A Guide to Project Financial Management: 10 Successful Steps

Key Highlights:

- Project financial management helps you plan for uncertainties like scope changes, currency fluctuations, and rising costs with contingency reserves.

- Track expenses and billable hours in real-time with financial management tools to prevent overspending.

- Create detailed budgets that include all costs, overheads, and profit margins, using historical data for accuracy.

Managing a project isn’t just about meeting deadlines or delivering quality—it’s also about keeping the finances in check.

Project financial management ensures every dollar spent aligns with the project’s goals, preventing budget overruns and unnecessary expenses.

It’s about more than just crunching numbers; it’s about forecasting, resource allocation, and staying agile in the face of unexpected challenges.

If you’re managing a small team or a large-scale operation, understanding the financial pulse of your project can make or break its success.

Let’s explore effective strategies to implement financial control and drive project success.

What is Project Financial Management?

Project financial management encompasses systematic planning, budgeting, controlling, and monitoring of financial resources throughout a project’s lifecycle in professional service organizations. It involves tracking billable hours, managing resource costs, monitoring project profitability, and ensuring optimal cash flow while maintaining client value delivery.

Effective financial management directly impacts project profitability, resource utilization, and overall business health. It enables organizations to maintain competitive pricing strategies while ensuring adequate profit margins.

Key objectives:

- Maximize project profitability: Ensure optimal resource utilization, manage costs effectively, and maintain healthy profit margins across all client engagements. A well-structured project financial management plan ensures financial stability and efficiency.

- Maintain cash flow stability: Monitor billing cycles, manage payment schedules, and maintain adequate working capital for ongoing operations along with new project investments.

- Enable accurate forecasting: Project future resource needs, anticipate financial requirements, and support strategic planning through reliable financial data.

- Ensure cost recovery: Track all project-related expenses, manage billing accuracy, and maintain transparent cost documentation for client accountability.

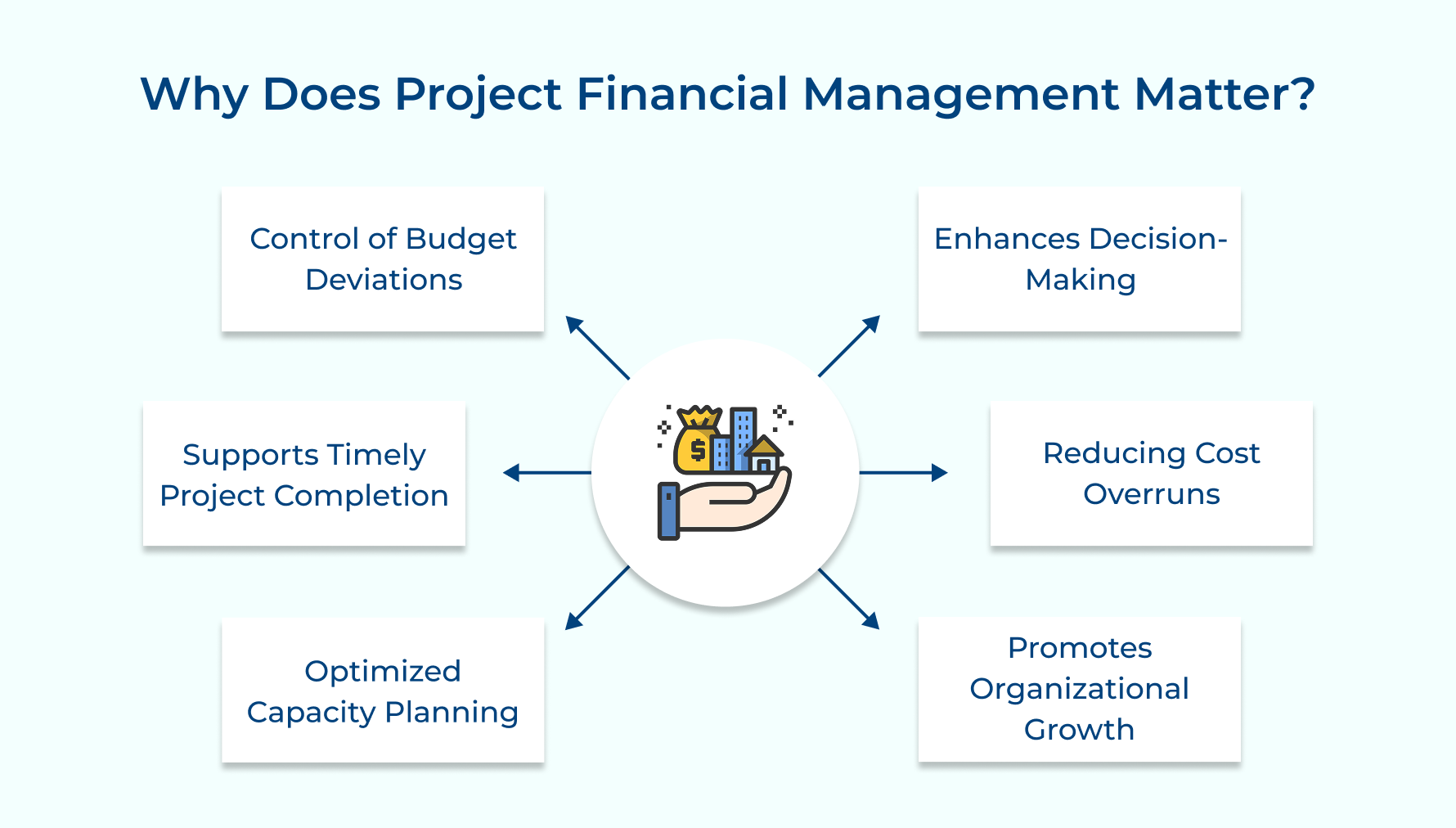

Why Does Project Financial Management Matter?

Ever wonder what keeps a project on track, not just in terms of tasks but also finances? Project financial management ensures your goals are achieved without breaking the budget.

Control of Budget Deviations

Keeping your project’s finances in check is easier with effective financial management. It lets you track spending patterns, monitor resource use, and spot potential issues early—so small hiccups don’t spiral into major budget blowouts. A strong financial project management strategy ensures that project budgets remain within control.

Supports Timely Project Completion

Good financial oversight ensures you always have the resources you need to keep the project moving. By aligning budgets with timelines, you can avoid delays and maintain momentum toward delivering on schedule. This is a critical aspect of project management financials, ensuring that finances align with project goals.

Optimized Capacity Planning

Financial insights aren’t just about dollars—they help you plan smarter. You can balance workloads, optimize billable hours, and decide whether it’s time to hire or reallocate resources based on what the numbers are telling you.

Enhances Decision-making

When the numbers speak, you can make confident decisions. Financial data helps you assess risks, evaluate opportunities, and prioritize investments wisely, keeping your projects both strategic as well as profitable.

Reducing Cost Overruns

Nobody likes unexpected costs creeping in. By keeping a close eye on expenses while also addressing scope changes early, financial management helps you avoid overruns and protect your profit margins. Using project financial examples can help teams anticipate and control costs effectively.

Promotes Organizational Growth

Strong financial management is all about building for tomorrow. Healthy cash flow, smart investments, and controlled scaling ensure your business grows sustainably while delivering top-notch results.

How to Implement Project Financial Management: 10 Steps

Feeling overwhelmed by the idea of managing project finances? Don’t worry! These 10 practical steps will guide you through setting up a project financial management system with ease.

1. Establish Clear Financial Goals

Imagine you’re leading a website redesign project for a client. Without clear financial goals, it’s easy to overspend or miss profitability targets.

Setting specific benchmarks—like achieving a 20% profit margin, keeping resource utilization above 80%, and hitting $50,000 in project revenue—keeps everyone on track as well as aligned with business objectives. These benchmarks are integral components of project financials.

These goals act as your financial guide to make better decisions throughout the project. For example, if unexpected scope changes arise, you can evaluate if they fit within your revenue and profit goals before proceeding.

Tips:

- Create a simple financial goal matrix with monthly, quarterly, and final project targets for metrics like profitability and revenue.

- Document your assumptions—like estimated hourly rates or expected resource needs—and update them if things change during the project.

2. Develop a Budget Management Framework

Let’s say you’re running a digital marketing campaign. A clear budget template helps you estimate costs for ad spending, design resources, and analytics tools, while also setting aside funds for unexpected tweaks.

By using standardized templates for projects like campaigns or product launches, you can ensure consistency and efficiency.

Pro Tips:

- Design templates with built-in calculations to save time and reduce errors for common project types.

- Set up clear approval processes for any budget adjustments—because no one likes last-minute surprises!

3. Use Financial Management Tools

Financial management tools automate tracking, reduce errors, and provide real-time visibility into project finances. They enable efficient data collection, analysis, and reporting while saving time on administrative tasks.

Deploy integrated project financial management software for time tracking, expense management, and financial reporting. Ensure tools connect with existing systems and provide necessary analytics capabilities.

4. Plan for Financial Risks

Financial risk planning helps identify potential issues before they impact project profitability. It enables proactive mitigation strategies and ensures adequate reserves for unexpected challenges.

Develop risk assessment frameworks specifically for financial aspects. Include contingency planning, buffer allocation, and response strategies for common financial risks.

5. Monitor Financial Performance Regularly

Regularly monitoring your project’s financial health helps you spot issues early and take corrective actions before they snowball.

It’s key to staying profitable and keeping your financial goals on track. Here’s how you can make this a habit:

- Create weekly dashboards that show your project’s key financial metrics and trends in an easy-to-understand format.

- Hold bi-weekly financial review meetings with your project team and stakeholders to discuss progress and address any red flags.

- Compare your actual performance with planned targets as well as dig into any variances to understand what’s working and what needs fixing.

6. Establish Financial Reporting Protocols

Having a streamlined reporting process ensures that everyone stays on the same page about the project’s financial status.

Consistent reporting builds transparency, keeps stakeholders informed, and speeds up decision-making. How to simplify your financial reporting?

- Create standardized report templates tailored to the needs of different stakeholders (e.g., executives, team leads, or clients).

- Set up a regular reporting schedule to maintain consistency—weekly, bi-weekly, or monthly, depending on the project’s needs.

- Automate your reports with tools that allow scheduled distribution, saving you time and reducing manual errors.

- Include essentials like key metrics, variance analysis, and forecasts so everyone gets a clear picture of where things stand along with what’s ahead.

7. Ensure Clear Communication with Stakeholders

Effective stakeholder communication maintains alignment on financial expectations and decisions. It helps prevent misunderstandings and ensures support for financial management actions.

Establish regular financial update meetings and clear communication channels. Create stakeholder-specific reports and maintain an open dialogue about financial performance.

Create a stakeholder communication matrix with financial update frequencies and formats. Develop standard templates for communicating financial changes as well as decisions.

8. Implement Cost Control Measures

Cost control measures ensure projects stay within budget and maintain profitability. They help identify and address cost overruns early while maintaining service quality.

Establish cost monitoring systems and control procedures. Implement approval processes for expenses and regular cost reviews.

9. Track Cash Flow

Tracking cash flow is essential to ensure you have enough funds to keep your project running smoothly. It helps you pay vendors on time, allocate resources effectively, and maintain overall business stability.

- Develop rolling cash flow forecasts that you update weekly to stay ahead of any surprises.

- Align payment schedules with project milestones to optimize cash outflows and ensure smooth operations.

- Regularly monitor incoming and outgoing cash so you’re always aware of your financial position.

10. Evaluate Financial Outcomes Post-Project

Once the project is completed, it’s time to dive into the numbers. Evaluating financial outcomes helps you fine-tune your estimation processes and spot opportunities for improvement. It’s a crucial step for smarter planning in the future.

- Use standardized post-project financial analysis templates to make the review process consistent and efficient.

- Compare actual results against your initial plans to understand what went well and where you can improve.

- Hold a “lessons learned” session within two weeks of project completion to focus on the financial aspects and document key takeaways.

Project Financial Management Challenges

Managing project finances comes with unexpected challenges that can pop up and throw you off track. Let’s explore some common hurdles and how to tackle them effectively.

Monitoring too many project metrics: When you monitor too many financial metrics, it’s easy to feel overwhelmed and lose sight of what truly matters. This data overload often prevents teams from focusing on the crucial indicators that impact success, like indirect costs or cost variances.

The fix? Identify core financial KPIs that align with your business objectives and project scope. Streamline your dashboards to focus on actionable metrics, such as utilization rates, profit margins, and cost variances.

Inconsistent data across project phases: When teams use different methods to track and report financial data, it creates inconsistencies as well as confusion. This makes it hard to compare project performance or make informed decisions, especially when managing costs across the entire project scope.

The solution: Implement standardized financial tracking systems and templates for all project phases. Set clear data entry protocols and conduct regular validation checks to ensure consistency as well as accuracy throughout the project lifecycle.

Neglecting to address change management: Neglecting the financial impact of project changes is a recipe for budget overruns and scope creep. Change requests, if not managed properly, can throw off resource allocation and increase indirect costs, making it difficult to stay on track.

What works? Put a formal change management process in place. This should include thorough financial impact assessments, clear approval workflows, and a system to track modifications that affect the project’s finances.

Dealing with forecasting discrepancies: Inaccurate financial forecasting can derail your resource planning and budget management efforts. Teams often struggle to predict future costs and revenue streams effectively, which impacts long-term financial stability.

How to fix it: Enhance forecasting accuracy by analyzing historical data, monitoring current market trends, and regularly reviewing forecasts. Tools like rolling forecasts and predictive analytics can help refine projections as well as keep your financial planning on point.

Tips for Budget Management in Project Management

Managing a project budget can feel like a balancing act—one wrong move, and you risk overspending. Here are some practical tips to keep your project finances in check.

- In-depth budget planning: A solid budget is the backbone of any successful project. Take the time to build a detailed budget that includes all resource costs, billable hours, overhead expenses, and profit margins. Use historical data, market rates, and the complexity of the project to set realistic financial baselines for each client engagement.

- Anticipate scope change: Scope changes are inevitable, so why not plan for them? Build a flexible financial framework that can adapt to changes in the project scope. Set up clear change management processes that outline cost implications, and keep a buffer in your budget for those unexpected (but likely) project tweaks.

- Consistent cost forecasting: Accurate cost forecasting can make or break a project’s financial health. Set up regular forecasting cycles to predict upcoming expenses, resource needs, and revenue flows. Combine insights from historical data with real-time project metrics to keep your projections sharp and decision-making on point.

- Assessing financial uncertainty: Financial risks—like currency fluctuations, rising resource costs, or unpredictable market changes—can hit hard if you’re not prepared. Develop risk assessment protocols, maintain contingency reserves, and have mitigation strategies in place to handle financial bumps along the way.

- Transparent financial reporting: No one likes wading through complicated financial data. Generate clear, easy-to-understand financial reports that show your budget status, resource utilization, and profit metrics. Stick to a regular reporting schedule and create simple dashboards so stakeholders can digest the information quickly.

- Automated budget monitoring: Manual tracking is time-consuming and error-prone—automate it! Use financial management tools to monitor expenses, billable hours, and project costs in real-time. Set up alerts to flag when you’re approaching budget limits so you can take action before it’s too late.

- Profit margin protection: Profit margins tell you if your project is truly a success, so don’t lose sight of them. Monitor margins regularly with thorough cost analysis and efficiency checks. If you notice margins slipping, identify the cause and take corrective action to keep your profitability on target.

Ensuring Project Success Through Financial Control

Financial control is key to achieving both project and organizational goals. Implementing robust financial management practices, such as accurate budgeting, risk assessment, and regular monitoring, helps maintain control over costs as well as prevent overruns.

Effective financial oversight not only mitigates risks but also empowers teams to make informed decisions. Timely adjustments based on accurate financial data can significantly improve efficiency, reduce waste, and increase profitability throughout the project lifecycle.

Well-managed project budgets serve as the foundation for successful execution. With proper financial control, projects are more likely to be completed on time, within scope, and within budget, leading to greater stakeholder satisfaction while supporting long-term growth.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Neeti Singh is a passionate content writer at Kooper, where he transforms complex concepts into clear, engaging and actionable content. With a keen eye for detail and a love for technology, Tushar Joshi crafts blog posts, guides and articles that help readers navigate the fast-evolving world of software solutions.