Maximizing Project Profitability: Essential Steps & Metrics

- What is Project Profitability?

- Five Critical Factors That Make or Break Your Project Profits

- How to Calculate Project Profitability: 7 Strategic Steps

- How to Measure Project Profitability: 6 Metrics

- How to Increase Project Profitability: Best Practices

- Project Profitability: Turn Clients’ Projects into Profit Powerhouses

- FAQs about Project Profitability

Key Highlights:

- Project profitability reveals the true financial contribution of each project after accounting for all direct and indirect costs.

- Enable proactive budget corrections during execution, preventing cost overruns before they escalate.

- Maximize project profitability with practical methods for budget tracking, resource management and ongoing project profitability analysis.

Some projects look great on paper – delivered on time, happy client, busy team. But dig deeper, and you’ll find they quietly drained your resources as well as barely broke even. Without the right tracking in place, it’s tough to know which projects are actually helping your agency grow.

Every hour spent on an unprofitable project is time your team could’ve used on work that drives real value. When you’re not measuring profitability properly, pricing errors pile up and put your business on shaky ground.

This guide walks you through smarter ways to measure and boost project profitability. From simple tracking systems to operational tweaks, you’ll learn how to spot what’s working, fix what’s not, and start turning more client work into sustainable profit.

What is Project Profitability?

Project profitability measures how much money your agency actually keeps after covering all costs for a specific client project. For professional services and agencies, this metric separates successful projects from expensive mistakes that drain your resources.

Your project profitability calculation starts with total project revenue and subtracts every cost involved in delivery. It includes obvious expenses like employee salaries and freelancer payments plus hidden costs such as software subscriptions as well as office overhead.

Key objectives:

- Identify which projects generate the highest returns so you can pursue similar opportunities in the future.

- Spot cost overruns early before they transform profitable projects into financial disasters.

- Set accurate pricing strategies that cover all expenses while remaining competitive in your market.

- Allocate resources efficiently by understanding which team members and processes deliver the best value.

- Make data-driven decisions about which clients and project types deserve your continued investment.

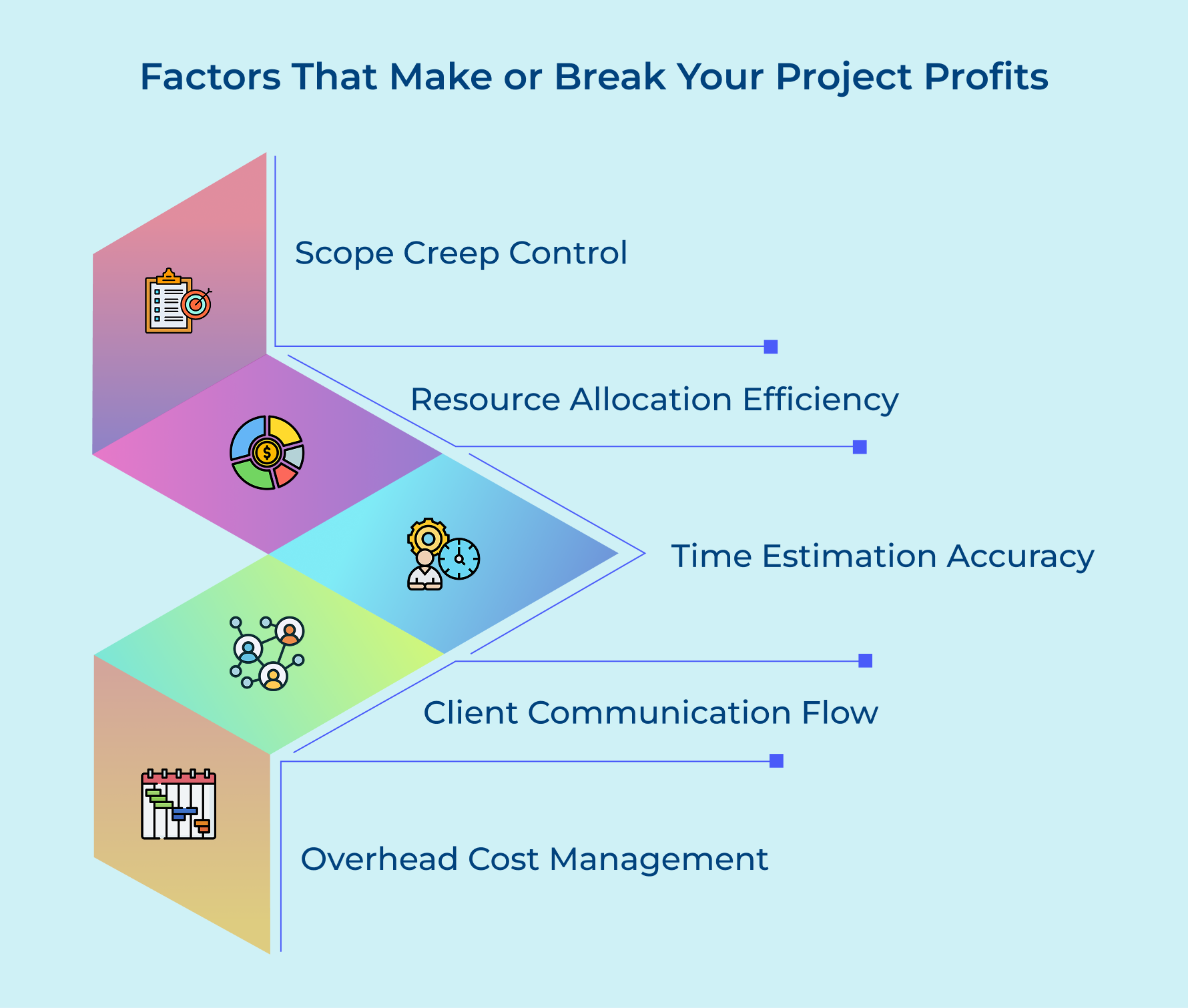

Five Critical Factors That Make or Break Your Project Profits

Project profits don’t just depend on delivery, they hinge on smart decisions throughout the process. Avoid budget overruns and protect your profit investment ratio.

Scope Creep and Change Management

Uncontrolled project scope expansions destroy budgets faster than any other factor. When clients request additional features or revisions without proper change orders, your team works extra hours while your profit margin disappears into unpaid overtime.

Resource Allocation and Team Efficiency

Assigning the wrong skill levels to tasks creates expensive inefficiencies that eat profits. Senior designers handling junior tasks or inexperienced team members struggling with complex work both inflate costs while reducing the quality of deliverables.

Accurate Time Estimation and Tracking

Poor time estimates lead to underpriced projects that become financial disasters. If your team keeps underestimating task time, you’ll lose money on projects while still needing to meet client expectations.

Client Communication and Approval Processes

Delayed feedback and unclear approval workflows create costly project bottlenecks. Client delays and vague feedback trap your team in long revision cycles, using up billable hours without bringing in more revenue.

Overhead Cost Management and Project Sizing

Fixed costs like office rent and software subscriptions hurt smaller projects disproportionately. A project that barely covers direct labor costs becomes unprofitable when you factor in the overhead expenses that keep your agency running daily.

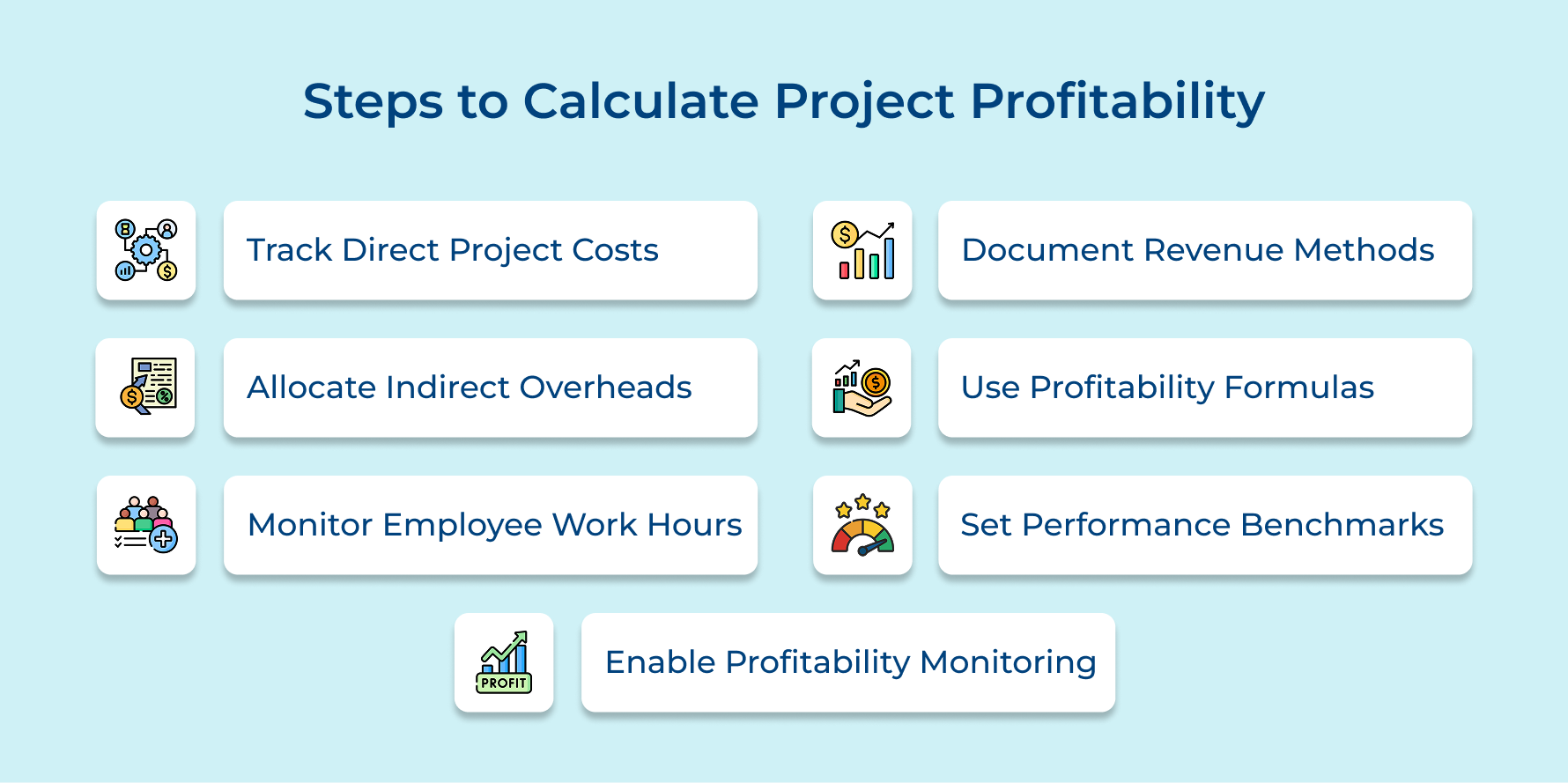

How to Calculate Project Profitability: 7 Strategic Steps

We’ve identified 7 strategic steps that will empower you to calculate project profitability in project management with precision, ensuring informed decisions and enhancing your company’s financial stability

1. Track All Direct Project Costs

If you’re not tracking direct costs, you’re only guessing at profitability. These are the expenses directly tied to a specific client project and they can quietly drain your margins. Use project management tools to log every dollar spent.

Track these four key costs:

- Employee wages & contractor fees (include benefits and taxes)

- Project-specific software subscriptions (used only for this client)

- Materials & vendor charges (like printing or design support)

- Client-related travel & expenses (meals, lodging, transport)

Agencies often miss these because teams juggle multiple clients at once. Solve it with time tracking tools that assign every hour to a project code, no more guessing where your money’s going.

2. Calculate Indirect Overhead Allocation

Your office rent, admin staff, and leadership time don’t show up on project invoices but they still affect profitability. Without fair allocation, you risk budget overruns and false profit assumptions.

Ask yourself:

- How much space and admin time does this project use?

- How involved is leadership in reviews and strategy?

- Which general expenses support this project’s delivery?

Start by calculating total overhead, then divide it by your monthly billable hours. Multiply that rate across each project’s hours to fairly assign overhead. This way, each project pays its share and you get a clearer picture of profit.

3. Monitor Real-Time Employee Work Hours

Waiting until project wrap-up to see time logs is too late. Real-time tracking lets you catch overages before they eat into profits and destroy your rate realization.

Use your project management tools to:

- Compare estimated vs. actual hours per task

- Flag time overruns before they escalate

- Spot where project estimates consistently fall short

Also, track billable vs. non-billable time:

- Billable: client calls, deliverables, project management

- Non-billable: internal meetings, training, admin work

This kind of insight drives better resource management, boosts team productivity and ensures you’re paid fairly for the time you invest.

4. Document Revenue Recognition Methods

It’s easy to overstate revenue if you recognize payments too early. Instead, link your revenue recognition to actual work completed, not just invoices.

Use these methods:

- Milestone-based recognition: Log revenue only when deliverables are completed

- Retainer allocation: Spread upfront payments across phases based on effort

- Scope change tracking: Log extra work separately to protect profit margins

For example, if you get $10,000 upfront for a 3-month project, only record $2,500 after each completed milestone, not the full amount on day one. This approach keeps your revenue aligned with your output and prevents inflated margins.

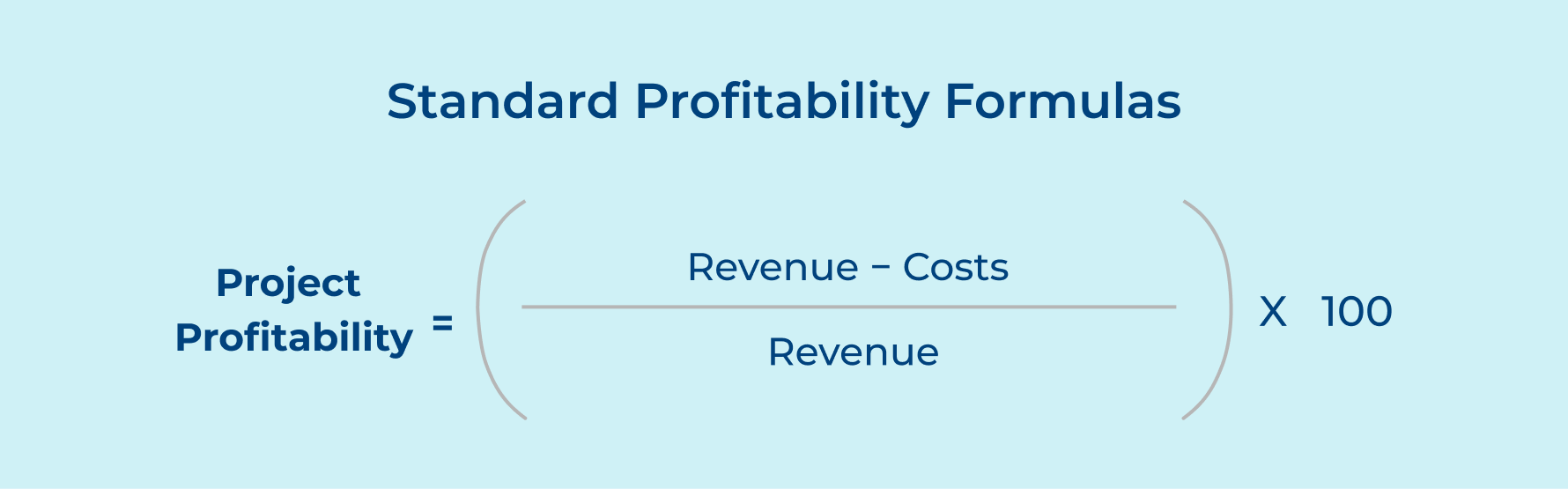

5. Apply Standard Profitability Formulas

Guesswork won’t help you grow. Use consistent math to understand which projects are truly profitable. Start with this basic formula:

Here’s what to include:

- Revenue: contract amount + change orders

- Costs: direct (like wages) + indirect (like rent)

Example: If a project brings in $50,000 and costs $35,000, your profit margin is 30%. To go deeper, calculate ROI by comparing profit to the time and effort invested. These numbers help you evaluate success and spot patterns worth repeating.

6. Implement Project Performance Benchmarking

How do you know if your projects perform well? Compare them to both industry standards and your own historical data. That’s where project performance benchmarking comes in.

Here are some common profit margin benchmarks:

- Creative agencies: 15–25%

- Consulting firms: 20–35%

- Digital marketing agencies: 10–20%

- IT services: 15–30%

To get started:

- Analyze the last 3 years of projects

- Track average margins by service type

- Identify which client types or project sizes deliver best returns

This helps refine your resource management strategy and pricing models to prioritize profitable work.

7. Create Ongoing Profitability Monitoring

Waiting until project completion to check profitability is risky. Ongoing monitoring gives you control and helps avoid budget overruns before they snowball.

Here’s how to stay on track:

- Set weekly dashboards to compare actual vs. budgeted costs

- Do monthly reviews of profit margins and project trajectory

- Create alerts when you hit 80% of your allocated hours

- Rank projects monthly by profitability for better decisions

Use project management tools to automate these check-ins. This approach helps you act fast, make informed resource shifts and protect your rate realization before it’s too late.

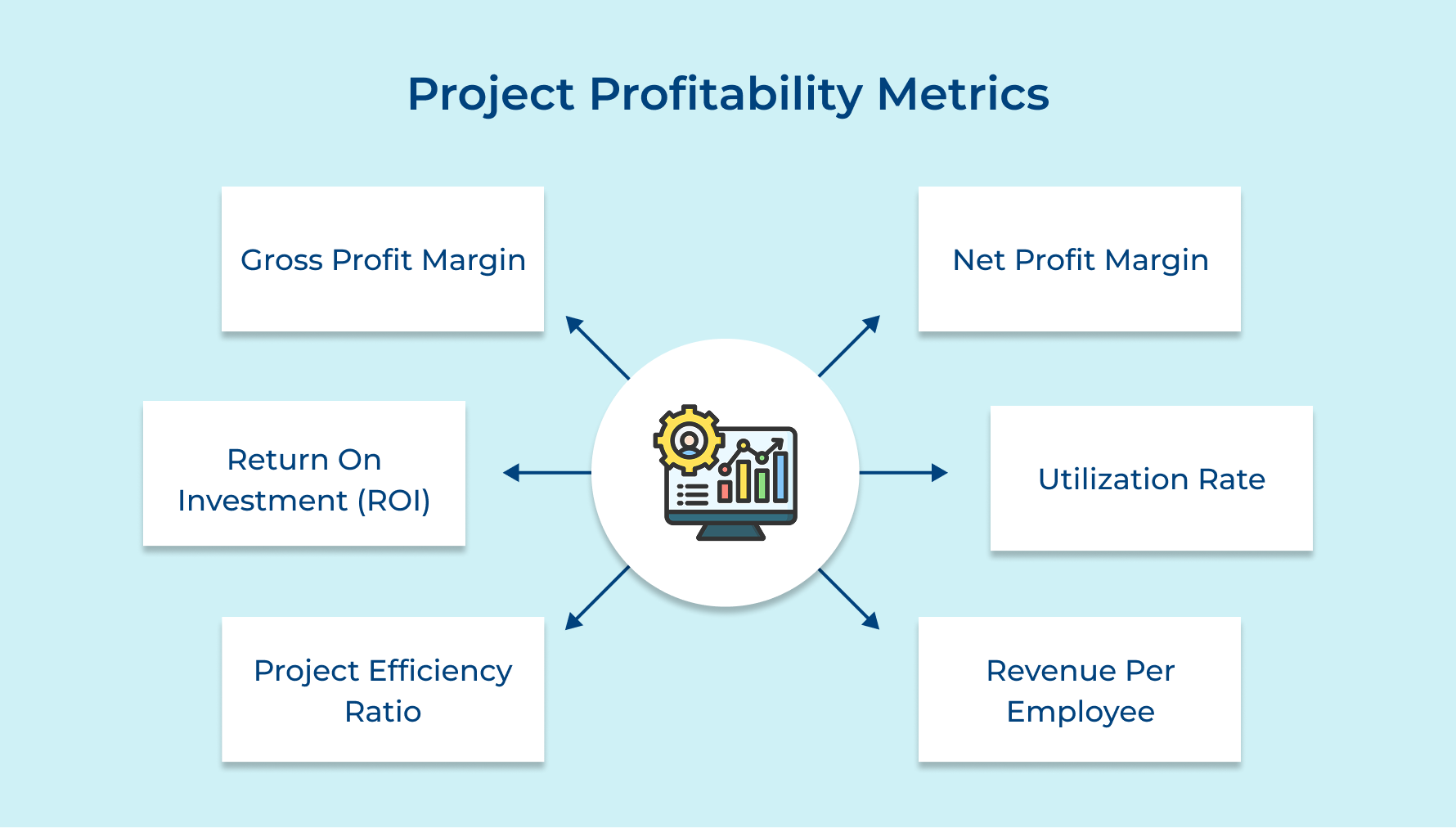

How to Measure Project Profitability: 6 Metrics

These six metrics provide real-time insights that help you understand financial performance throughout every phase of your client engagements.

Before diving into specific metrics, ask yourself these fundamental questions that reveal the true financial health of your projects.

- How much actual profit does each project generate after covering all direct and indirect costs?

- What percentage of your estimated budget gets consumed by unexpected expenses or scope changes?

- How efficiently does your team convert billable hours into profitable revenue for each client engagement?

- Which projects consistently exceed profit expectations while others struggle to break even?

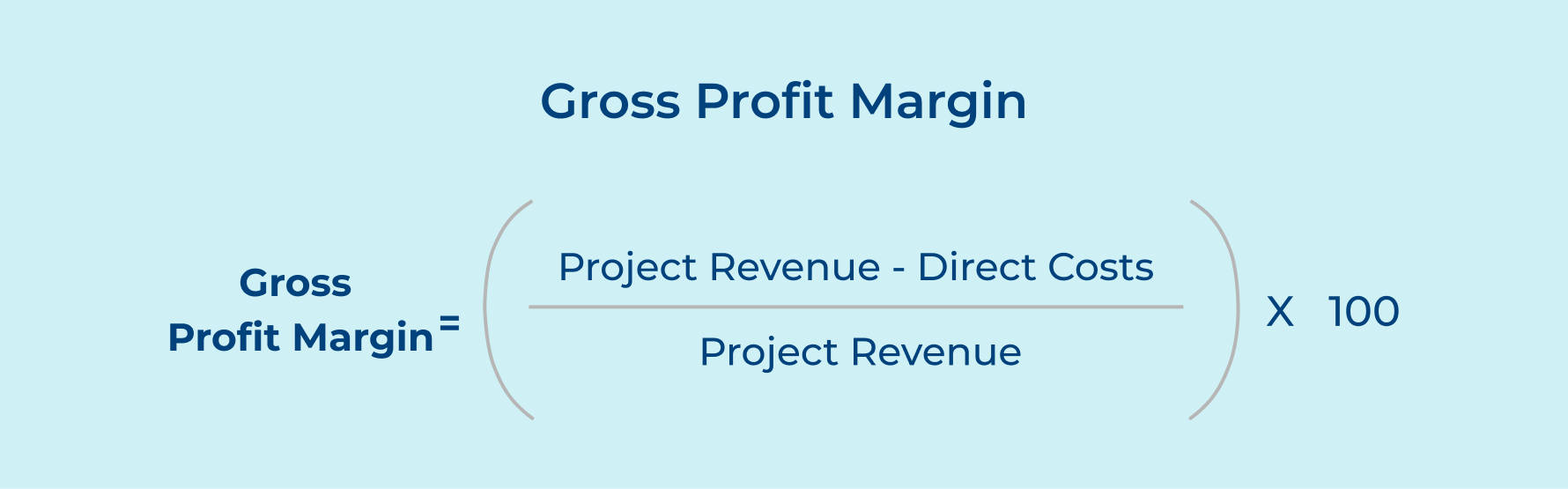

Gross Profit Margin

Gross profit margin shows how much of your project revenue is left after covering direct costs, before factoring in overhead. It’s a quick way to see if a project is contributing to your agency’s fixed expenses and bottom line.

Standard Benchmark: Professional services agencies typically aim for gross profit margins between 50% and 70%, depending on service complexity as well as market position.

This metric helps assess if your pricing structure is strong enough to cover direct costs while still leaving room for overhead and profit. It’s an early check on financial health—before full profitability numbers come in.

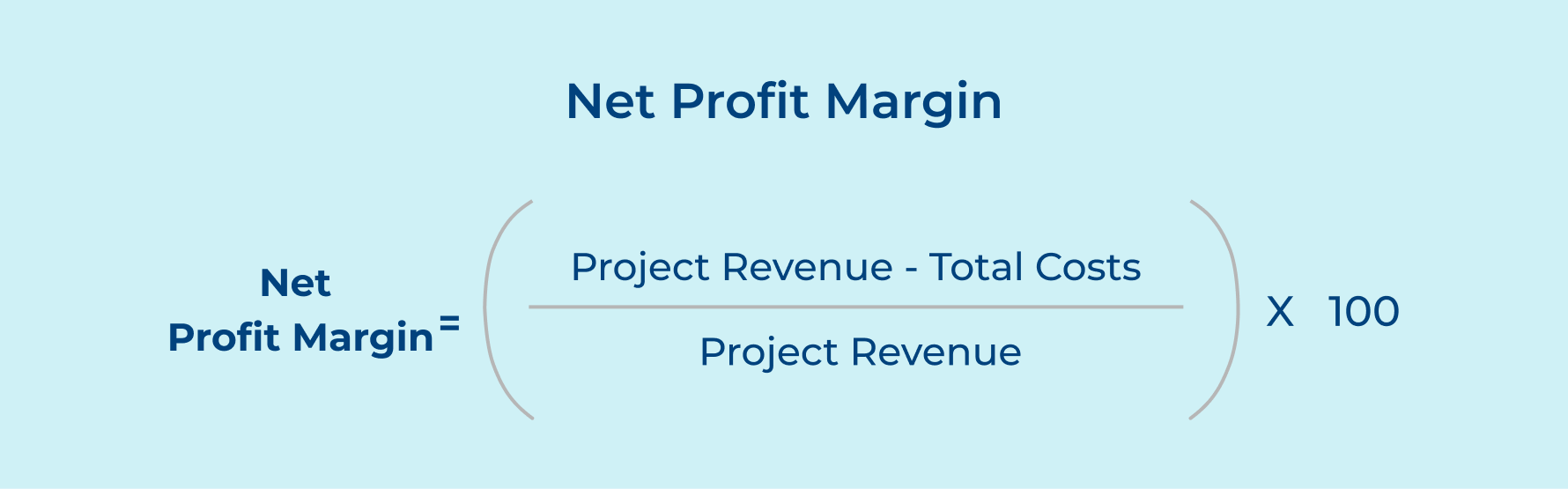

Net Profit Margin

Net profit margin gives you the full picture. It shows what percentage of your project revenue turns into actual profit after deducting all costs including overhead.

Standard Benchmark: Successful agencies tend to maintain net profit margins between 15% and 30% across projects to ensure sustainable growth.

This metric helps you distinguish between projects that truly fuel your agency’s growth and those that just break even. It’s a critical number for guiding pricing strategies and deciding which client relationships are worth keeping.

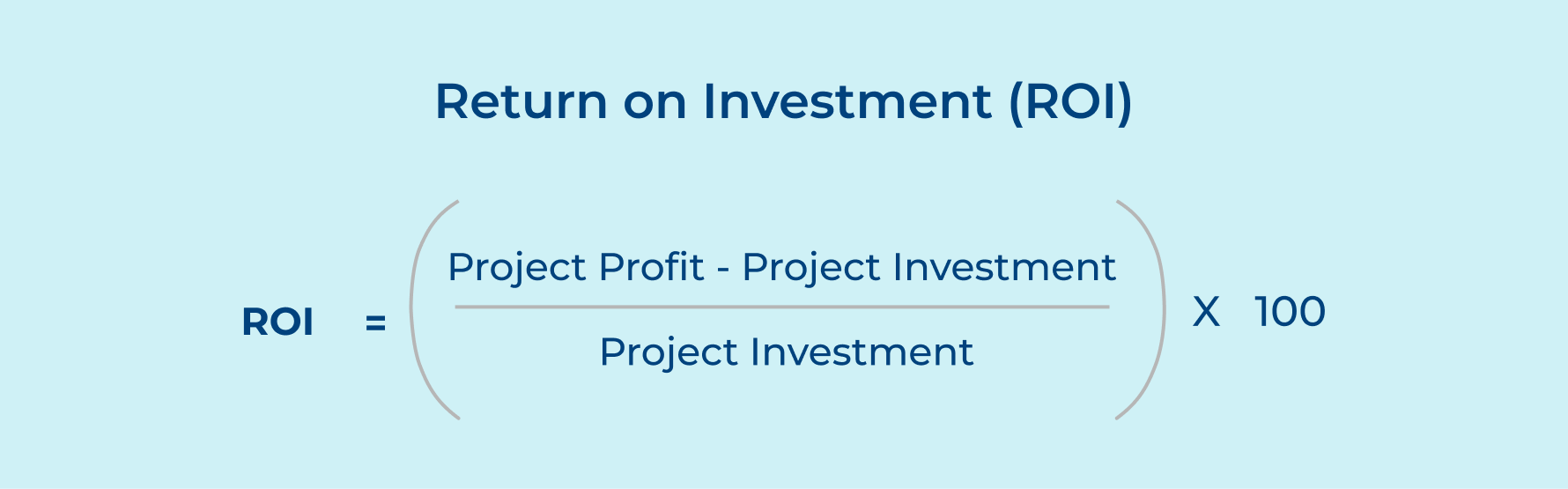

Return on Investment (ROI)

ROI tells you how much profit a project delivers compared to the total resources you invested—time, money, tools, and people. It’s a great way to evaluate if the project was worth the effort.

Because ROI standardizes profit relative to investment, it’s especially useful for comparing projects of different sizes or durations. It helps you prioritize high-return work and guides smarter resource allocation across your agency.

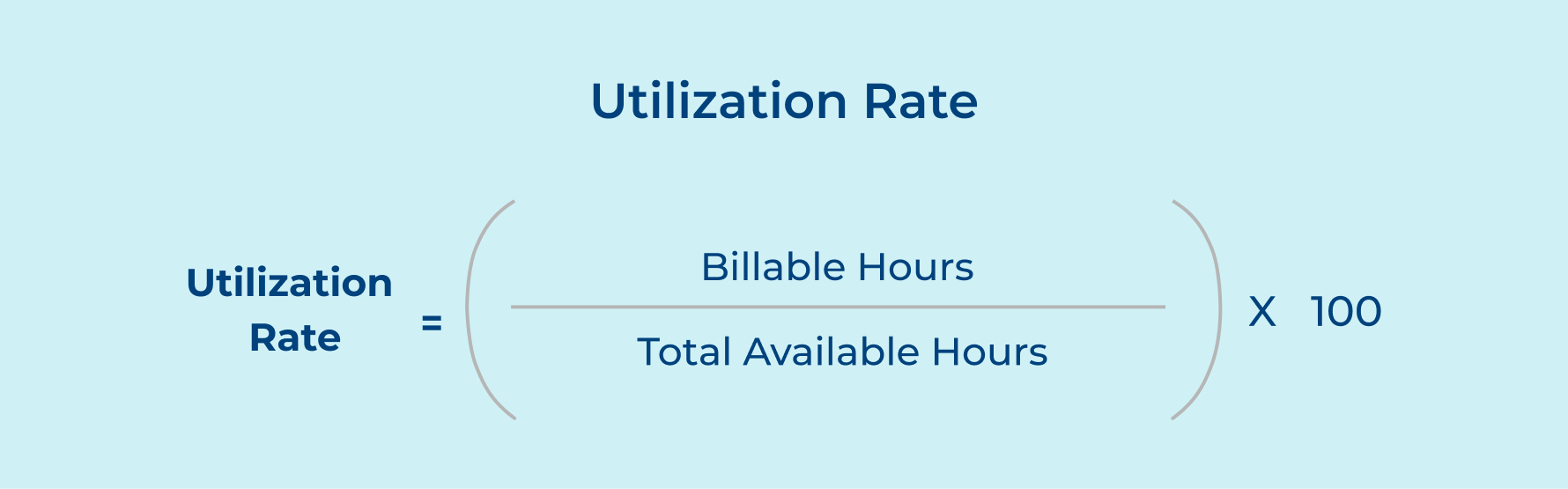

Utilization Rate

Utilization rate shows how effectively your team turns their available time into billable work. It’s a strong indicator of productivity and has a direct impact on profitability.

Here you can quickly see where staff time isn’t used effectively. It might be because of too many meetings, admin work, or poor scheduling. This metric supports better workflow design, staffing decisions, and overall resource planning.

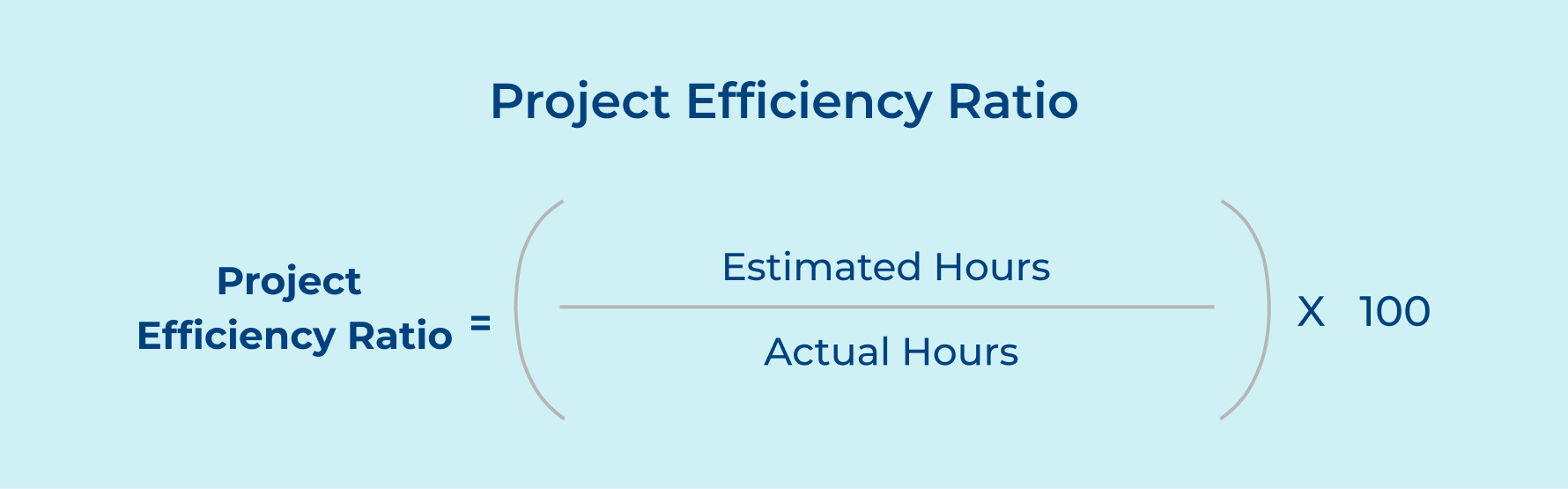

Project Efficiency Ratio

The project efficiency ratio compares your team’s estimated hours with the actual time spent delivering the work. It’s a great way to measure how well your planning aligns with reality.

Standard Benchmark: Agencies that hit between 90% and 110% show solid estimation practices along with minimal scope creep.

This ratio helps you fine-tune future estimates and understand which types of projects regularly blow past time budgets. It’s also useful for setting clearer client expectations while avoiding underpriced work.

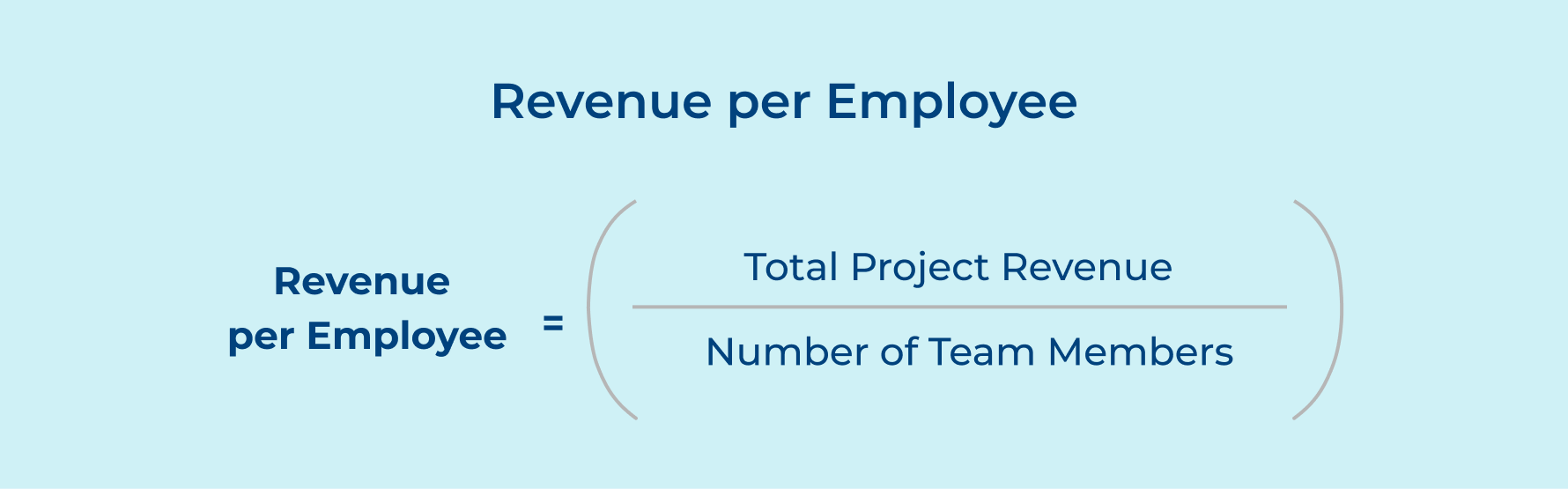

Revenue per Employee

Revenue per employee measures how much income each team member generates during a project. It’s a straightforward way to assess the productivity and profitability of your staffing model.

This metric helps you evaluate if your current team size and skill mix are optimized for the work at hand. It also supports hiring decisions, if you need more hands, different expertise, or better resource planning to grow profitably.

How to Increase Project Profitability: Best Practices

Smart agencies implement systematic practices that consistently drive better margins. These proven strategies help professional services firms transform their financial performance through deliberate operational improvements.

Implement Value-Based Pricing Instead of Hourly Rates

Value-based pricing focuses on business outcomes your agency delivers rather than time spent on tasks. This approach captures more revenue when your expertise solves complex problems efficiently while building stronger client relationships.

Establish Clear Project Scope and Change Management

Well-defined boundaries prevent scope creep that destroys profitability through unpaid work and endless revisions. Create detailed statements specifying deliverables and implement formal change processes requiring client approval before modifications.

Optimize Team Composition for Maximum Efficiency

Strategic team composition matches right skill levels to appropriate tasks while avoiding expensive overqualification scenarios. Assign senior professionals to high-value work while delegating routine tasks to junior members at lower rates.

Automate Repetitive Tasks and Standardize Processes

Process automation eliminates time-consuming manual work that reduces profitability without adding client value. Invest in tools and templates that streamline deliverables so teams focus on creative problem-solving rather than overhead.

Monitor Project Health Through Regular Financial Reviews

Regular monitoring catches profitability problems while you can still implement corrections rather than discovering losses after completion. Schedule weekly budget reviews comparing costs against projections with trigger points for management intervention.

Project Profitability: Turn Clients’ Projects into Profit Powerhouses

Project profitability represents the foundation of sustainable agency growth because it determines whether your creative work generates actual business value or simply keeps you busy. Without systematic profitability management agencies struggle with cash flow issues and unsustainable client relationships.

Professional services businesses can transform their financial performance by implementing value-based pricing strategies and rigorous project monitoring systems. These practices simultaneously improve operational efficiency through better resource allocation while enhancing client engagement through transparent communication and results-focused delivery approaches.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Pooja Deshpande is a content contributor at Kooper, focused on creating insightful resources that help agencies and service providers scale efficiently. Passionate about SaaS trends, content strategy, and operational excellence, she delivers practical, easy-to-implement guidance for modern business leaders.