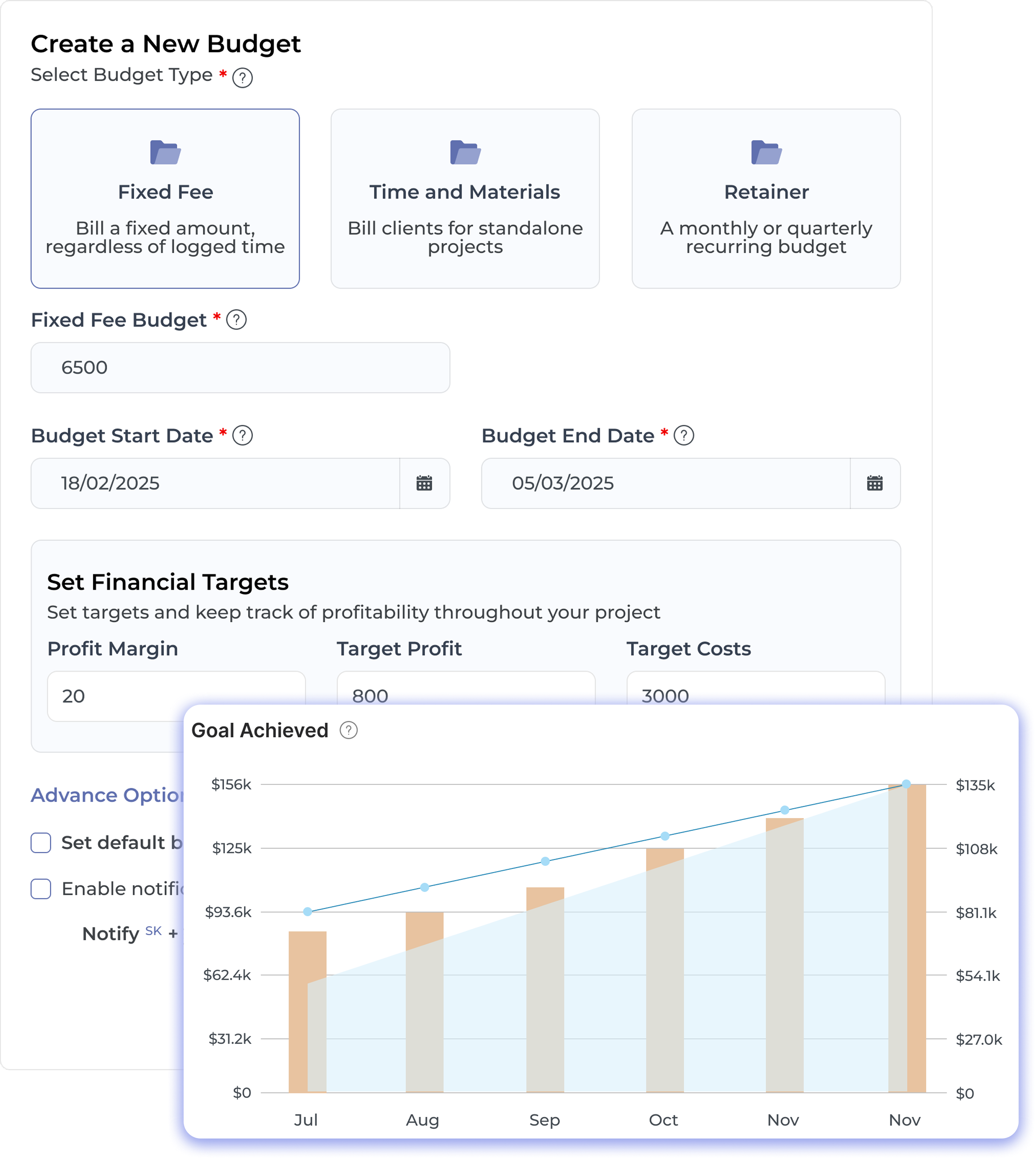

Establish Clear Project Scope and Budgets

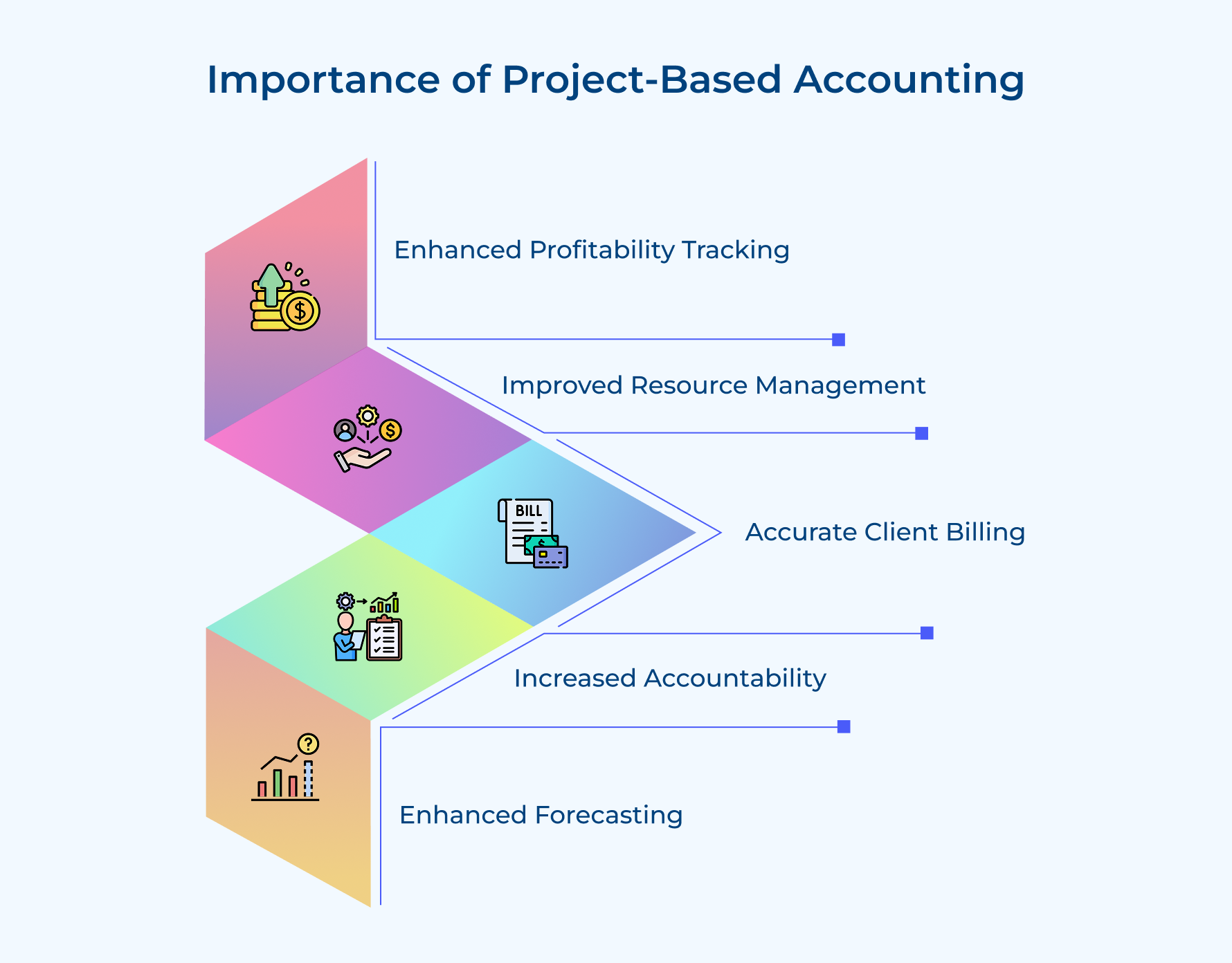

A clear project scope and a well-defined project budget ensure that expectations are set from the start and help prevent scope creep. It also acts as a baseline to track performance and profitability.

How to implement it effectively:

Work with clients to define a detailed scope. Create a full budget that includes direct and indirect costs. Use project accounting software to compare actual costs to budgeted amounts on a project basis.

Implement a Robust Time Tracking System

Implementing time tracking solutions helps record billable hours accurately and boosts billing, resource planning, and project profitability.

Effective ways to implement it:

Use time tracking tools that integrate with your project management system. Train employees on time entry and audit entries regularly to maintain accuracy.

Establish Project-Specific KPIs

Tracking KPIs on a project basis helps monitor financial health as well as performance. It shows if projects meet goals and where improvements are needed.

How to implement it effectively:

Choose KPIs based on your industry and project type. Set up automated KPI tracking and review results with your team regularly.

Implement Efficient Resource Allocation

The right resource allocation prevents overloading or underusing staff. It improves project delivery and boosts profitability. A reliable work management platform further helps teams balance workloads and align project accounting with real-time performance.

Implement it effectively through:

Use resource planning tools to track availability as well as workloads. Keep staff skill profiles updated and set up a formal process for resource requests.

Leverage Technology for Automation and Reporting

Automation helps reduce manual work and errors. Reporting tools give real-time insights into finances, resource use, and cost centers.

Effectively implement it by:

Adopting professional services automation allows you to integrate time tracking, invoicing, and reporting, making team training and system updates more efficient.

Maintain Detailed Documentation

Clear documentation supports accurate reporting and helps during audits or disputes. It also provides a reference for future projects.

Effective implementation starts by:

Using a centralized system for storing project documents. Set rules for naming and saving files as well as review documents often for accuracy.

Conduct Regular Project Financial Reviews

Frequent financial reviews help catch problems early and keep projects aligned with business goals.

How to implement it effectively:

Hold monthly financial check-ins with project and finance teams. Use standard reports to review costs, revenue, and indirect costs.

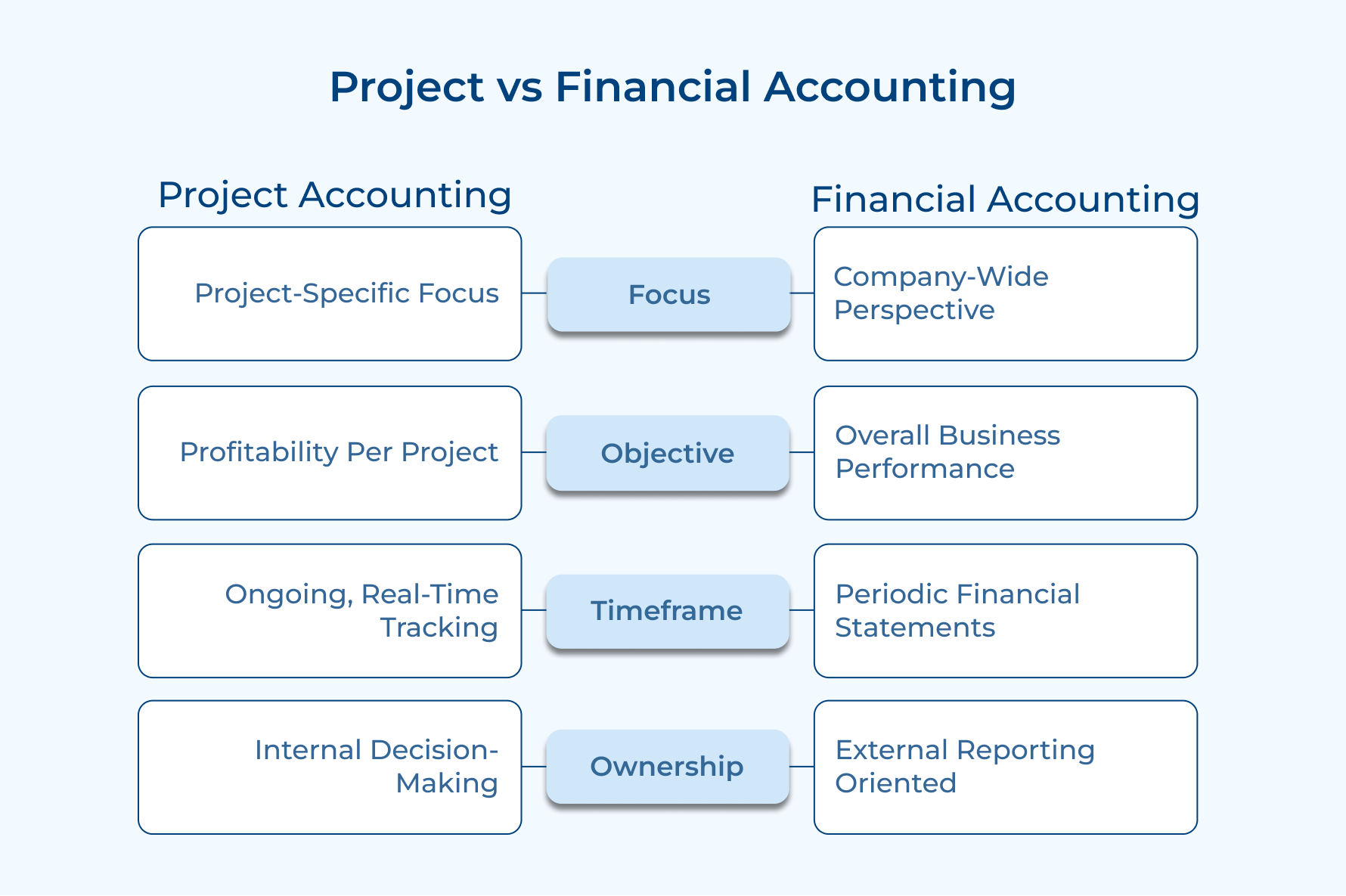

Integrate Project Accounting with Overall Financial Management

Linking project accounting with your main financial system gives a full view of performance. It helps manage budgets, cost centers, and financial plans.

Implement it effectively through:

Use software that connects project data with company finances. Make sure codes and categories match across systems while reconciling accounts regularly.