

Consistent follow-ups protect your revenue while keeping things from becoming awkward. Instead of waiting and hoping, you take control of the process while maintaining good client relationships. That balance of firmness and professionalism ensures your business runs smoothly.

When Should you Send Client Invoices?

Timing your invoice delivery correctly can significantly impact your payment speed and cash flow management. Understanding the optimal moments to send invoices helps you maintain professional relationships while ensuring steady revenue streams.

Immediately After Project Completion

Send digital invoices within 24–48 hours of completing a project to make the most of client satisfaction and project momentum. Since the value of your work is still fresh, approvals usually happen faster and payments move through without unnecessary delays.

At Predetermined Milestone Intervals

Longer projects will need you to break billing into phases and send invoices at agreed milestones. This approach ensures steady cash flow and makes costs easier for clients to manage. Using recurring invoices at checkpoints can streamline the process and save you time.

On Specific Monthly Billing Dates

If you’re handling retainer work, set fixed monthly billing dates. Predictable schedules help clients plan budgets and give you a smooth routine for administration. Automated recurring invoices make this even easier.

Before Major Holiday Periods

Send invoices at least two weeks before holidays when accounting teams are short-staffed. Early digital invoices get processed quickly and avoid sitting idle in inboxes. This proactive timing keeps your cash flow steady even when offices close for extended breaks.

During Client’s Preferred Payment Cycles

Some clients have strict accounting cycles. Align your invoice timing with their process and include options like digital wallets for quicker approvals and payments. Meeting them on their schedule shows flexibility and strengthens your long-term business relationship.

When Cash Flow Requires Acceleration

If your business needs faster cash flow, send invoices earlier than planned. Leveraging digital tools and payment links ensures you get paid promptly without straining client relationships. This flexibility gives you more control over financial stability during crunch periods.

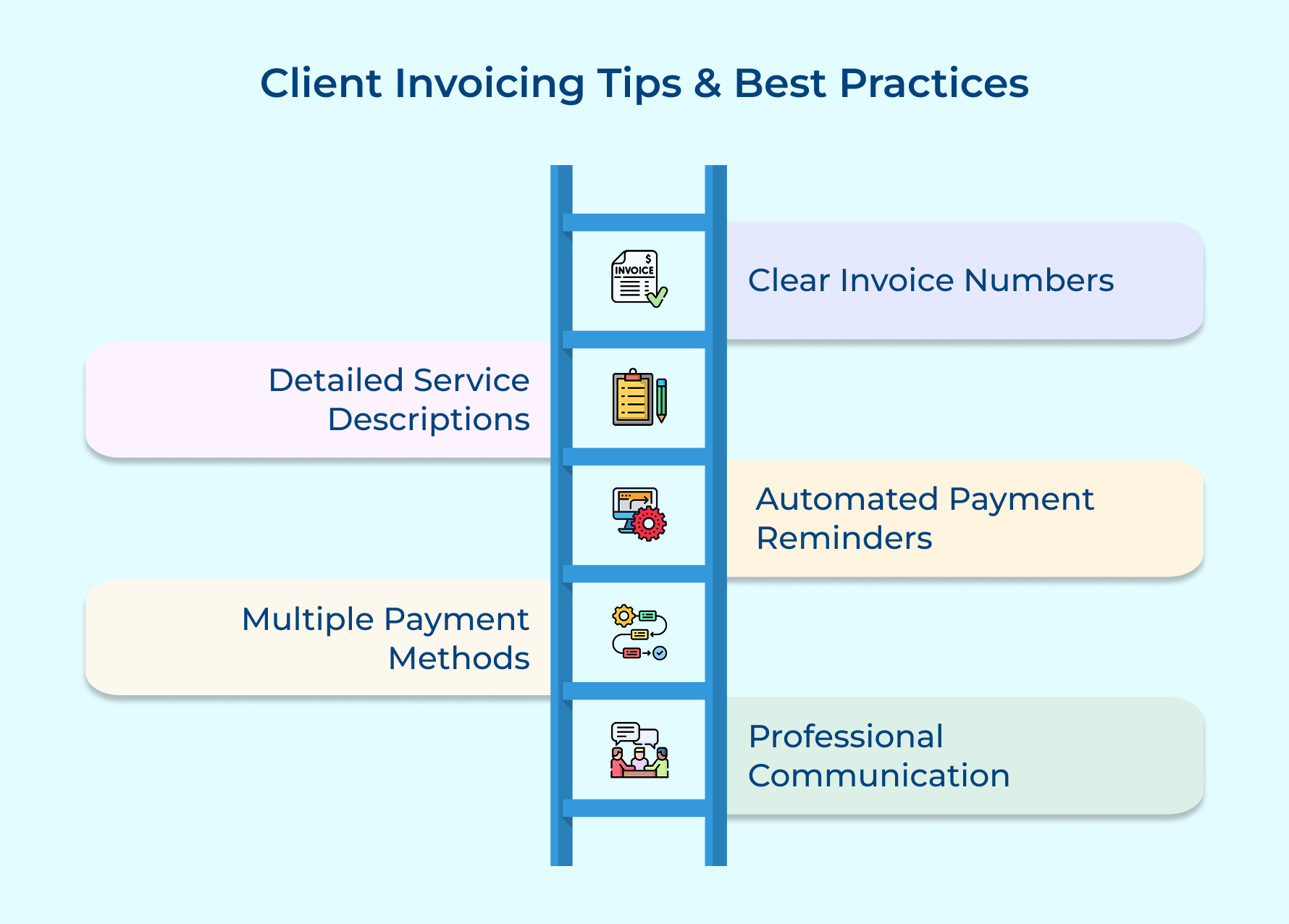

Advanced Client Invoicing Tips & Best Practices

Mastering invoicing fundamentals is just the beginning of building an efficient billing system. These advanced strategies will help you create smoother payment experiences for both you and your clients.

Use Clear Invoice Numbers and Reference Systems

Sequential invoice numbering creates an organized tracking system that prevents confusion during future conversations. Think of invoice numbers as unique identifiers that transform chaotic billing records into organized documentation that accounting departments can process easily.

Consider these organizational approaches that successful businesses use:

- Incorporate the year into numbering to separate invoices by fiscal periods

- Add client abbreviations to quickly identify which business each invoice represents

- Include project codes when managing multiple assignments for the same client

Professional reference systems eliminate frustration when searching for specific transactions during tax season or client disputes.

Include Detailed Descriptions for Each Service Line

Service descriptions help clients understand exactly what value they received for their investment. Vague line items like “consulting work” create confusion as well as may delay payment approval since accounting departments cannot categorize unclear expenses properly.

Transform generic descriptions into specific value statements that showcase meaningful work completed during each billing period. Instead of writing “marketing services” specify “social media content creation for Facebook and Instagram campaigns targeting local demographics.”

Set Up Automated Payment Reminders

Automated reminder systems function as your virtual assistant maintaining consistent follow-up without consuming valuable time or mental energy. These systems send polite payment reminders at predetermined intervals which helps maintain relationships while protecting cash flow.

Consider reminder schedules that escalate gradually from friendly notifications to urgent communications based on overdue periods:

- Initial friendly reminders maintain positive relationships while addressing simple oversights

- Progressive escalation shows professionalism while protecting your business interests

- Consistent timing eliminates emotional stress of deciding when to contact clients

Automated systems remove awkwardness from collection activities because clients understand that reminders represent standard procedures rather than personal confrontations.

Offer Multiple Payment Methods for Convenience

Offering flexible payment methods shows great customer service and makes it easier for clients to pay on time. Every client has different preferences depending on their accounting processes and cash flow habits, so giving them options helps speed up collections.

Businesses currently expect choices, from traditional checks to digital wallets and online platforms that process payments instantly while keeping automatic records. Letting clients pick the method that fits their workflow, instead of forcing them to adapt to yours, makes the whole process smoother for everyone.

Maintain Professional Communication Throughout the Process

Professional communication represents the foundation supporting all successful client relationships and directly impacts how quickly invoices receive payment approval. Your tone during billing interactions influences whether clients view you as a trusted partner or simply another vendor.

Consider every invoice-related communication as an opportunity to reinforce your professional reputation and strengthen relationships that generate repeat work:

- Express appreciation for their business partnership in invoice cover messages

- Use respectful language even when following up on significantly overdue payments

- Provide clear contact information and encourage questions about billing details

Common Mistakes to Avoid in Client Invoicing

Even experienced business owners can fall into common invoicing traps that damage cash flow and strain client relationships. Understanding these pitfalls helps you build a stronger billing process.

Sending Invoices with Incomplete Information

Missing details like project descriptions or contact information create confusion that delays payment processing as well as frustrates accounting departments. When clients cannot quickly understand what they are paying for they often set invoices aside until later.

Using Vague or Generic Service Descriptions

Generic line items such as “consulting services” fail to communicate the specific value you delivered during the engagement. Accounting teams struggle to categorize these expenses properly which can lead to payment delays while they seek additional clarification.

Ignoring Client Payment Preferences and Processes

Failing to accommodate client payment methods or internal approval workflows creates unnecessary friction that can significantly extend your collection timeline. Each organization has established procedures and forcing them to adapt often results in delayed payments.

Neglecting to Follow Up on Overdue Payments

Assuming that clients will automatically pay on time without reminders often leads to extended payment delays that hurt cash flow. Many overdue payments result from simple oversight rather than intentional avoidance but require gentle nudging.

Here are practical solutions that address each of these common invoicing mistakes and help you build more effective billing processes.

- Create detailed invoice templates that include all required fields and information to ensure completeness every time you bill clients.

- Develop specific service description templates that clearly explain the value and scope of work completed for each type of project you handle.

- Research each client’s payment preferences during project setup conversations and adapt your invoicing methods to match their internal requirements as well as timelines.

- Implement automated reminder systems with escalating follow-up schedules that maintain consistent communication about overdue invoices without requiring daily manual effort.

- Use invoice review checklists and digital tools with built-in calculation features to catch errors before sending bills to clients for payment processing.

Elevate Your Client Relationships with Seamless Invoicing

Professional client invoicing transforms routine billing into relationship-building opportunities that strengthen trust and demonstrate your commitment to excellent service. When you master these invoicing fundamentals you create positive touchpoints that keep clients satisfied throughout your business partnership.

Implementing these strategies protects your cash flow while showcasing the organizational skills that clients value in long-term business relationships. Remember that every invoice represents your professionalism and attention to detail which directly influences future collaboration opportunities.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Shivank Kasera is part of the marketing team at Kooper, where he focuses on building content that helps agencies and service providers grow. With a keen interest in SaaS, operations, and scalability, he translates practical insights into actionable resources for business leaders.