How to Bill a Client Faster: Agency Invoicing Best Practices

- What is Client Billing?

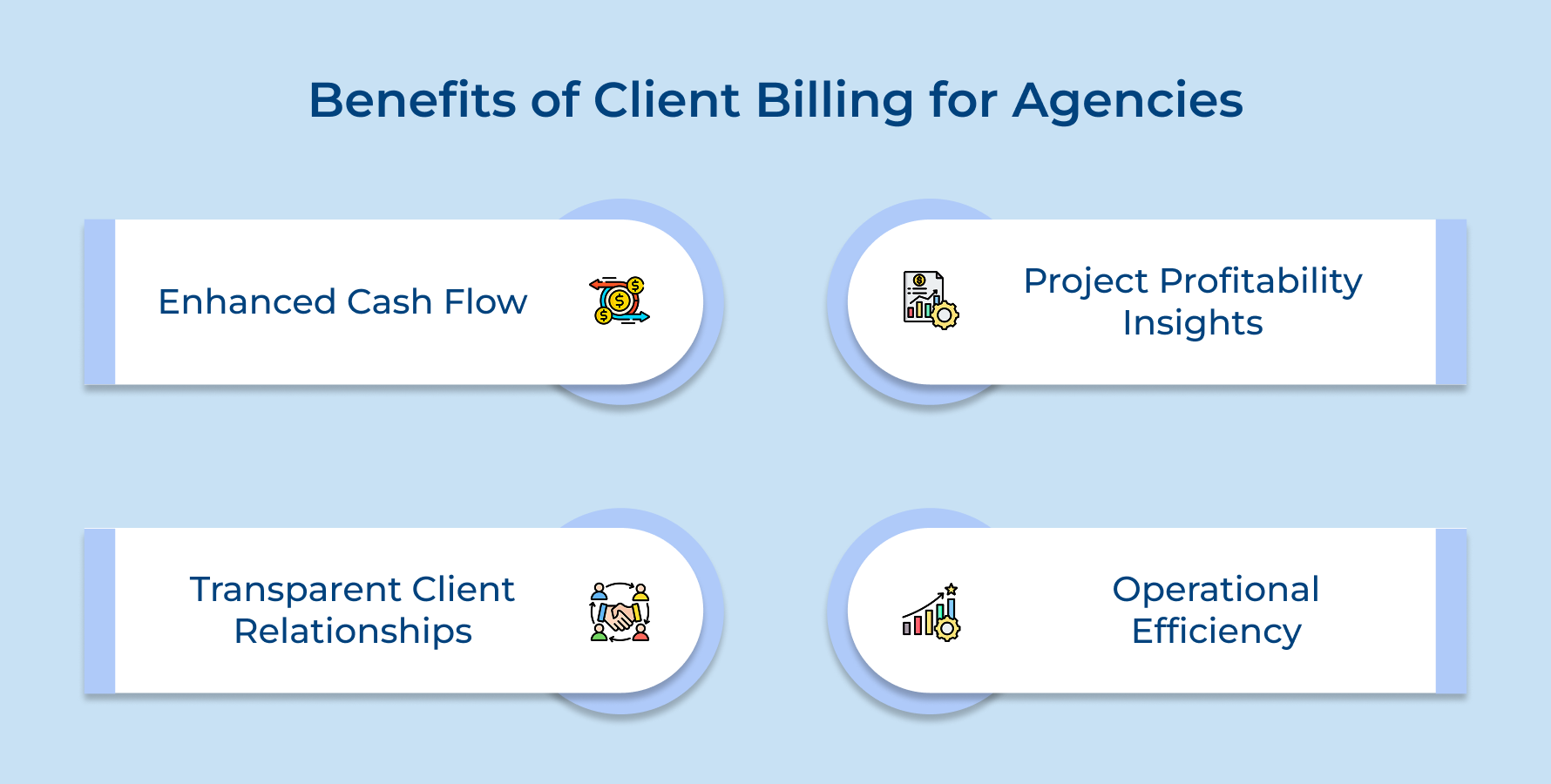

- Benefits of Client Billing for Agencies

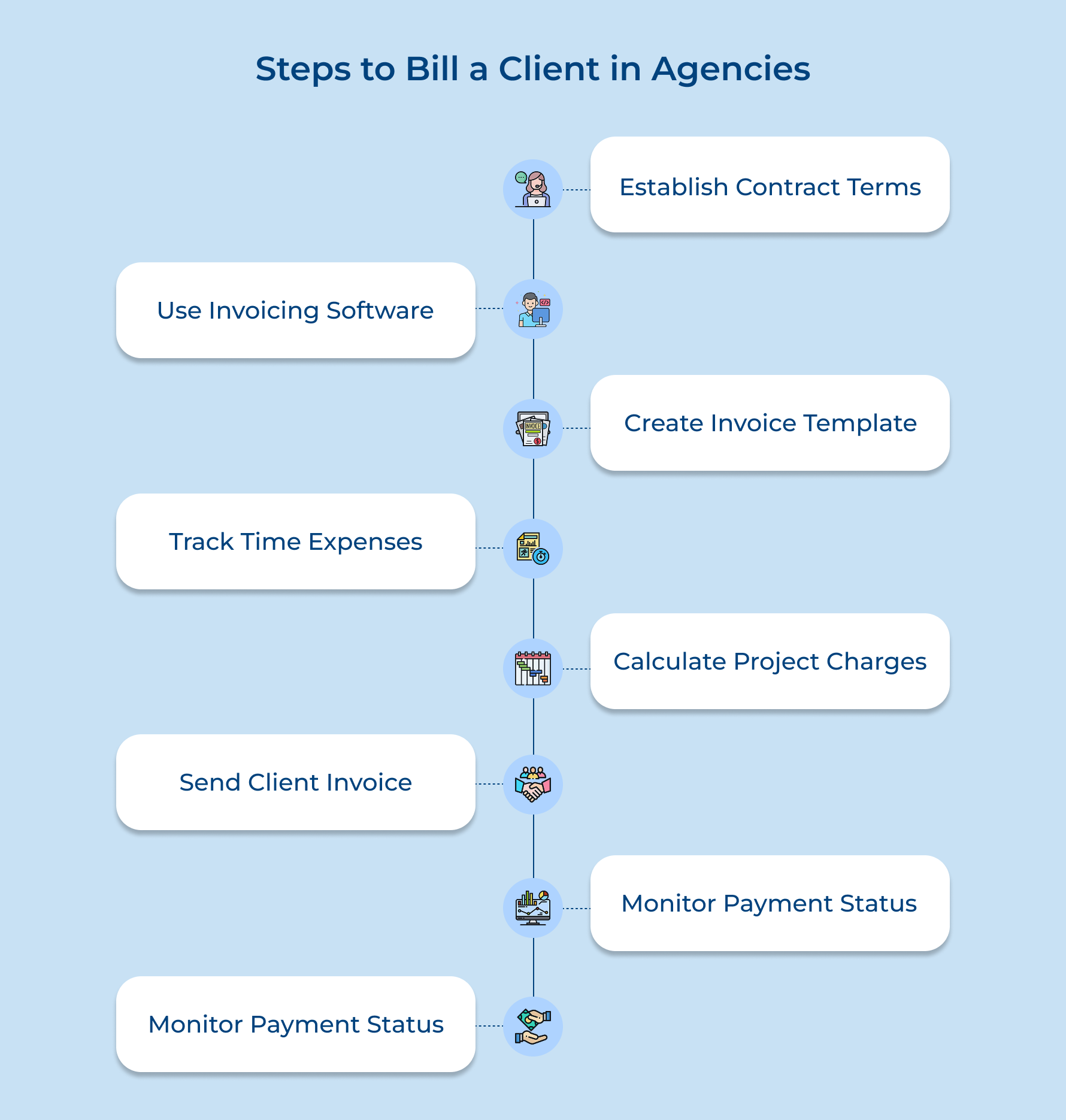

- 8 Practical Steps for Learning How to Bill a Client Correctly

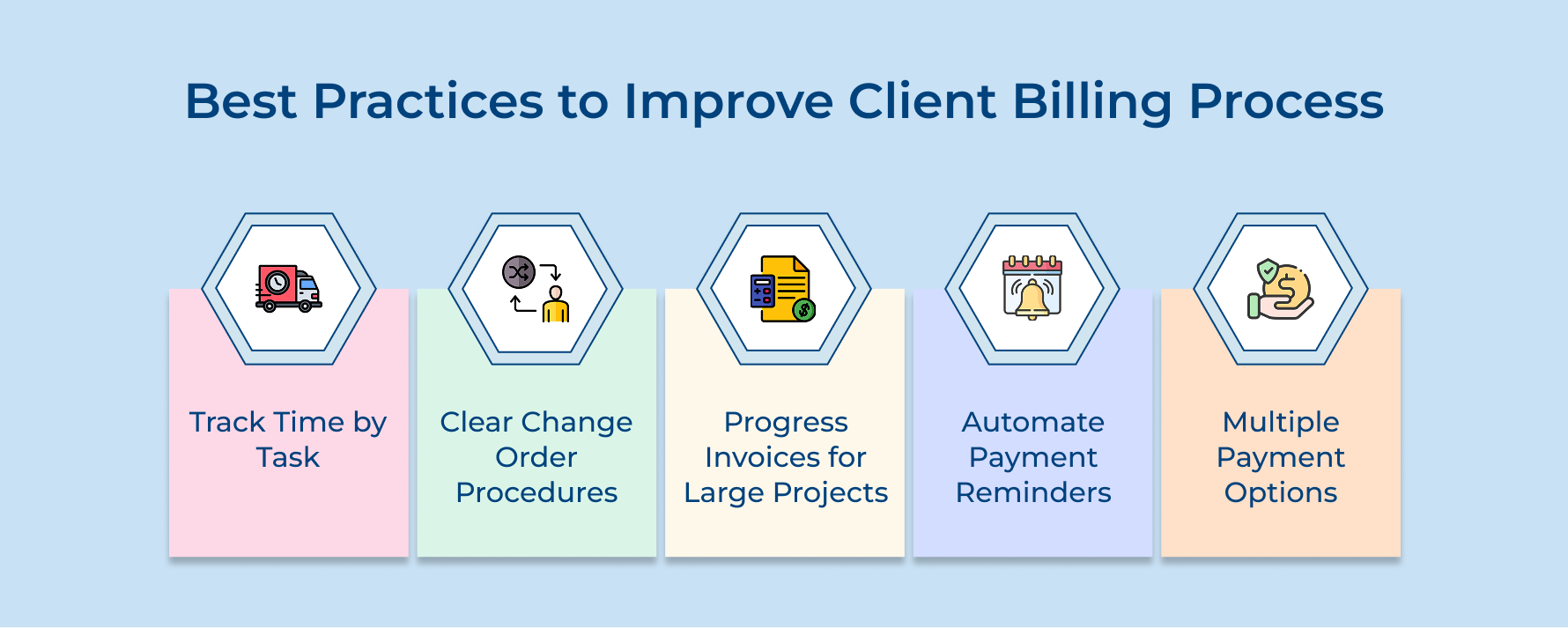

- Best Practices to Improve the Client Billing Process

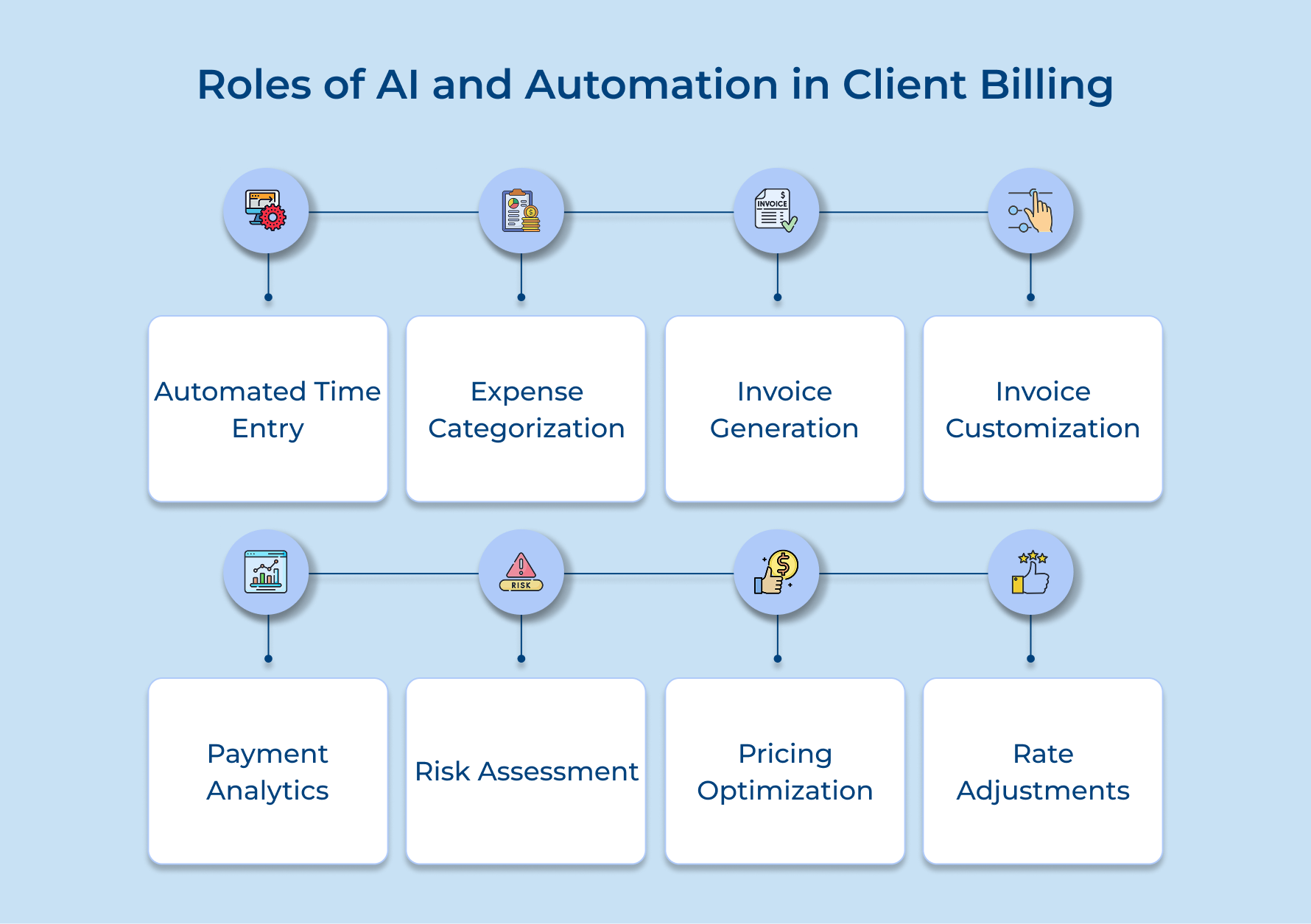

- Roles of AI and Automation in Client Billing

- Common Client Billing Mistakes You Should Avoid

- How to Bill a Client – Simplify Your Invoicing, Amplify Your Success

- FAQs about How to Bill a Client

Key Highlights:

- Transparent client billing ensures steady cash flow, prevents disputes and strengthens trust in long-term agency relationships.

- Automate reminders, track time by task and offer flexible payment methods to speed up collections.

- Use automation, detailed invoicing and proactive follow-ups to simplify billing, reduce errors while improving overall agency profitability.

Many agencies face delayed payments and billing disputes that hurt cash flow while putting client relationships at risk. Complicated invoicing often confuses clients, while manual tracking causes missed billable hours and lost revenue.

Every day without a proper billing system costs your agency money. On top of that, poor billing practices can make you look unprofessional and pile extra admin work on your team, taking focus away from client projects.

How to build a client, you ask? This guide is exactly what you need. It shows how to turn your billing into a simple, transparent system that gets you paid faster and builds client trust. You’ll learn proven strategies professional service firms use to streamline invoicing, boost cash flow and keep clients satisfied.

What is Client Billing?

Client billing is the systematic process of invoicing clients for professional services rendered by agencies, consultancies and service firms. It involves tracking time spent on projects, calculating fees based on agreed rates or project scope and generating invoices that detail the work completed.

Professional service firms track billable hours or project milestones throughout client engagements using time-tracking software or project management tools. They apply predetermined hourly rates or fixed fees to calculate total charges. The billing team then generates detailed invoices showing work performed and submits them to clients according to agreed payment terms.

Key objectives:

- Accuracy and transparency: Record every billable hour and expense correctly. Give clients a clear breakdown of the work done and the costs involved.

- Timely cash flow: Send invoices quickly after completing work. This keeps revenue steady and shortens the gap between service delivery as well as payment.

- Client relationship preservation: Use clear and honest billing practices. This builds trust and avoids disputes or confusion about charges.

- Operational efficiency: Simplify the billing process to cut down admin work. This also reduces errors that cause payment delays or unhappy clients.

- Profitability optimization: Compare project costs with billing rates. This helps you see which services and clients give you the best margins for smarter decisions.

Benefits of Client Billing for Agencies

Effective client billing transforms how professional service firms operate and grow their businesses sustainably.

Enhanced Cash Flow Management

Systematic billing creates steady revenue by setting regular payment cycles and cutting collection delays. Firms can forecast income better and make smarter choices about investments, hiring, growth, etc.

Improved Project Profitability Analysis

Detailed billing records reveal which services, clients and team members generate the highest returns on investment. This visibility helps agencies optimize their service offerings, adjust pricing strategies and allocate resources to the most profitable activities while identifying underperforming areas.

Stronger Client Relationships Through Transparency

Clear, itemized invoices build trust by showing clients exactly what work was performed and how their investment was utilized. This transparency reduces billing disputes, demonstrates value delivery and creates opportunities for meaningful conversations about project scope as well as future needs.

Operational Efficiency and Time Savings

Automated billing processes eliminate manual data entry, reduce administrative overhead and free up valuable time for revenue-generating activities. Teams can focus on client work rather than chasing payments or reconciling billing discrepancies, leading to higher overall productivity.

8 Practical Steps for Learning How to Bill a Client Correctly

Here’s a comprehensive 8-step process designed on how to bill and invoice clients. Explore how it simplifies and enhances your agency’s client billing system.

1. Establish Contract Terms and Expectations

The first step to how to bill a client is setting clear contract terms. This prevents disputes and makes sure both you as well as your client know what to expect. Strong agreements also protect your revenue and set professional boundaries, which makes billing much easier.

It’s equally important to define the project scope and deliverables upfront. This way, there’s no confusion about what gets billed. When tasks are clearly listed, clients know exactly what they’re paying for and you can avoid scope creep.

Payment terms and invoice schedules also keep your cash flow steady. They spell out when and how you’ll be paid. For example:

- Weekly invoicing works well for short projects that need quick payments.

- Monthly invoicing is a great fit for retainers or ongoing projects.

- Quarterly invoicing suits milestone-based or high-value consulting work.

Be clear about your pricing structure. Whether you charge hourly rates or fixed pricing, clarity avoids confusion and helps clients plan their budgets. It also makes invoice generation faster since you won’t be negotiating fees after the work is done.

2. Choose an Invoicing System

An invoicing system makes billing easier by automating repetitive tasks and keeping your financial records organized. The right system saves time, reduces errors and leaves a professional impression that builds client trust.

Professional service firms usually pick an invoicing method that fits their needs best:

- Manual invoicing with templates: You create invoices in Word or Excel and fill them out for each client. It works for small firms but quickly becomes time-consuming as your business grows.

- Cloud-based invoicing software: These tools automate invoice creation, track time and even process payments. They can handle recurring invoices and send reminders, cutting down your admin work.

- Enterprise resource planning (ERP) systems: These integrate billing with project management and accounting. Large agencies benefit because all financial and operational data connect in one place.

For example, one marketing agency switched from Excel to cloud-based software and cut their invoicing time from four hours to just thirty minutes a week. The system also improved collections by sending automatic reminders, so payments came in faster without extra effort.

3. Design Custom Invoice Template Format

A professional invoice template keeps your billing consistent and reinforces your brand every time you send it to a client. A well-designed template also speeds up payments by including all the details clients need, reducing confusion as well as back-and-forth questions.

When creating your template, ask yourself: Does this invoice clearly show the value delivered? Could someone new in the client’s accounting team easily understand it? Are payment instructions clear and simple to follow?

Your template should include a few key elements:

- Branding and header: Add your logo and contact details to look professional as well as build recognition.

- Invoice number: Use a unique, sequential system for easy tracking.

Service details and dates: Clearly describe the work and when it was done. - Payment terms: State due dates and accepted payment methods.

- Footer info: Add tax IDs or other legal details.

The biggest challenge with custom templates is consistency. Solve this by setting clear guidelines on how to describe services and using approval steps before invoices go out.

4. Track Billable Time and Expenses

Time and expense tracking captures every billable moment as well as cost associated with client work to ensure accurate invoicing. Without systematic tracking, agencies lose revenue from unrecorded hours and forget to bill legitimate project expenses that reduce profit margins.

Effective tracking involves logging hours immediately after completing tasks rather than trying to reconstruct time weeks later during invoice preparation. Use digital tools that sync across devices so team members can record time if they’re in meetings or working remotely from different locations.

Pro tips:

- Start your timer before beginning any client task to capture the complete time investment accurately.

- Take photos of receipts immediately and categorize expenses by client to streamline the billing process later.

5. Calculate Total Project Charges Properly

Charge calculation transforms tracked time and expenses into accurate invoice amounts that reflect the true value delivered to clients. Precise calculations prevent revenue loss from mathematical errors and ensure you’re fairly compensated for all work performed during the billing period.

These four critical questions ensure accurate project charge calculations:

- Have all billable hours been accounted for across team members?

- Are the correct hourly rates applied based on contract agreements?

- Have all project-related expenses been included and properly documented?

- Do the total charges align with any agreed-upon budget caps or minimums?

Answering these questions systematically prevents common billing errors that lead to disputes or lost revenue opportunities. Implementation begins by gathering all time entries and expense records for the billing period then applying agreed-upon rates while double-checking contract terms for any special pricing arrangements.

6. Generate Detailed Professional Client Invoice

Invoice generation is the process of creating a formal billing document that shows the work you’ve completed and requests payment from your client. A clear, professional invoice builds trust by highlighting the value delivered and makes it easier for your client’s accounting team to process payments without confusion.

To create an effective invoice, make sure you:

- Double-check client contact details and billing addresses.

- Provide clear descriptions of the services with specific dates or hours.

- Apply the right taxes and itemize all charges for full transparency.

- Proofread everything before sending to avoid errors and maintain professionalism.

It’s also important to send invoices on the agreed schedule. This keeps your cash flow steady and shows clients you’re reliable. Consistency helps their accounting team plan payments smoothly within their budget cycle.

7. Monitor Payment Status and Delivery

Payment monitoring means keeping track of when invoices are sent, received and paid. It’s one of the most critical steps for agencies because it affects cash flow directly. By monitoring payments closely, you can spot issues early and maintain good client relationships through proactive communication.

Here are some smart ways to track payments:

- Automated dashboards: Show real-time status of invoices and send alerts for overdue bills.

- Client communication logs: Keep a record of payment-related emails, calls, or meetings to understand client behavior and follow up with context.

- Accounts receivable reviews: Check outstanding invoices weekly or biweekly to prioritize collections and detect early signs of client financial trouble.

One common mistake? Assuming late payments are intentional. Sometimes invoices never reach the right person and they sit in the wrong inbox for weeks. Always confirm delivery to avoid unnecessary delays.

8. Follow Up on Outstanding Payments

Payment follow-up involves systematic communication with clients about overdue invoices to secure payment while preserving professional relationships. This step becomes necessary because even the best clients occasionally overlook invoices or experience internal processing delays that require gentle reminders.

Effective follow-up begins with polite inquiry emails sent shortly before due dates then escalates gradually through phone calls and formal collection letters. The key lies in maintaining a professional tone while being persistent enough to secure payment within reasonable timeframes.

Consider these proven phrases that agencies should use when following up on client payments:

- “I wanted to check on the status of invoice #[number] which was due on [date] – please let me know if you need any additional information.”

- “Our records show that payment for invoice #[number] is now [X] days past due – can we discuss a timeline for resolution?”

- “I’m following up on our outstanding invoice from [date] and wanted to ensure it reached the appropriate person in your accounting department.”

- “We value our working relationship and want to resolve this payment matter quickly – what steps can we take to move this forward?”

Best Practices to Improve the Client Billing Process

These proven strategies help agencies streamline their billing operations while strengthening client relationships and accelerating payment collection.

1. Implement Time Tracking at the Task Level

Instead of logging only total project hours, track time for specific tasks like research, strategy, or client calls. This gives clients a clear breakdown on invoices and helps your team see which tasks take the most effort while delivering the most value.

2. Establish Clear Change Order Procedures

Always have a written approval process for scope changes. Communicate extra costs right away before starting additional work. This avoids billing disputes and prevents clients from being surprised by unexpected charges later.

3. Send Progress Invoices for Large Projects

For long projects, bill in stages tied to milestones instead of sending one big invoice at the end. This keeps cash flow steady and avoids overwhelming clients with large lump-sum payments.

4. Automate Payment Reminders and Follow-ups

Set up email reminders that go out before due dates and follow up if payments are late. Automation saves time, ensures consistency and keeps communication professional.

5. Offer Multiple Payment Options and Incentives

Let clients pay by credit card, bank transfer, or online portals. You can also offer early payment discounts. This flexibility makes it easier for clients to pay and helps you get paid faster.

Roles of AI and Automation in Client Billing

AI and automation are transforming how professional service firms handle billing operations by reducing manual work and improving accuracy. Consider these fundamental questions before adopting automated billing technologies:

- What specific billing tasks consume the most time and create the highest error rates in your current process?

- How will AI integration affect your existing client relationships and their expectations for personalized service?

- What level of human oversight do you need to maintain for compliance and quality control purposes?

- Which billing data points provide the most valuable insights for improving your agency’s profitability and efficiency?

Automated Time Entry and Expense Categorization

AI can track billable time automatically from calendars, emails and project tools. It also categorizes expenses based on patterns. This reduces manual errors and ensures no billable hours are missed.

Intelligent Invoice Generation and Customization

AI creates invoices tailored to each client by learning their preferences, contracts and payment history. It keeps invoices professional and consistent while adapting automatically without extra effort.

Predictive Payment Analytics and Risk Assessment

AI reviews client payment behavior to predict which invoices may be delayed. It can also flag clients showing financial risks, giving agencies time to adjust payment terms before issues arise.

Dynamic Pricing Optimization and Rate Adjustments

AI evaluates market rates, project complexity and past profit data to suggest better pricing strategies. This helps agencies stay competitive and grow revenue with data-backed decisions.

Common Client Billing Mistakes You Should Avoid

Even experienced agencies fall into predictable billing traps that damage client relationships and hurt cash flow. Understanding these common pitfalls helps you build stronger billing processes that protect your revenue and maintain professional credibility.

Inconsistent Time Tracking and Delayed Entry

Agencies often lose revenue when team members log hours from memory days later. Important billable work gets missed, leading to underreported time on invoices.

Vague Service Descriptions and Unclear Value Communication

Invoices with vague terms like “consulting” or “project work” cause confusion. Clients need clear details about deliverables and outcomes to see the value of what they’re paying for.

Ignoring Payment Terms and Inconsistent Follow-up

Many agencies send invoices but don’t enforce payment deadlines. Without regular follow-ups, clients assume due dates are flexible and delay payments.

Poor Documentation and Missing Expense Tracking

Teams often forget to log travel costs or software purchases on time. Later, trying to rebuild records from receipts leaves gaps, reducing billable amounts and profit.

These proven strategies address the root causes of billing problems rather than just treating symptoms.

- Implement daily time tracking with automatic reminders to ensure accurate hour capture before memory fades

- Create standardized service descriptions that clearly communicate value delivered and outcomes achieved for each billable activity

- Establish automated payment reminder systems with escalating follow-up procedures for overdue accounts

- Use expense tracking apps that capture receipts instantly and categorize costs by client automatically

- Conduct weekly billing reviews to catch errors early and ensure all work gets properly documented

How to Bill a Client – Simplify Your Invoicing, Amplify Your Success

Effective client billing serves as the financial backbone of professional service firms because it directly converts expertise into sustainable revenue streams. Without systematic billing processes, agencies risk cash flow problems and client disputes that can threaten business stability.

For agencies wondering how to bill a client effectively, the answer lies in creating streamlined billing systems. Professional service businesses improve profitability by reducing administrative overhead and strengthening client relationships through transparent communication. These improvements build predictable revenue patterns that support strategic growth and enhanced service delivery.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Shivank Kasera is part of the marketing team at Kooper, where he focuses on building content that helps agencies and service providers grow. With a keen interest in SaaS, operations, and scalability, he translates practical insights into actionable resources for business leaders.