How to Create a Project Budget? Guide for Project Managers

Key Highlights:

- A project budget helps managers control resources, avoid surprises and ensure project success.

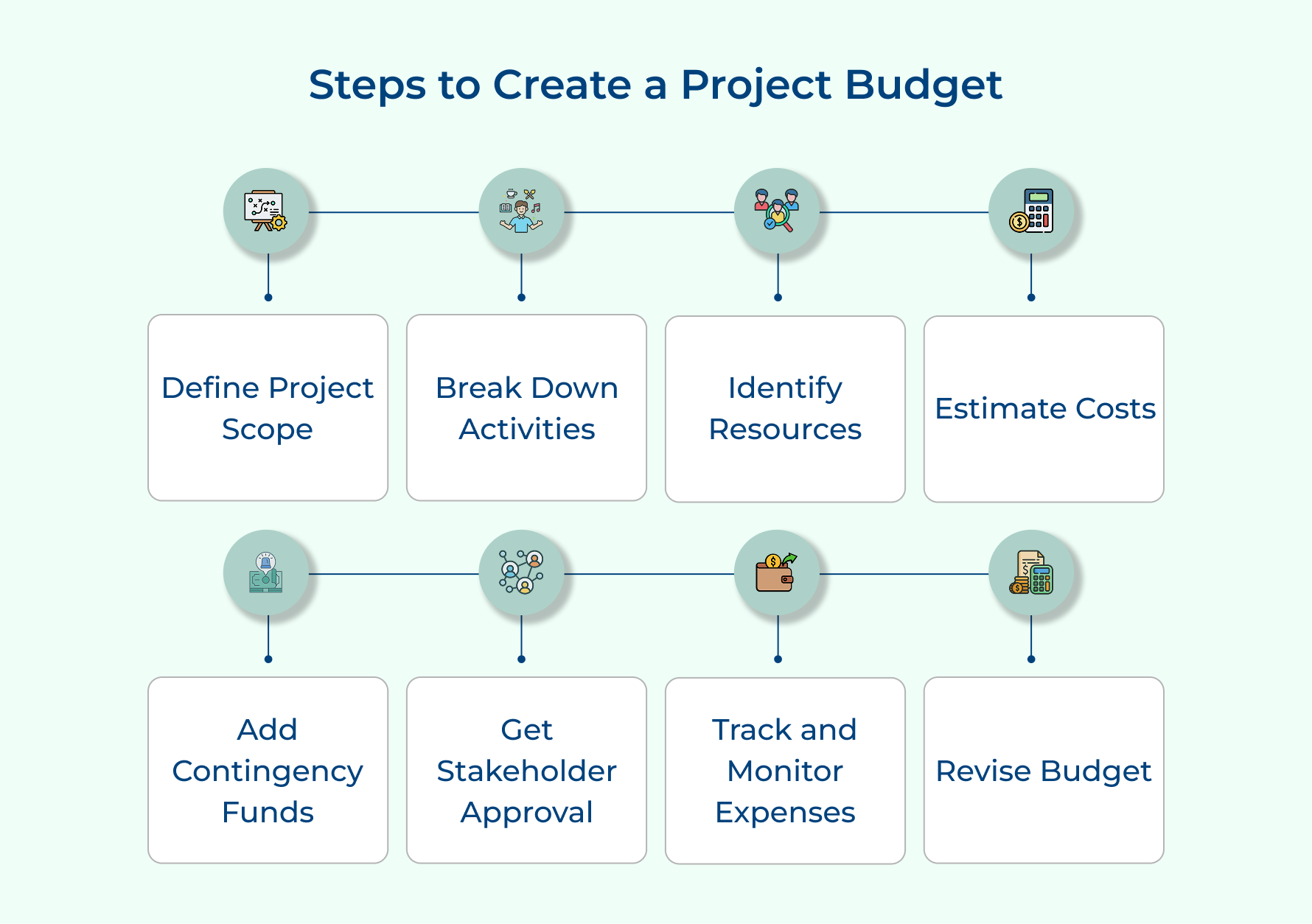

- Following eight steps (scope, breakdown, resources, estimates, contingency, approval, monitoring, revision) teaches project managers how to create a project budget effectively.

- Retainer, time/materials and milestone-based project budget examples show flexible approaches tailored to client needs as well as project scope.

Tired of projects going over budget, missing deadlines and frustrating stakeholders? This isn’t just your rodeo. Learning how to create a project budget can turn chaos into clarity. With the right approach, budgeting becomes a powerful tool to guide decisions, manage resources, and keep your project on track.

In fact, a solid budget helps you gain client trust, avoid surprise costs, and deliver results without the stress. Ready to make budgeting your secret weapon? Let’s break it down into eight simple steps that make sense and actually work.

What is a Project Budget?

A project budget is your financial blueprint that outlines all expected costs needed to complete a project successfully. It maps out every resource requirement (from staffing/materials to software as well as contingencies) giving you clarity on what funds you’ll need and when you’ll need them throughout the project lifecycle.

For agencies, a solid project budget prevents scope creep and protects profit margins while demonstrating professionalism to clients. For clients, it provides financial predictability and prevents unexpected costs that might derail business plans. Both parties benefit from the transparency and accountability that comes with a well-structured budget.

Common cost categories:

- Labor costs cover salaries and wages for everyone working on the project including full-time staff as well as contractors.

- Material costs include physical items needed to create deliverables like raw materials or components.

- Equipment and technology costs encompass hardware purchases, software licenses, along with specialized tools needed to execute the project.

- Overhead costs represent indirect expenses like office space, utilities, and administrative support that keep the project running.

- Contingency reserves set aside funds for unexpected challenges or opportunities that inevitably arise during project execution.

8 Steps to Create and Manage Project Budget

Let’s guide you through eight practical steps that will empower you to successfully plan and oversee your project budget.

1. Define Clear Project Scope

A clear project scope is your best defense against scope creep and surprise costs. It sets firm boundaries around what will and won’t be delivered, so everyone’s on the same page from the start.

When figuring out how to create a project budget,

- Start by mapping deliverables. Spell out exactly what you’ll produce, including formats, quality standards, and what “done” actually means.

- Prioritize features: label them as must-have, should-have, or nice-to-have. That way, if budget pressure hits, you know what’s flexible.

- Don’t skip quality benchmarks. Clear expectations here help estimate the time, skill, and cost involved.

For instance, in a website redesign, outline page counts, functions, and performance needs to avoid surprises as well as keep budgets accurate.

2. Break Down Required Activities

Breaking your project into smaller, manageable activities is key when learning how to create a project budget. It takes a big, messy task and turns it into clear, trackable pieces, making it much easier to estimate time, effort as well as cost accurately.

For example, if your deliverable is “Create Digital Marketing Assets,” don’t stop there. Break it down further:

- Research your audience

- Design brand elements

- Craft messaging

- Create platform-specific graphics

- Produce a demo video

This level of detail prevents you from underestimating how much work is really involved. It also helps you spot task dependencies and potential cost drivers early, so you can build a more reliable, realistic budget from the ground up.

3. Identify All Necessary Resources

When figuring out how to create a project budget, don’t overlook the full list of resources you’ll need, this is where many budgets go off track. Resource identification means more than just people; it’s everything required to get the job done. Here’s what to consider:

- Human resources: Who’s needed and what roles they’ll play – think designers, developers, content writers.

- Software tools: Platforms for design, collaboration, or project tracking.

- Hardware/equipment: Laptops, cameras, or any gear your team needs to deliver.

- Materials: Things like print supplies or raw materials for prototypes.

- External services: Freelancers, voiceover talent, or consultants.

Pro tip: Map how these resources interact. For example, a new team member might also need a laptop and software licenses. Plan ahead to avoid budget surprises.

4. Estimate Costs For Each Element

Cost estimation is where your budget starts to take shape. Once you’ve identified your resources, the next step in how to create a project budget is assigning real dollar amounts to each one. This helps stakeholders understand total costs and sets you up for realistic funding.

Before you estimate, ask yourself:

- How long will each task take and how much effort is needed?

- What quality is expected, and how does that impact cost?

- Are there seasonal or regional price shifts to consider?

- Will a tight timeline drive costs up?

Popular estimation methods include:

- Analogous: Use past project data—fast, but less precise.

- Parametric: Multiply known rates by quantity (e.g., 15 hrs per page × 20 pages).

- Bottom-up: Estimate every task, accurate but time-intensive.

Don’t forget hidden costs like taxes, benefits, or inflation!

5. Add Contingency Reserve Funds

When learning how to create a project budget, don’t skip building in contingency reserves, they’re your financial safety net. These funds cover surprises without derailing your project or forcing you to cut scope.

Here’s how to do it smartly:

- Set aside 5–10% of your total budget based on how complex or uncertain the project is. More unknowns? Go higher.

- Document specific risks: List potential issues (like vendor delays or tech failures), how likely they are, and what they could cost.

- Create a risk register to show stakeholders you’re not just guessing, you’re planning smartly.

This way, if something unexpected pops up, you’re ready. And you won’t need to scramble for extra funds or compromise quality mid-project.

6. Get Stakeholder Review And Approval

The final step is getting stakeholder review and it’s a must. This is where your budget shifts from draft to official plan, locking in buy-in, accountability as well as a clear financial baseline.

Here’s how to make it count:

- Present clearly: Explain your assumptions, cost breakdowns, and contingencies in plain language.

- Encourage feedback: Be open to questions and adjust the budget as needed, then document all changes.

- Use a one-page summary: Highlight key numbers and assumptions so busy stakeholders can review quickly.

- Plan ahead: Schedule the review early so there’s time for revisions before kickoff.

With a solid, approved budget in place, you’ll avoid confusion later and start your project with confidence.

7. Track And Monitor Expenses Regularly

Expense tracking is the heartbeat of your budget—it tells you what’s really happening with your money in real time. It ensures you stay in control, spot red flags early and make smart resource decisions.

Use this checklist to track effectively:

- How often should we review? Weekly or biweekly is usually best—frequent enough to catch issues without becoming a burden.

- Which categories need extra attention? Focus on high-cost or volatile areas like contractors or third-party services.

- Who’s tracking? Assign clear ownership and include a verification process for accuracy.

- What triggers alerts? Define thresholds (e.g., 10% variance) that require a deeper look.

Don’t just track, analyze. Use metrics like CPI, burn rate, as well as variance analysis to spot trends and act early.

8. Revise Budget As Project Progresses

A solid project budget isn’t set-it-and-forget-it, it should grow with your project. A key part of how to create a project budget is knowing when and how to revise it. Conditions change, new info surfaces, and your budget needs to stay relevant.

Here’s how to keep it current:

- Rolling wave planning: Refine short-term estimates regularly while keeping long-term projections flexible.

- Threshold-based revisions: Set clear trigger (like a 10% variance or completion of a major milestone) to prompt a review.

- Include stakeholders: Bring decision-makers into major updates to keep trust and alignment strong.

Treat your budget like a living document. Revisions based on performance data make it a powerful tool and lead to better financial results.

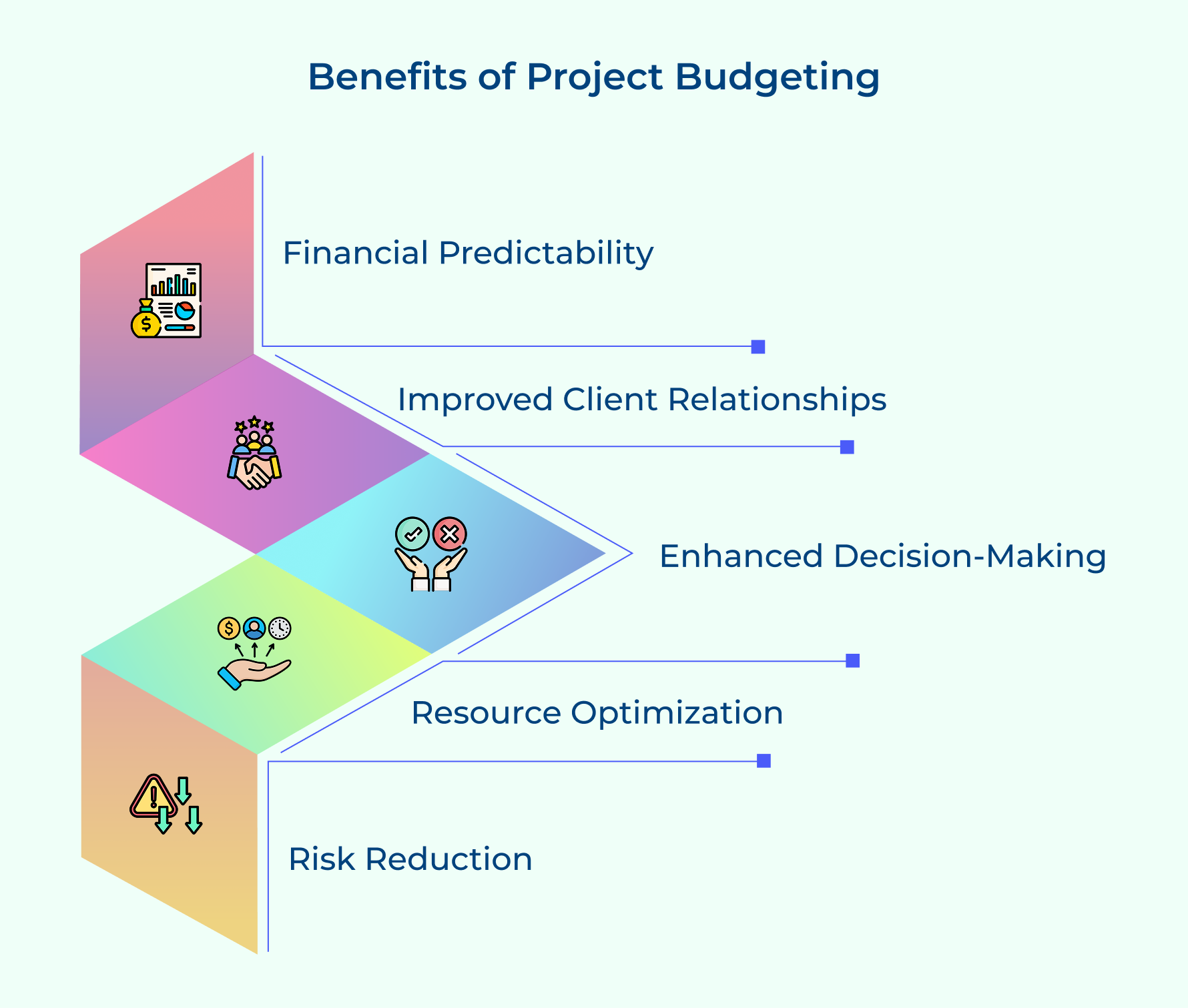

How to Make a Project Budget: 5 Important Benefits

Project budgeting delivers significant advantages regardless of whether you’re managing client work or internal initiatives. It serves as both a financial roadmap and a strategic management tool that impacts multiple aspects of project success.

Financial Predictability

Project budgeting helps project managers forecast cash flow and allocate resources smartly. It keeps finances steady and avoids surprise project costs, even when juggling multiple projects.

Enhanced Decision-Making

A solid budget gives project managers real data to guide choices. When priorities shift or new requests pop up, decisions are based on budget impact, leading to smarter calls.

Improved Client Relationships

Clear budgets set the right expectations from day one. Clients know what they’re paying for and why, which builds trust while also reducing confusion about deliverables.

Resource Optimization

Budgeting pushes teams to be strategic. It uncovers ways to cut waste, use existing tools and focus efforts on high-value tasks, all key to running lean as well as efficient projects.

Risk Reduction

The budgeting process flags financial risks early. Project managers can plan ahead with contingencies, reducing the chance of unexpected costs that could derail progress or hurt profits.

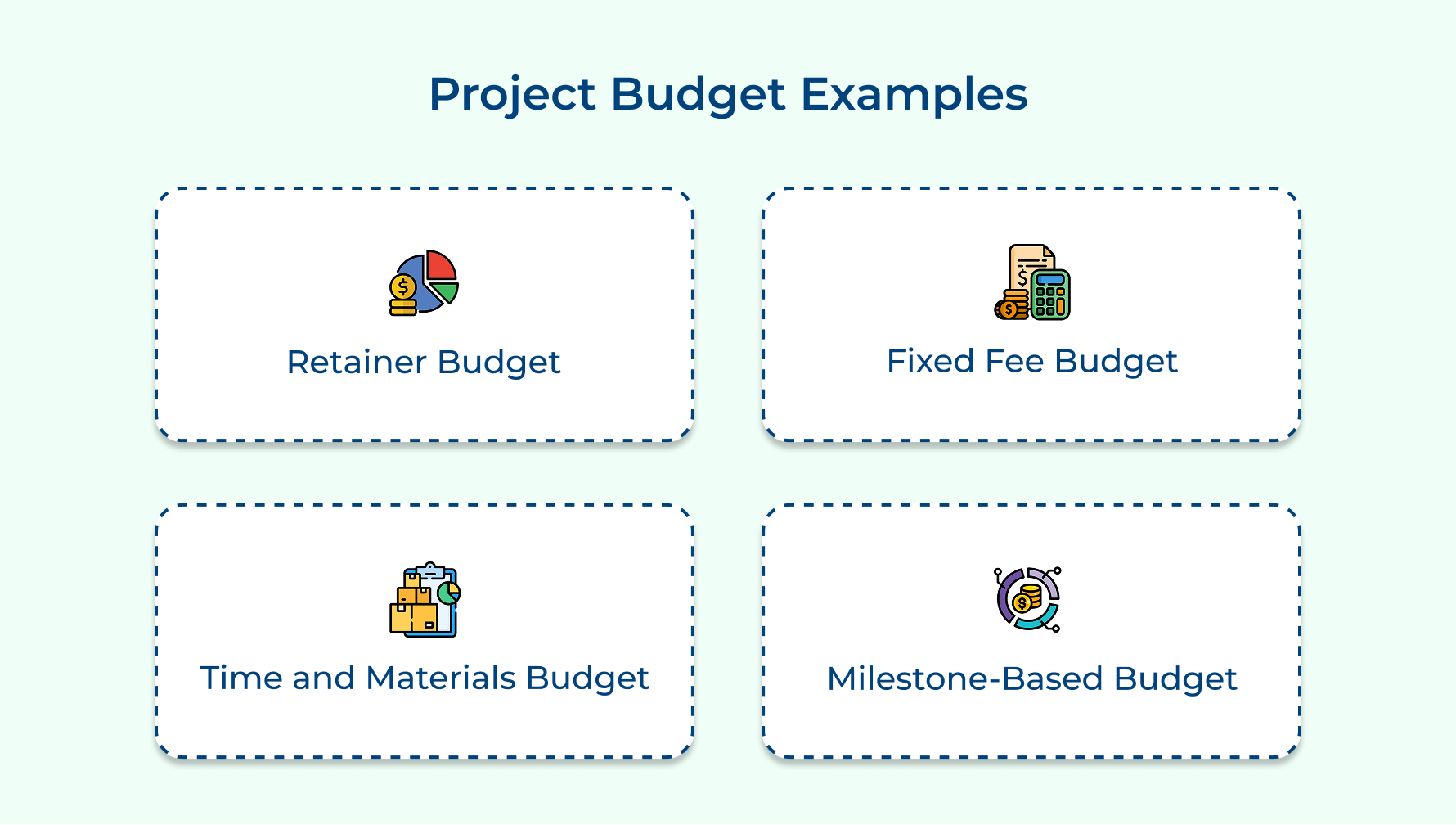

Project Budget Examples

Let’s explore four effective budget examples that adapt to various business scenarios.

Retainer Budget

A retainer budget involves clients paying a fixed amount regularly (typically monthly) for a predetermined amount of work or access to your services. This creates a stable, predictable income stream while giving clients flexibility in how they use allocated hours or resources.

Retainers work exceptionally well for ongoing relationships where clients need consistent access to your expertise. For example, a marketing agency might offer a monthly retainer of 20 hours at $150/hour for $3,000 per month, covering regular website updates, social media management, and ad campaign optimization.

The client enjoys priority service without processing new contracts monthly, while your business benefits from predictable revenue that helps with resource planning and cash flow management.

Fixed Fee Budget

A fixed fee budget establishes a single predetermined price for the entire project scope regardless of the actual time or resources consumed. This approach creates maximum financial clarity for clients who want to know exactly what they’ll pay before work begins.

Fixed fee budgets require exceptionally careful scope definition and risk assessment. For instance, a web development company might charge $25,000 for a complete e-commerce website with specific functionality, pages, and features clearly documented.

The client appreciates knowing their total investment upfront with no surprises. However, you also absorb the risk of underestimating complexity, making thorough planning and detailed scoping essential.

Time and Materials Budget

A time and materials budget charges clients based on the actual hours spent as well as resources used throughout the project. This flexible approach allows for evolving project scopes and accommodates situations where requirements cannot be fully defined in advance.

This model works well for complex projects with many unknowns. For example, a software development firm might estimate a client app at 350-450 hours at $125/hour plus actual costs for third-party integrations and licenses. The client receives regular, detailed invoices showing exactly what they’re paying for, creating transparency.

Your business benefits from reduced risk since you’re compensated for all work performed, even as project requirements evolve or unexpected challenges arise during implementation.

Milestone-Based Budget

A milestone-based budget breaks the project into distinct phases with separate payments tied to the completion of specific deliverables. This approach balances risk between client and service provider while creating natural checkpoints for project evaluation.

This structure works particularly well for long-term projects with clearly defined outputs. For example, a brand strategy project might include $5,000 upon completion of market research, $8,000 upon delivery of brand positioning, and $7,000 upon finalization of brand guidelines. Clients appreciate seeing tangible progress before making full payment, reducing their perceived risk.

Common Challenges in Creating a Project Budget

In this article, we will delve into the most common challenges encountered when crafting a project budget, along with strategies to overcome them effectively

- Inaccurate time estimates: Teams often underestimate hours for tricky tasks because of optimism or unclear requirements. This can throw your whole budget off and risk project success.

- Hidden costs: Things like admin overhead, software licenses, or compliance fees often slip under the radar but add up fast.

- Lack of historical data: New teams or projects without past data have to guess more, which can lead to off-base estimates.

- Market volatility: Economic shifts, supply chain issues, or regulatory changes can suddenly raise costs, especially on longer projects.

To overcome these:

- Use three-point estimates—optimistic, realistic, and pessimistic—to get balanced cost projections.

- Make checklists for often-forgotten expenses.

- Back your budget with solid data that ties costs to project success.

- Build an internal cost database from past projects.

- Add escalation clauses and set aside reserves for market changes.

Creating and Managing Project Budgets with Kooper

Kooper transforms project budgeting through its all-in-one platform, which seamlessly integrates financial tracking with project management capabilities. This allows teams to create accurate budgets, monitor expenses in real time, and make data-driven decisions that maximize project profitability while minimizing administrative burden.

Automated expense categorization that instantly organizes costs by project, client, and budget category for clear financial visibility. Collaborative budget approval workflows that streamline stakeholder review processes and maintain a complete history of all budget versions. Customizable financial reporting that generates client-ready budget summaries alongside detailed internal cost analysis views.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Neeti Singh is a passionate content writer at Kooper, where he transforms complex concepts into clear, engaging and actionable content. With a keen eye for detail and a love for technology, Tushar Joshi crafts blog posts, guides and articles that help readers navigate the fast-evolving world of software solutions.