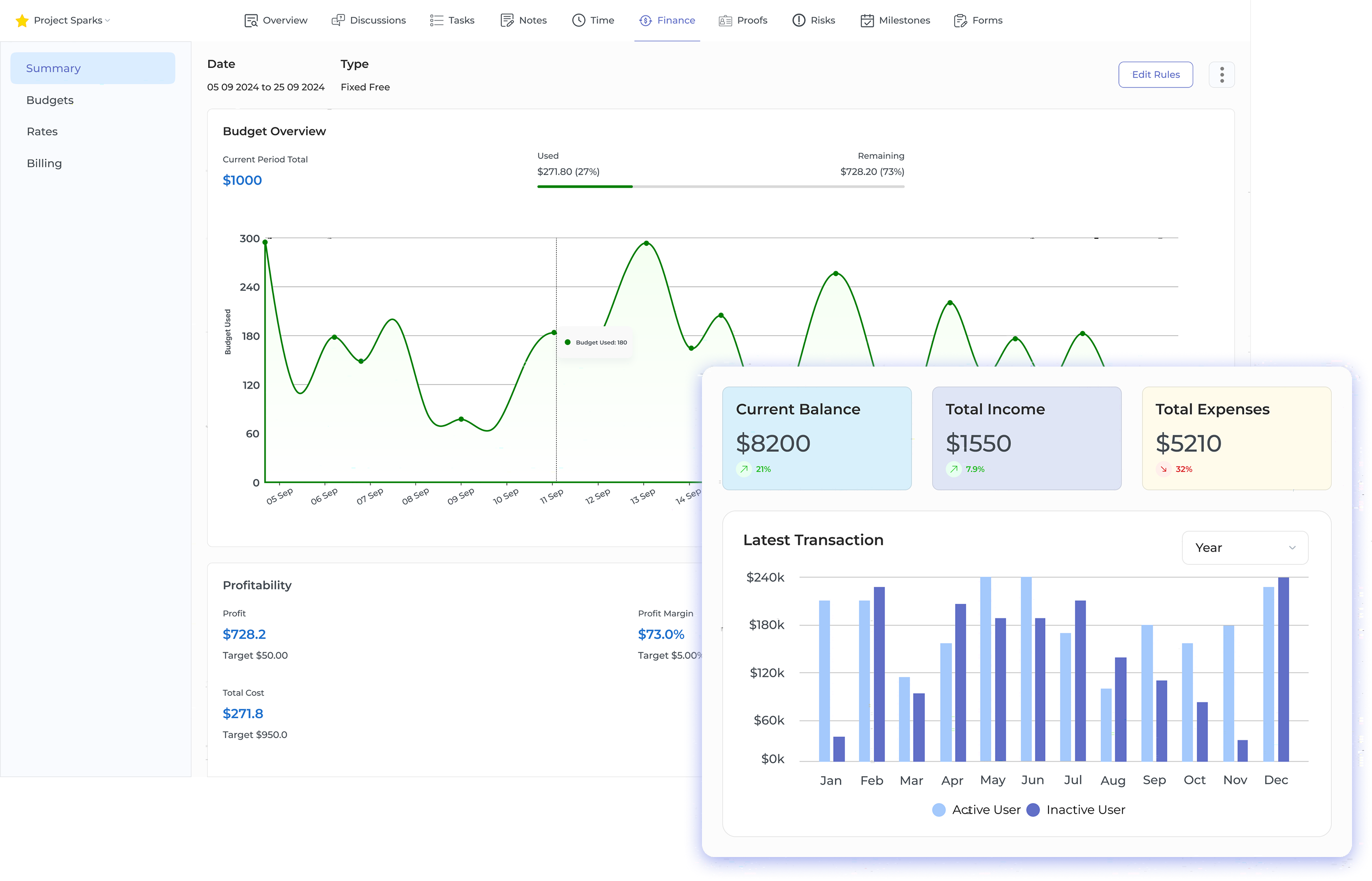

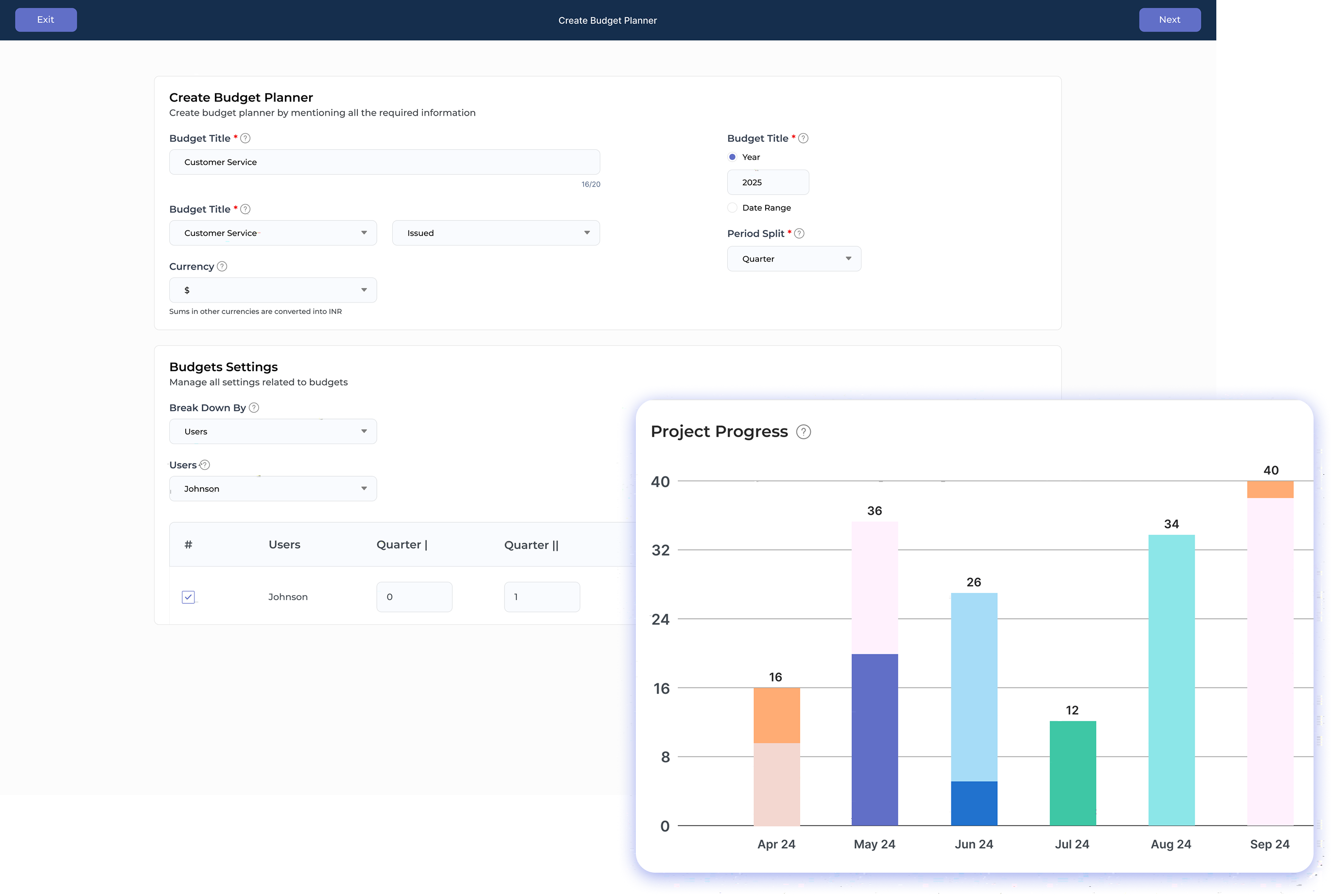

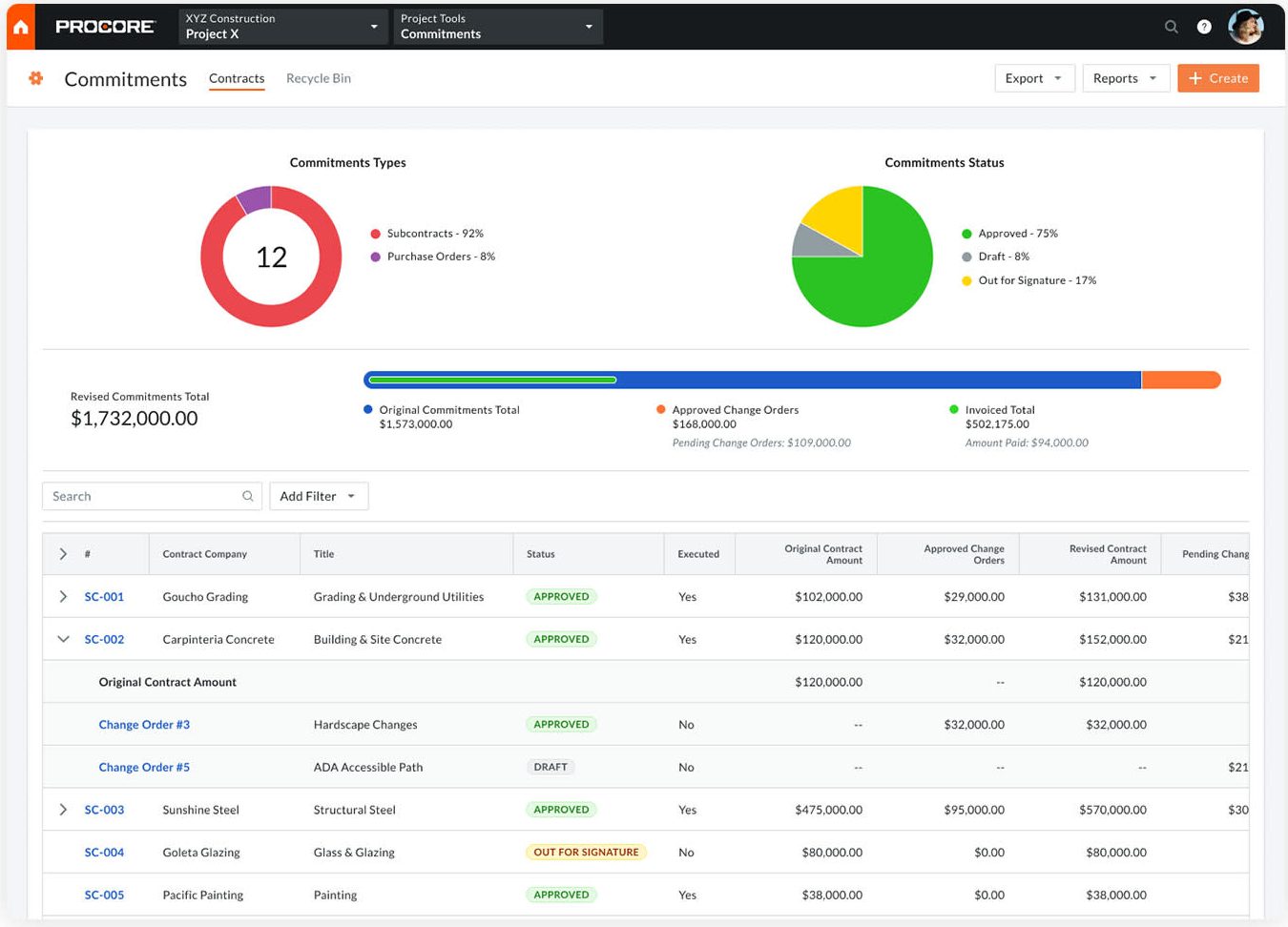

Budget Management and Tracking

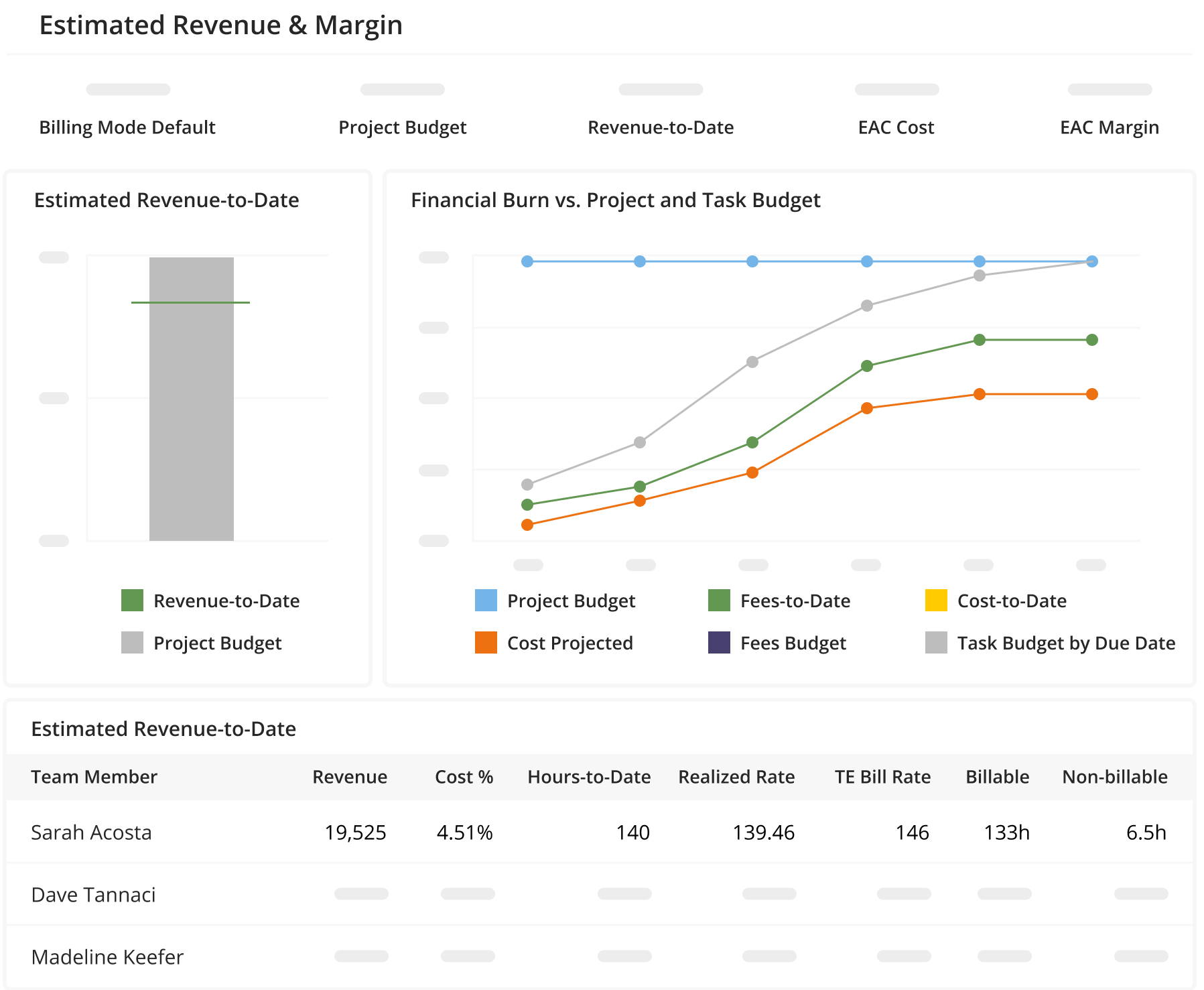

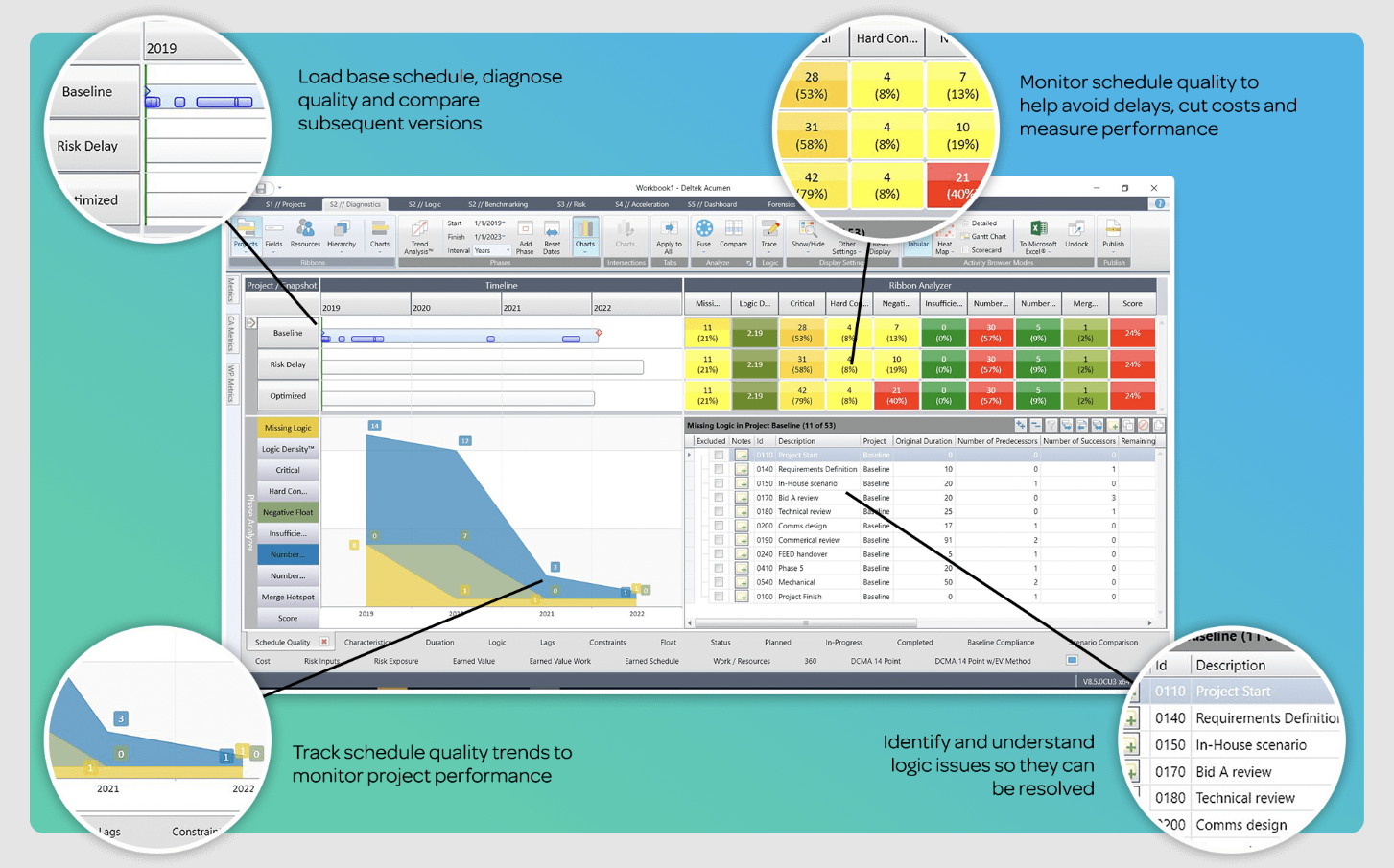

The management and tracking feature helps create, monitor, as well as control project budgets in real time. In architecture firms, architecture project management tools help managers set budgets, monitor spending, and receive timely alerts for overspending. It includes tools for forecasting, scenario planning, and variance analysis. Automated reconciliation and rolling forecasts adjust to project changes. AI predicts budget overruns and suggests solutions.

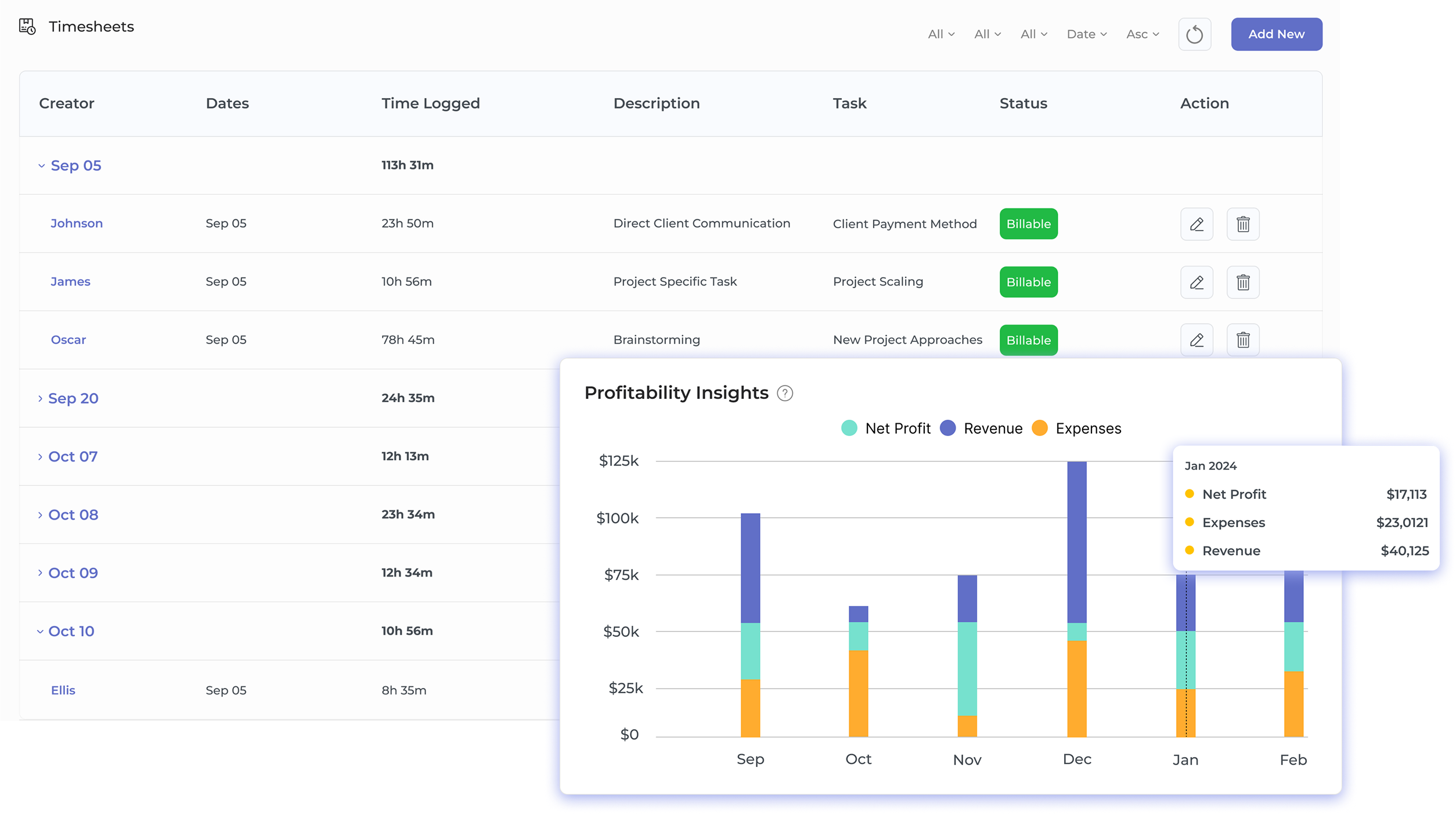

Resource Allocation and Cost Tracking

The system helps assign financial resources as well as track costs like labor, materials, and overhead. It combines cost management with project tracking to improve efficiency and transparency. Features like capacity planning and predictive analytics optimize resource distribution. Real-time calendars and custom cost rules ensure better cost control.

Time and Expense Tracking

The time and expense tracking module captures work hours as well as expenses, automating approvals as well as cost allocation. For teams focused on accuracy, understanding what is project accounting ensures smoother integration with payroll and accounting systems. Mobile access allows real-time submissions. AI extracts receipt data, validates expenses, and supports multi-currency transactions.

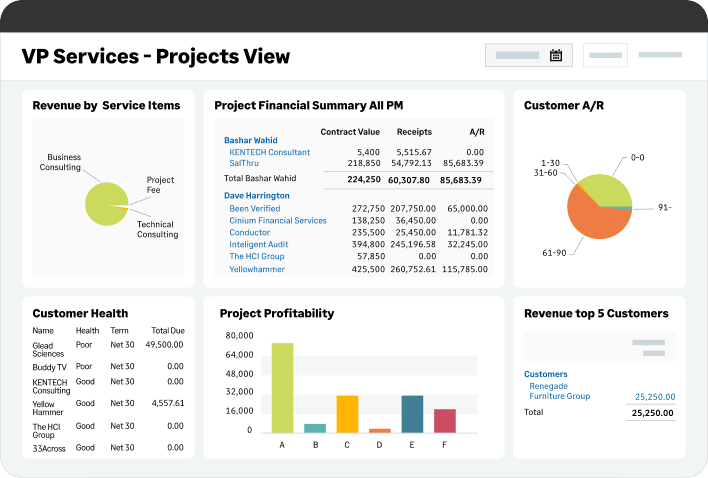

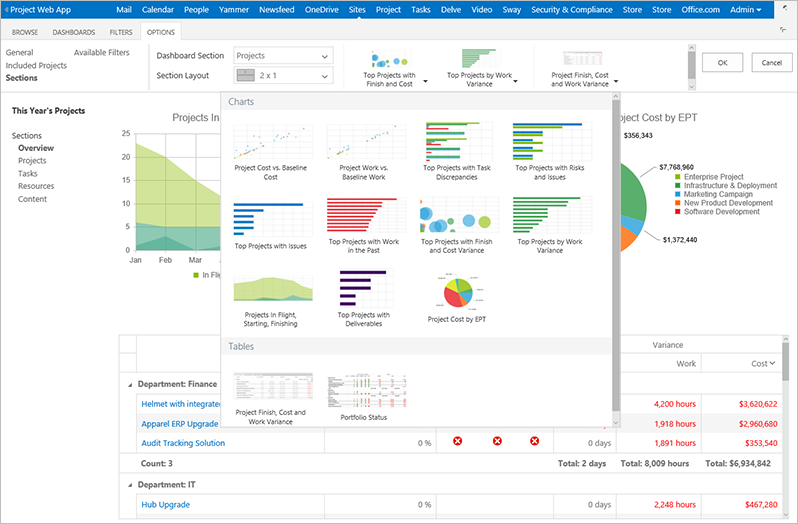

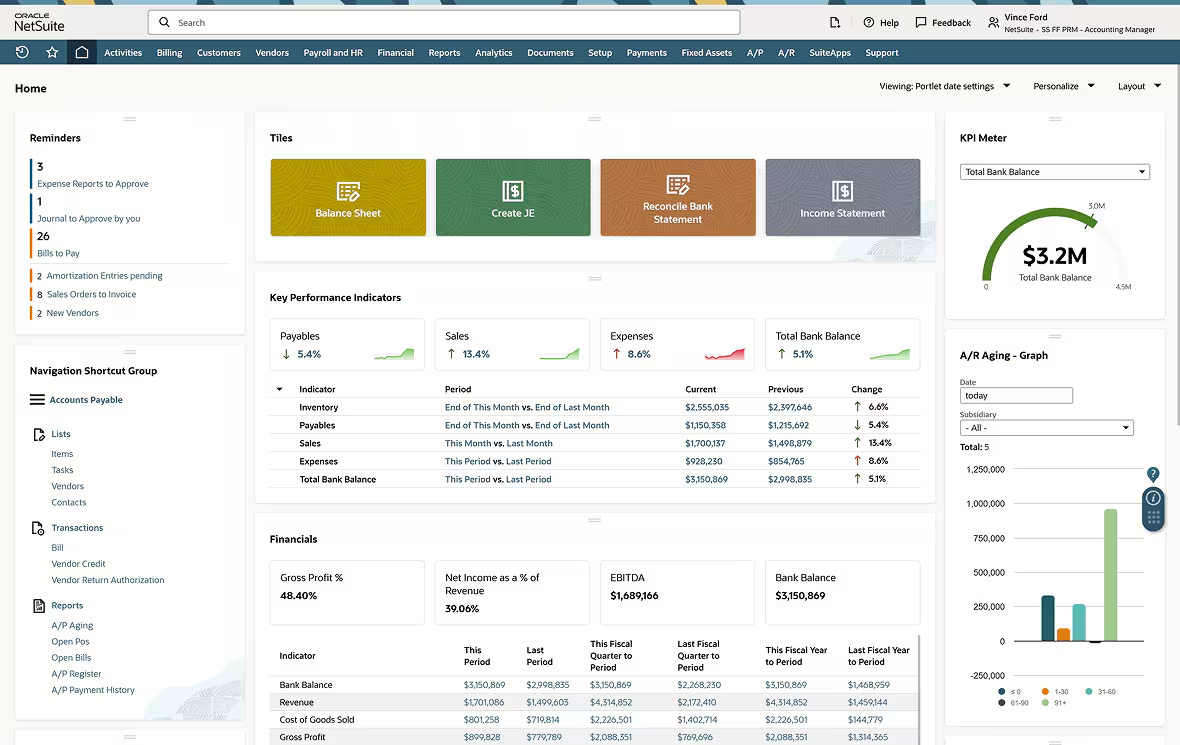

Financial Reporting and Analytics

The reporting and analysis system generates reports as well as dashboards to track financial health, KPIs, trends, etc. AI-powered analytics detect patterns and anomalies. Users can customize reports, automate scheduling, and explore data for deeper insights.

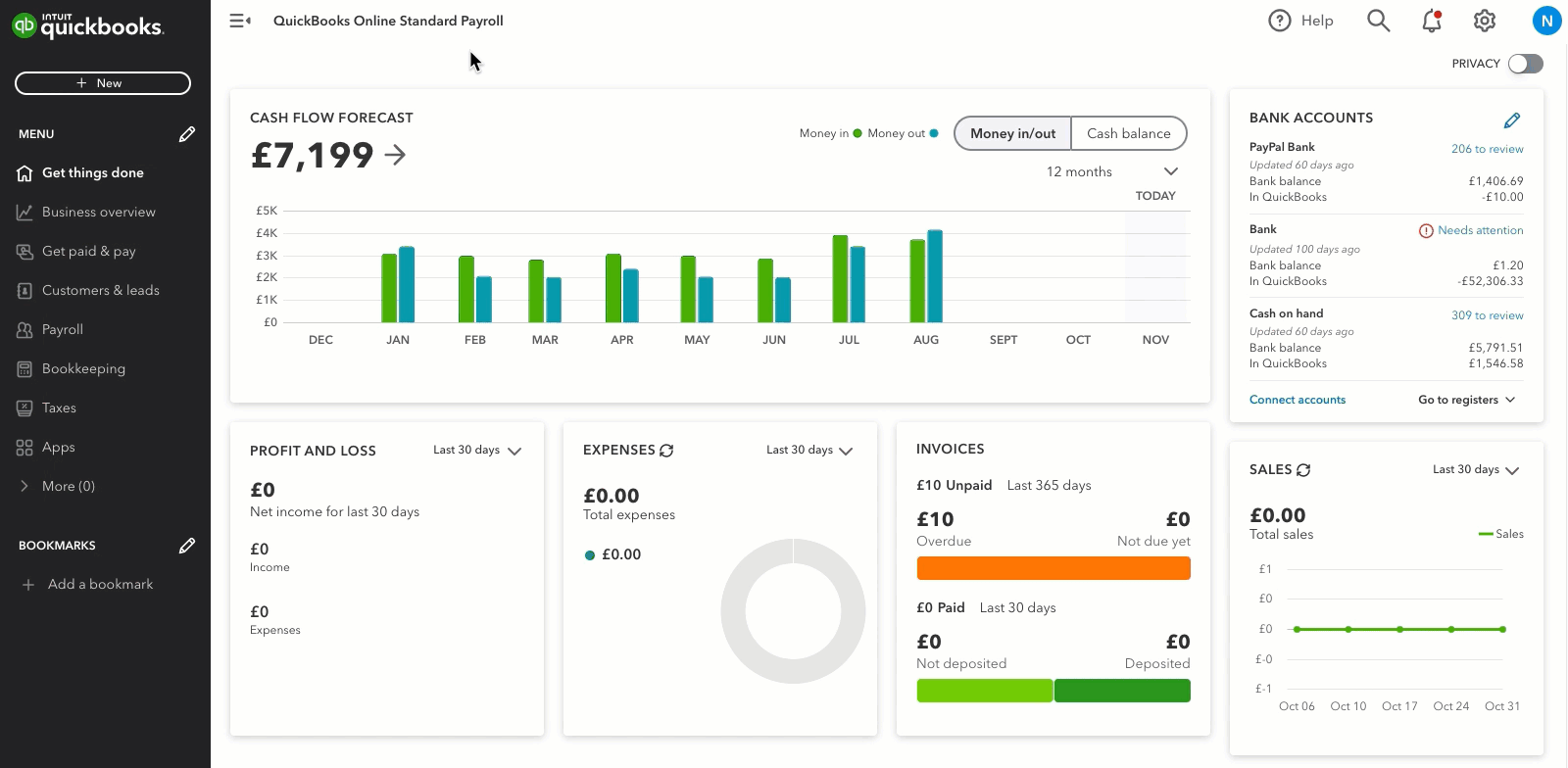

Invoicing and Billing Automation

The feature automates invoice generation based on milestones, time, and expenses. It includes billing schedules, payment tracking, and accounting integration. Such invoicing software for SMBs offers an all-in-one solution to handle payments and compliance effortlessly for teams managing finances in small businesses. Multi-currency support and tax compliance ensure accurate global billing. Automated reconciliation reduces manual work.

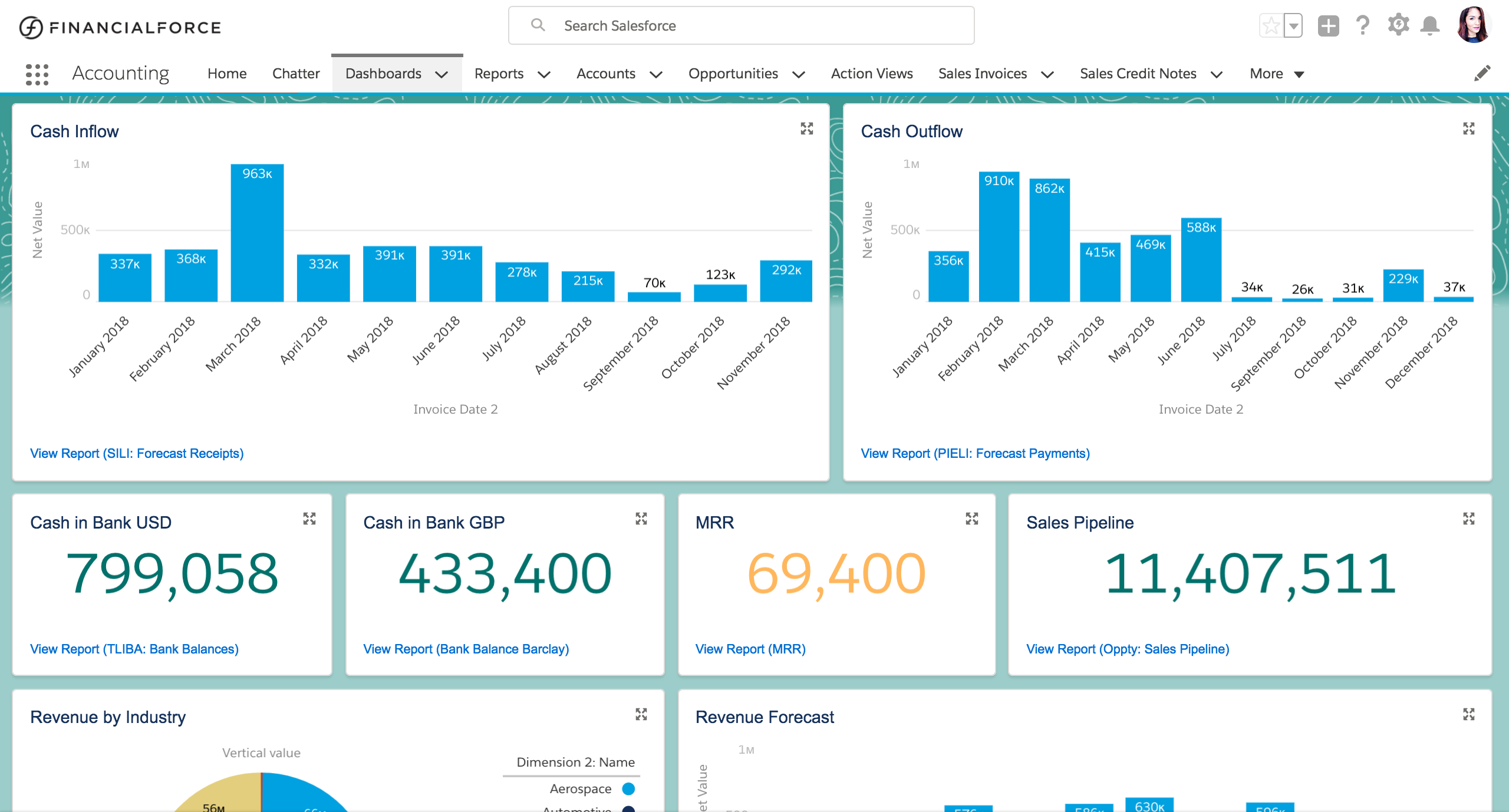

Cash Flow Management

It helps track and forecast project cash flow, ensuring enough funds are available. The system provides alerts for cash issues and automates payment reminders. AI suggests the best payment timings to optimize cash flow.

Cost-benefit Analysis

The tool helps assess project profitability and return on investment (ROI). Managers can compare costs and benefits to make informed decisions. It includes financial modeling, risk assessment, as well as various valuation methods like NPV and IRR.

Integration Capabilities

The software connects with accounting, ERP, and project management systems for smooth data flow. APIs enable custom integrations and automated workflows. Integrating ERP for professional services further enhances data accuracy and consistency across platforms.

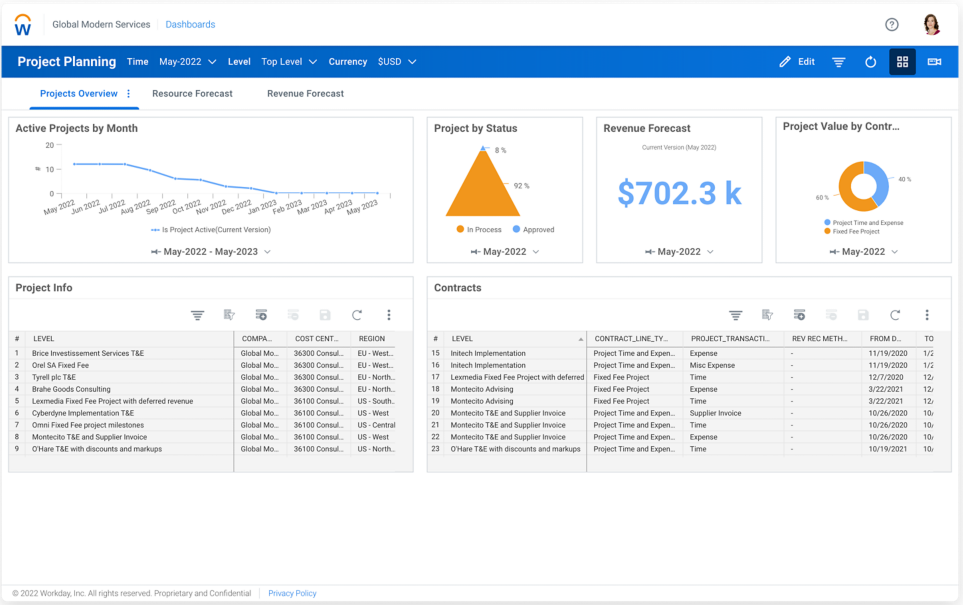

Portfolio Financial Management

Portfolio financial management provides a financial overview of multiple projects, helping optimize resources and prioritize investments. Advanced analytics highlight high-performing projects. Tools for portfolio balancing and scenario planning support strategic decisions.