What is Project Billing? A Guide to Process & Best Practices

- What is Project Billing?

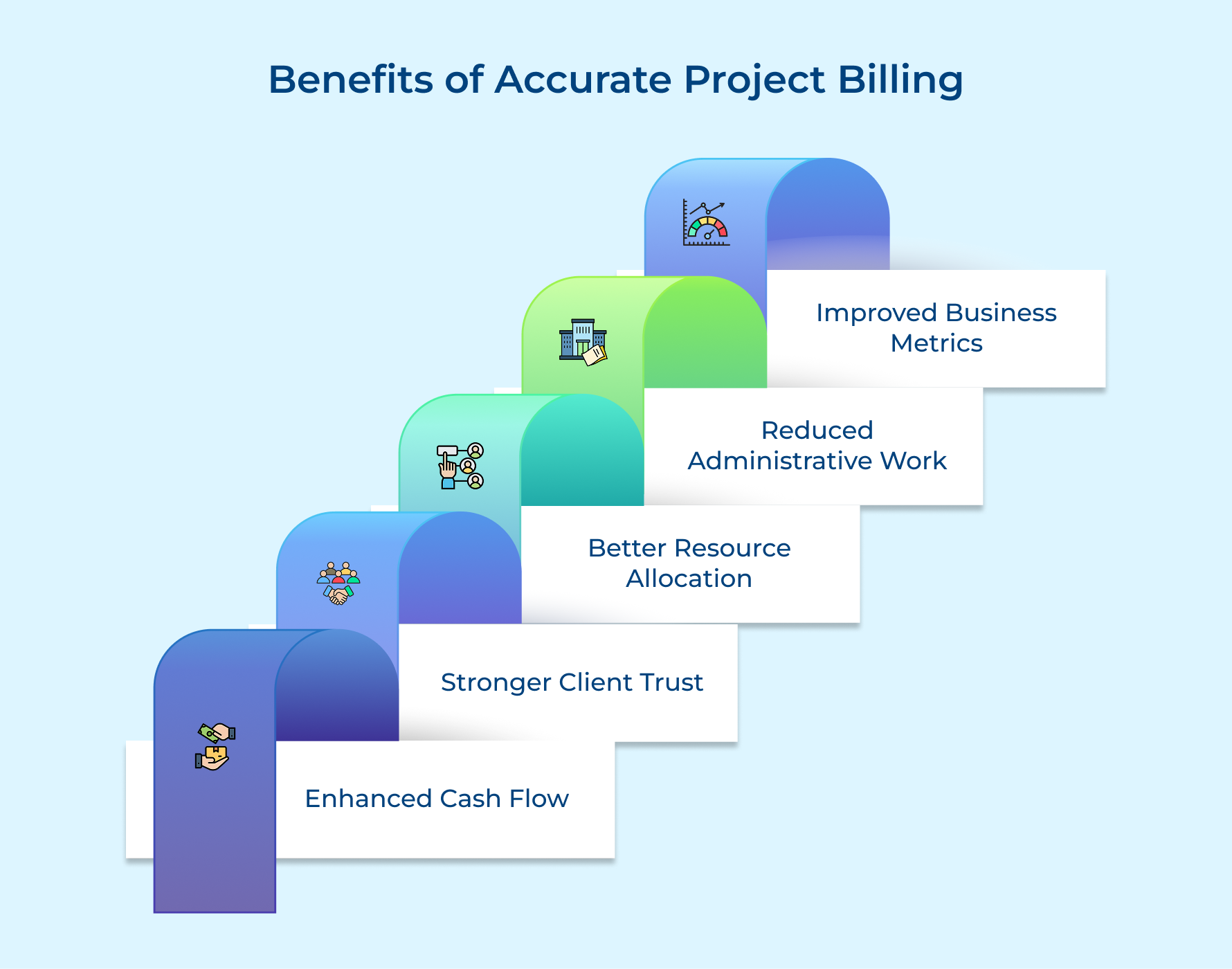

- Benefits of Accurate Project Billing

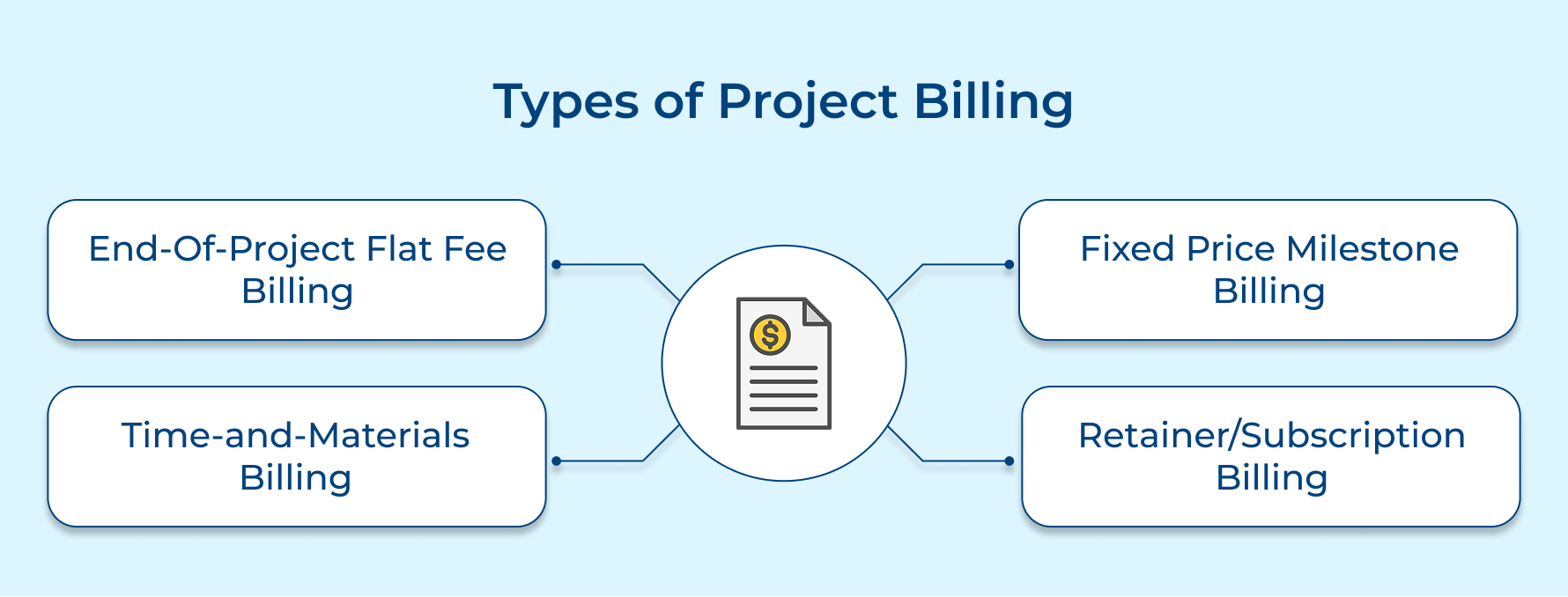

- Types of Project Billing

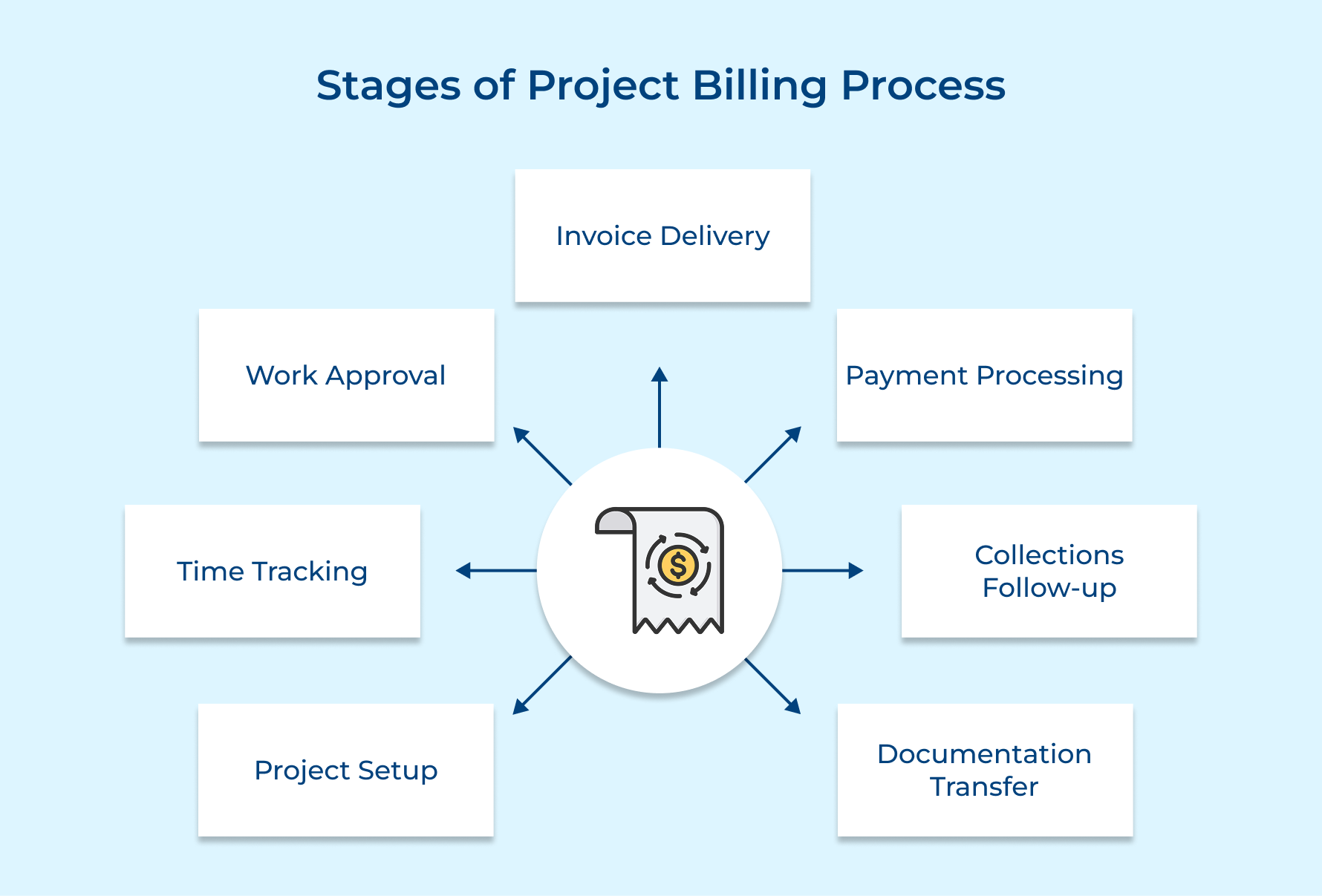

- Stages of Project Billing Process

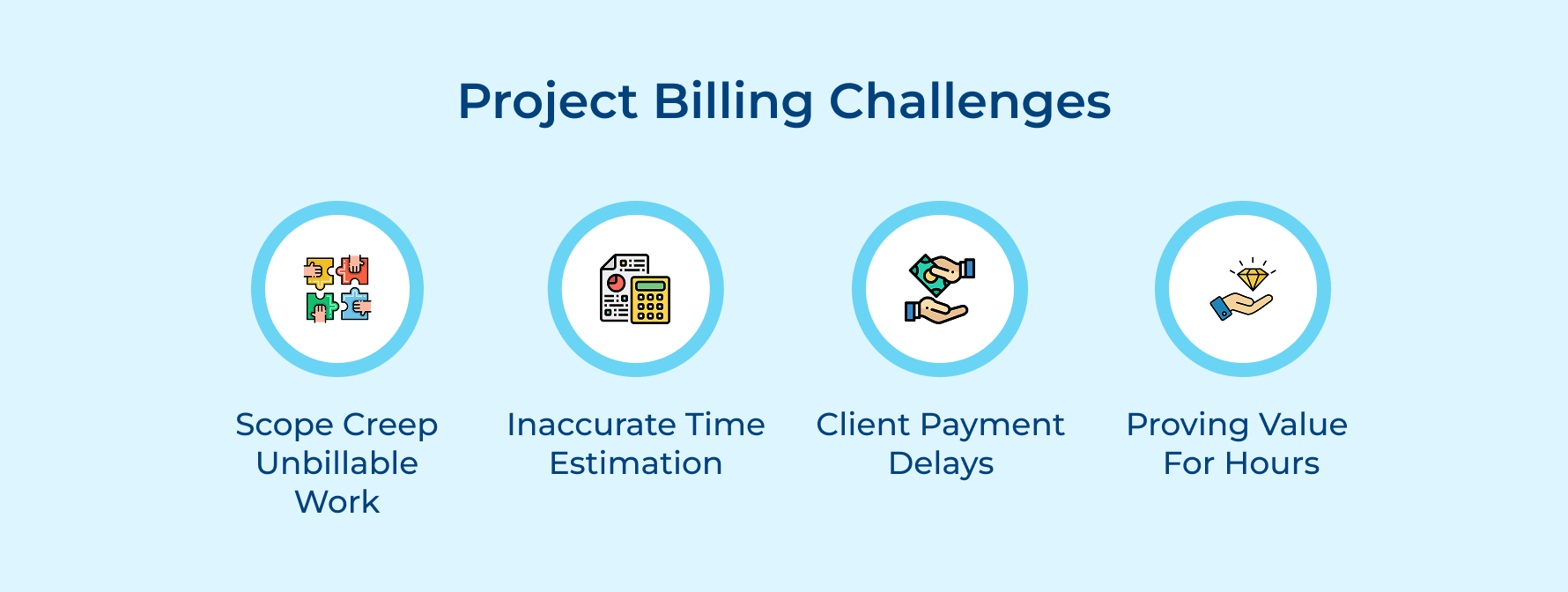

- Project Billing Challenges You Should Know

- Tips and Best Practices to Improve Project Billing

- Elevate Client Project Management with Seamless Project Billing

- FAQs about Project Billing

Key Highlights:

- Project billing ensures accurate invoices, steady cash flow and stronger client trust through transparent tracking of time as well as deliverables.

- Automated time tracking and regular billing cycles streamline operations while preventing revenue leaks.

- Accurate billing data supports profitability tracking, resource allocation and smarter business decisions.

Many agencies face cash flow issues and client disputes because their project billing as well as revenue management lack structure. Disorganized billing reduces profits and strains client relationships.

Delayed payments and confused clients questioning unclear invoices create ongoing frustration. Over time, these issues build up, putting serious financial pressure on growing businesses.

This guide shares proven project billing strategies that turn chaotic invoicing into a streamlined revenue process. Learn to manage every billing stage effectively, improve profitability and strengthen client trust through accuracy as well as transparency.

What is Project Billing?

Project billing is the systematic process of tracking time, expenses and deliverables throughout a project lifecycle to generate accurate invoices for clients. It serves as the financial backbone that connects your team’s work efforts to revenue generation. This method ensures agencies and professional services firms capture every billable hour as well as project cost for proper client compensation.

How Project Billing Works?

Teams log their time and expenses against specific projects or client accounts throughout the work period. The system then compiles this data with predetermined rates and project terms to create detailed invoices. This process transforms tracked work activities into revenue by applying billing rules and client agreements to generate accurate financial statements.

Key objectives:

- Revenue accuracy: Capture every billable hour and expense to maximize legitimate income from client work.

- Client transparency: Provide detailed breakdowns that show exactly what work was performed and when it occurred.

- Cash flow management: Generate timely invoices that maintain steady revenue streams and support business operations.

- Profitability tracking: Monitor project margins by comparing actual costs against billed amounts for better decision making.

- Compliance assurance: Meet contractual obligations and regulatory requirements through proper documentation along with billing practices.

Benefits of Accurate Project Billing

When agencies nail their project billing process, the positive ripple effects touch every corner of their business operations and client relationships. Here are the benefits to consider:

Enhanced Cash Flow Predictability

When your payment schedule is clear and accurate, revenue becomes easier to forecast. Agencies can plan investments, maintain steady operations and make growth decisions without the stress of unpredictable cash flow.

Stronger Client Trust and Relationships

Transparent billing shows clients exactly where their money is going and the value they’re getting. This clarity builds trust, reduces disputes and helps build long-term partnerships.

Better Resource Allocation Decisions

Accurate billing data, often powered by time tracking software, reveals how each team member contributes to revenue across projects. Managers can then assign the right people to the right work for maximum efficiency.

Reduced Administrative Overhead

A precise payment schedule as well as accurate records mean fewer invoice corrections, less back-and-forth and more time for teams to focus on delivering great client work.

Enhanced Business Performance Metrics

Agencies can measure KPIs like utilization rates and project success, driving smarter, data-based decisions with reliable billing data from your time tracking software.

Types of Project Billing

Professional services firms have multiple billing approaches to match different client needs and project characteristics. Choosing the right method can make or break project profitability.

End-of-Project Flat Fee Billing

This approach involves setting one fixed price for the entire project scope and collecting payment only after completing all deliverables. Clients appreciate knowing their total investment upfront while agencies can focus on delivery without frequent billing administration.

Key considerations for flat fee success:

- Detailed scope documentation prevents expensive misunderstandings later

- Built-in buffer margins protect against scope creep and unexpected complications

- Clear milestone checkpoints help track progress toward final delivery

Agencies benefit from predictable revenue planning but must carefully estimate project complexity to avoid losses from underpriced work. This method works best for well-defined projects with experienced teams who can accurately forecast time requirements.

Fixed Price Milestone Billing

Projects get divided into specific phases with predetermined prices for each milestone completion and payment occurs upon achieving each agreed-upon deliverable. This structure balances cash flow needs with client budget predictability throughout longer engagements.

Strategic questions to address upfront:

- How will you handle milestone dependencies that could delay subsequent payments?

- What happens when client feedback requires significant revisions to completed milestones?

- How detailed should each milestone definition be to prevent payment disputes?

This billing type reduces financial risk for both parties while maintaining project momentum through regular payment intervals. Clients see tangible progress for their investments while agencies receive steady cash flow without waiting for project completion.

Time-and-Materials Billing

Teams track actual hours worked and expenses incurred then bill clients based on predetermined hourly rates plus material costs. This transparent approach ensures agencies get compensated for all legitimate work performed while clients pay only for services actually received.

Essential elements for T&M success:

- Robust time tracking systems capture every billable minute accurately

- Regular expense documentation with receipts maintains client trust

- Weekly or monthly reporting keeps clients informed about spending patterns

The flexibility of this model accommodates changing project requirements without complex contract amendments. However it requires disciplined time tracking and clear communication about budget expectations to prevent client surprise at invoice time.

Retainer/Subscription Billing

Clients pay fixed monthly amounts for ongoing access to agency services within agreed-upon parameters such as hours or deliverable quantities. This creates predictable revenue streams while giving clients budget certainty for their professional service needs.

The billing model strengthens client relationships through consistent engagement while providing agencies with reliable monthly revenue for business planning purposes. Both parties benefit from reduced administrative overhead compared to project-by-project billing arrangements.

Stages of Project Billing Process

Let’s delve into the essential stages of the project billing process, exploring key components from project initiation to the final invoice. Thus, ensuring you remain on top of your financial game.

1. Project Setup and Billing Configuration

Project setup and billing configuration lay the groundwork for how your agency charges clients across the entire project lifecycle. Getting this right upfront avoids costly misunderstandings and messy billing disputes later.

Key elements to lock in during setup include:

- Billing method: Decide whether the project will follow fixed-price milestones, time-and-materials, or a retainer model, based on scope certainty.

- Rate structure: Set hourly rates by role or skill level and define markup percentages for expenses.

- Payment terms: Agree on invoice frequency, payment deadlines and any late fees or early-payment discounts.

- Scope boundaries: Clearly define what’s covered in the budget and what counts as billable changes.

In practice, document all these terms in your project charter and get client sign-off before work begins. It becomes your go-to reference for every billing decision and keeps financial expectations clear for both sides.

2. Time and Expense Tracking

Time/expense tracking captures the actual work performed and costs incurred during project execution to ensure accurate billing as well as profitability analysis. This stage transforms your team’s daily activities into billable data that supports invoice generation.

Effective tracking systems allow team members to log hours against specific project tasks while automatically categorizing work for different billing rates. Modern tracking tools integrate with project management platforms and provide real-time visibility into project progress as well as budget consumption.

Pro tips:

- Encourage daily time entry rather than weekly batch updates to improve accuracy and reduce forgotten billable hours that hurt profitability.

- Use project task codes that match your client’s preferred invoice format to streamline the billing process and reduce administrative overhead.

3. Work Validation and Approval

Work validation is the quality check that ensures all tracked time and expenses meet internal standards as well as client expectations before invoicing. In project-based billing, this step safeguards your agency’s reputation and builds trust through accuracy.

Three simple ways to make it work:

- Supervisor review: Have project managers check time entries within 48 hours to confirm they match the approved plan and deliverables.

- Client checkpoints: Share weekly progress and time allocation updates so clients can address concerns before billing.

- Clear documentation: Require short, specific descriptions of completed work to justify hours and show value.

Instead of vague entries like “coding work,” record specifics such as “implemented user authentication system and performed security testing” to strengthen billing credibility.

4. Invoice Creation and Delivery

Invoice creation and delivery transforms approved work records into formal payment requests that communicate project value to clients while maintaining professional standards. This stage represents the crucial moment when tracked time and expenses become actual revenue for your agency.

Before creating and delivering client invoices agencies should answer these essential questions:

- Are all tracked hours and expenses properly approved by designated supervisors?

- Does the invoice format match the client’s preferred layout and required information fields?

- Have you included sufficient detail to justify charges without overwhelming the recipient?

- Are payment terms and due dates clearly stated according to your contract agreements?

These questions help agencies sidestep billing mistakes that slow down payments or strain client relationships, while ensuring invoices meet quality and compliance standards.

When creating professional invoices that get paid promptly follow these systematic steps:

- Compile data systematically: Gather all approved time entries and expense records from your tracking system into organized categories that match your rate structure.

- Apply rates accurately: Calculate totals using predetermined billing rates and markup percentages while double-checking mathematical accuracy to prevent embarrassing errors.

- Format professionally: Use consistent invoice templates that include project details and clear line items as well as your agency’s complete contact information for easy reference.

Although you have completed the creation process here comes the main challenge of effective invoice delivery through various available methods:

The most effective delivery methods include

- email delivery

- client portal uploads

- postal mail services

- accounting platform notifications.

Note: It is recommended to obtain client consent before sending invoices through any communication channel to respect their preferences and ensure successful delivery.

5. Payment Processing and Tracking

Payment processing and tracking monitors the financial completion of your billing cycle by following invoice status from delivery through final payment receipt. This stage ensures consistent cash flow while identifying potential collection issues before they become serious problems.

Payment processing begins with systematic invoice monitoring through these essential tracking elements:

- Automated payment reminders

- invoice aging reports

- client payment history analysis

- cash flow forecasting tools.

This monitoring approach allows agencies to spot payment delays early and take proactive steps to maintain healthy cash flow rather than waiting for problems to escalate into serious collection issues.

Processing received payments involves updating your accounting records to reflect completed transactions while reconciling payment amounts against outstanding invoice balances.

How should agencies handle payment discrepancies and billing inquiries when they arise? Start by reviewing your original invoice and contract terms to understand the client’s perspective then reach out through their preferred communication channel to discuss the issue professionally.

6. Collections and Follow-up

Collections and follow-up convert outstanding invoices into payments through systematic communication when clients miss payment deadlines. This stage protects cash flow while maintaining professional relationships with clients experiencing payment delays.

Send Payment Reminders for Overdue Invoices

Payment reminders gently bring overdue invoices back to client attention without creating confrontational situations. Professional systems start with friendly automated emails and escalate to personal calls as delays extend.

Escalate Collection Efforts for Late Payments

Collection escalation increases communication urgency as payment delays become problematic for business operations. This might involve senior management discussions or third-party collection services while preserving client relationships.

Negotiate Payment Plans and Dispute Resolutions

Payment negotiations provide flexible solutions helping clients manage obligations while ensuring agencies receive compensation within reasonable timeframes. These discussions often reveal underlying issues addressable through modified schedules.

7. Documentation and Knowledge Transfer

Documentation and knowledge transfer preserves billing insights from each project to improve future engagements along with financial processes. This stage transforms project experiences into organizational knowledge that enhances agency efficiency.

Key factors for documenting client billing records include these essential elements:

- Compliance requirements

- Accessibility standards

- Security protocols

- Retention policies

Consider a marketing agency that completes a six-month campaign for a technology startup and discovers that monthly milestone billing worked better than their usual end-of-project approach. The documentation process captures this insight and shares it with the business development team for future similar engagements.

Project Billing Challenges You Should Know

Professional service agencies face unique billing obstacles that can severely impact profitability and client relationships. Understanding these challenges helps agencies develop proactive strategies.

Scope Creep and Non Billable Work

It’s common for clients to ask for “just one more thing” without realizing it’s outside the agreed scope. The problem starts when teams jump in and do the work before confirming if it’s billable, leaving the agency to absorb the cost.

Inaccurate Time Estimation and Budget Overruns

Underestimating how long complex tasks take is a fast track to budget trouble. Often it’s due to inexperience or overlooking potential complications and revision cycles, costs you can’t always pass to the client.

Client Payment Delays and Cash Flow Issues

When payments arrive late, it can throw payroll and operating expenses off track. Sometimes it’s slow approval processes, other times it’s deliberate stalling, but either way it hits cash flow hard.

Difficulty Proving Value for Billable Hours

If clients can’t see a clear link between billed hours and project outcomes, they’ll start questioning the invoice – especially for knowledge work where results aren’t physically visible.

These obstacles require systematic approaches combining better processes with improved client communication to address root causes effectively.

- Implement detailed project scopes with change request procedures to prevent non billable work without proper authorization and payment agreements.

- Use historical project data and buffer calculations to create accurate estimates accounting for typical complications as well as revision cycles.

- Establish clear payment terms with automated reminders and consider requiring deposits to improve cash flow consistency.

- Create detailed work logs with outcome descriptions demonstrating value delivered through each billable hour and project activity

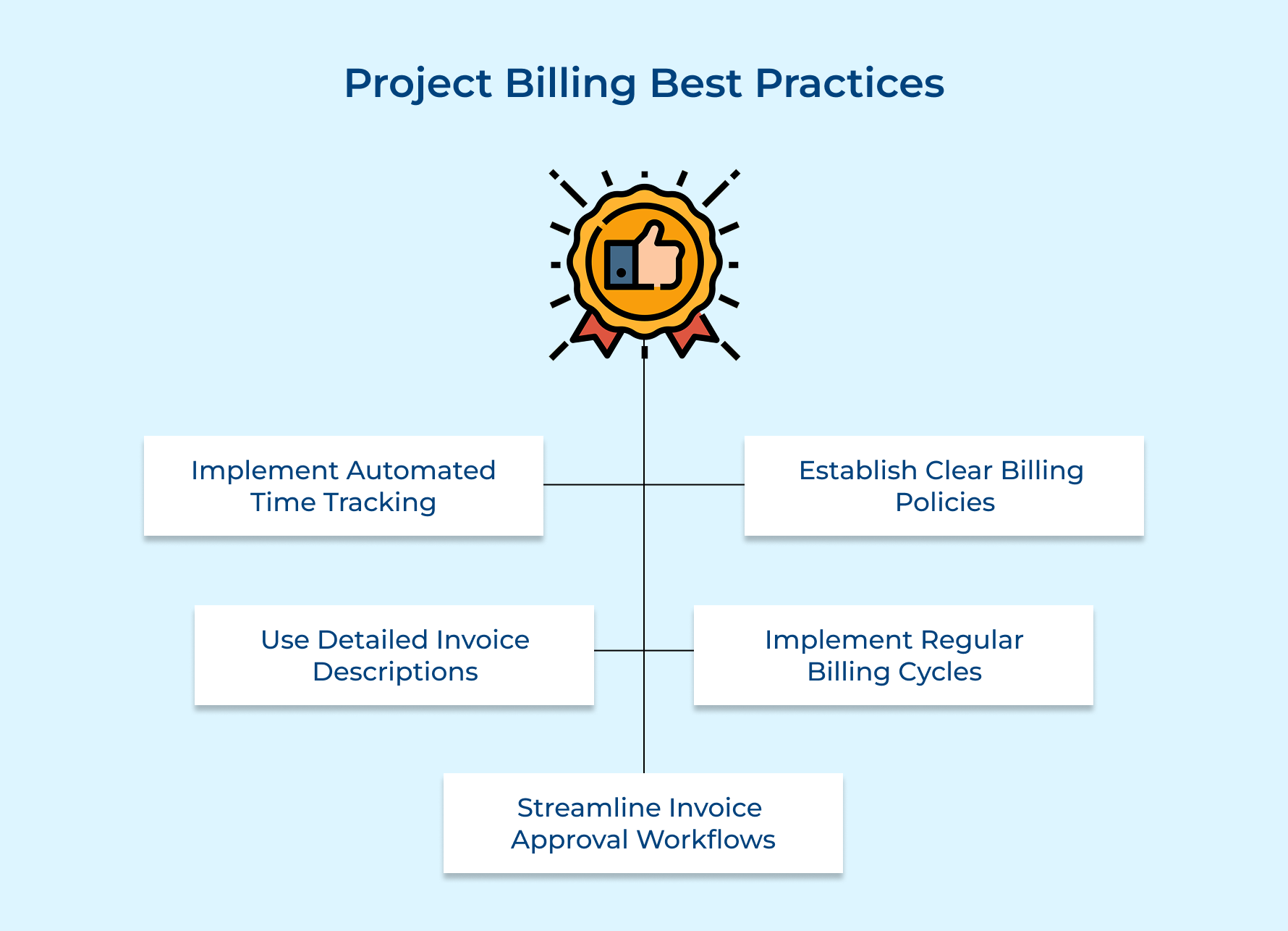

Tips and Best Practices to Improve Project Billing

Smart billing practices can transform your agency’s financial health and strengthen client relationships. These proven strategies help agencies capture more revenue while reducing administrative headaches.

Implement Automated Time Tracking Systems

Manual time tracking leads to forgotten hours and reduced profitability because team members often forget to log work performed throughout busy days. Automated systems capture billable activities in real-time and reduce administrative burden.

Essential features that maximize automated tracking effectiveness include:

- Project management tool integration for seamless workflow

- Mobile apps for time entry from any location

- Automatic reminders for missing daily submissions

Modern tracking solutions eliminate guesswork from billing cycles while providing detailed insights into team productivity. This data becomes invaluable for future project estimating and helps identify which activities generate the highest returns.

Establish Clear Billing Policies Upfront

Transparent billing policies prevent misunderstandings and payment disputes by setting clear expectations before project work begins. Written agreements protect both your agency and clients from costly conflicts that can damage professional relationships.

Comprehensive billing policies should address payment terms and scope change procedures as well as expense reimbursement guidelines that leave no room for interpretation. These documented standards become your reference point when challenging billing conversations arise.

Use Detailed Invoice Descriptions

Generic invoice line items like “consulting services” fail to communicate the value your agency provides to clients. Detailed descriptions justify your charges and help clients understand exactly what they received for their investment.

Key elements that strengthen invoice transparency include:

- Specific task descriptions with measurable outcomes

- Time breakdowns across different project phases

- Clear connection between deliverables and billed hours

Professional invoice formatting with comprehensive details reduces client questions and speeds up payment processing while demonstrating work thoroughness.

Implement Regular Billing Cycles

Consistent billing schedules improve cash flow predictability while reducing administrative burden of invoice preparation across multiple client accounts. Regular cycles also help clients budget for your services and establish payment routines.

Monthly billing cycles work best for most professional service engagements because they balance cash flow needs with administrative efficiency. Shorter cycles may overwhelm clients while longer cycles create cash flow challenges.

Streamline Invoice Approval Workflows

Complex approval processes delay invoice delivery and create unnecessary bottlenecks that hurt your agency’s cash flow as well as client satisfaction. Streamlined workflows ensure invoices reach clients quickly while maintaining necessary quality control standards.

Efficient approval systems typically involve two-step processes where project managers review work details and finance teams verify billing accuracy. This approach balances speed with accuracy while preventing costly errors.

Elevate Client Project Management with Seamless Project Billing

Effective project billing serves as the financial foundation that transforms client work into sustainable revenue while maintaining transparent relationships. Without systematic billing processes, agencies risk losing profitability and damaging client trust through unclear invoicing practices.

Strategic billing implementation enables agencies to maximize revenue capture, streamline administrative workflows and strengthen client partnerships through transparent communication. Professional services businesses achieve higher profitability by eliminating billing leaks and improving operational efficiency through automated systems.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Pooja Deshpande is a content contributor at Kooper, focused on creating insightful resources that help agencies and service providers scale efficiently. Passionate about SaaS trends, content strategy, and operational excellence, she delivers practical, easy-to-implement guidance for modern business leaders.