A Guide to Creating Retainer Invoices with Tips & Benefits

Key Highlights:

- Retainer invoices offer predictable revenue streams, simplifying cash flow management, and reducing the anxiety of fluctuating incomes.

- Streamlined payment processes ensure consistent cash flow by automating invoicing and reducing follow-ups.

- Clear service breakdowns and transparent fees build trust with clients, ensuring they understand their value.

Managing ongoing client payments can be tricky for businesses. It often leads to unpredictable cash flow, constant invoice follow-ups, and unnecessary stress.

Without a proper invoicing system for recurring projects or services, things can quickly spiral into disorganization, delayed payments, and even strained relationships with clients. Then, there are retainer invoices that offer a simple and efficient way to handle recurring payments for ongoing work.

Let us dive into what a retainer invoice is, why it’s a game-changer, and how it can make invoicing a breeze—while keeping your cash flow steady as well as your client relationships solid.

What is a Retainer Invoice?

A retainer invoice is a billing document issued to clients for prepaid professional services over a specified period, typically monthly basis or quarterly basis. Unlike traditional invoices that bill for completed work, retainer invoices charge in advance for the reserved time, expertise, and availability of services. Hence, establishing an ongoing professional relationship between service providers and clients.

Retainer invoices are crucial for establishing stable, long-term business relationships and ensuring consistent cash flow. They provide financial security for service providers while guaranteeing clients priority access to services.

Key objectives:

- Financial predictability: Ensures steady, reliable income streams for service providers while offering clients transparent, fixed-cost budgeting.

- Resource allocation: Enables efficient planning and distribution of time, expertise, as well as resources to meet client needs effectively.

- Service guarantee: Establishes clear expectations and commitments for both parties, ensuring priority service delivery for retainer clients.

- Relationship building: Builds long-term professional relationships by creating a framework for ongoing collaboration and service delivery.

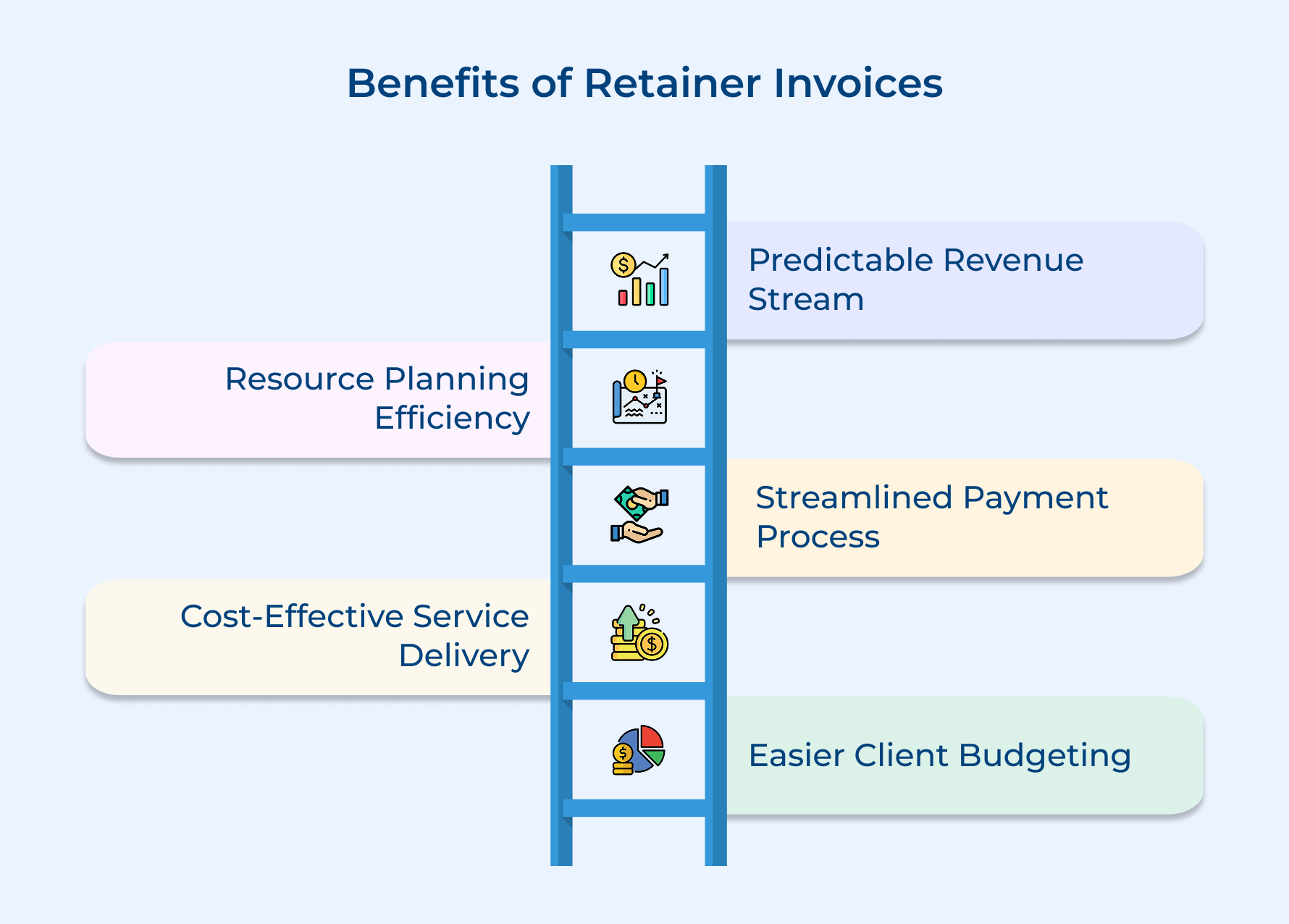

Benefits of Retainer Invoices

Retainer invoices aren’t just about billing—they’re about creating stability and building trust. Let’s explore how they can benefit your business.

Predictable Revenue Stream

Retainer invoices help you establish a steady income each month, giving you a solid foundation for your agency or service-based business. With a reliable cash flow, you can plan your finances better, run your operations smoothly, and make business decisions with more confidence—without worrying about unpredictable revenue.

Resource Planning Efficiency

Having clients on retainers makes it easier to plan your resources. With commitments in place, you can allocate your team more effectively, manage workloads better, and plan projects ahead of time.

Streamlined Payment Process

Retainer invoices simplify the whole payment process. Rather than chasing down multiple invoices for different tasks, your clients pay on a regular schedule. This means fewer follow-ups, fewer delays, and smoother cash flow, all while keeping things efficient.

Cost-effective Service Delivery

When you work with clients on a retainer, you build long-term relationships that help you become more efficient over time. You get to know their needs, preferences, and processes, reducing onboarding time while also allowing you to deliver services more effectively.

Easier Client Budgeting

Clients love retainer invoices because they make budgeting so much easier. Predictable payments allow clients to manage their budgets for ongoing services without the surprise of sudden, unexpected bills. With a fixed retainer rate, they don’t have to negotiate new terms every time a new task comes up, making the whole process more straightforward.

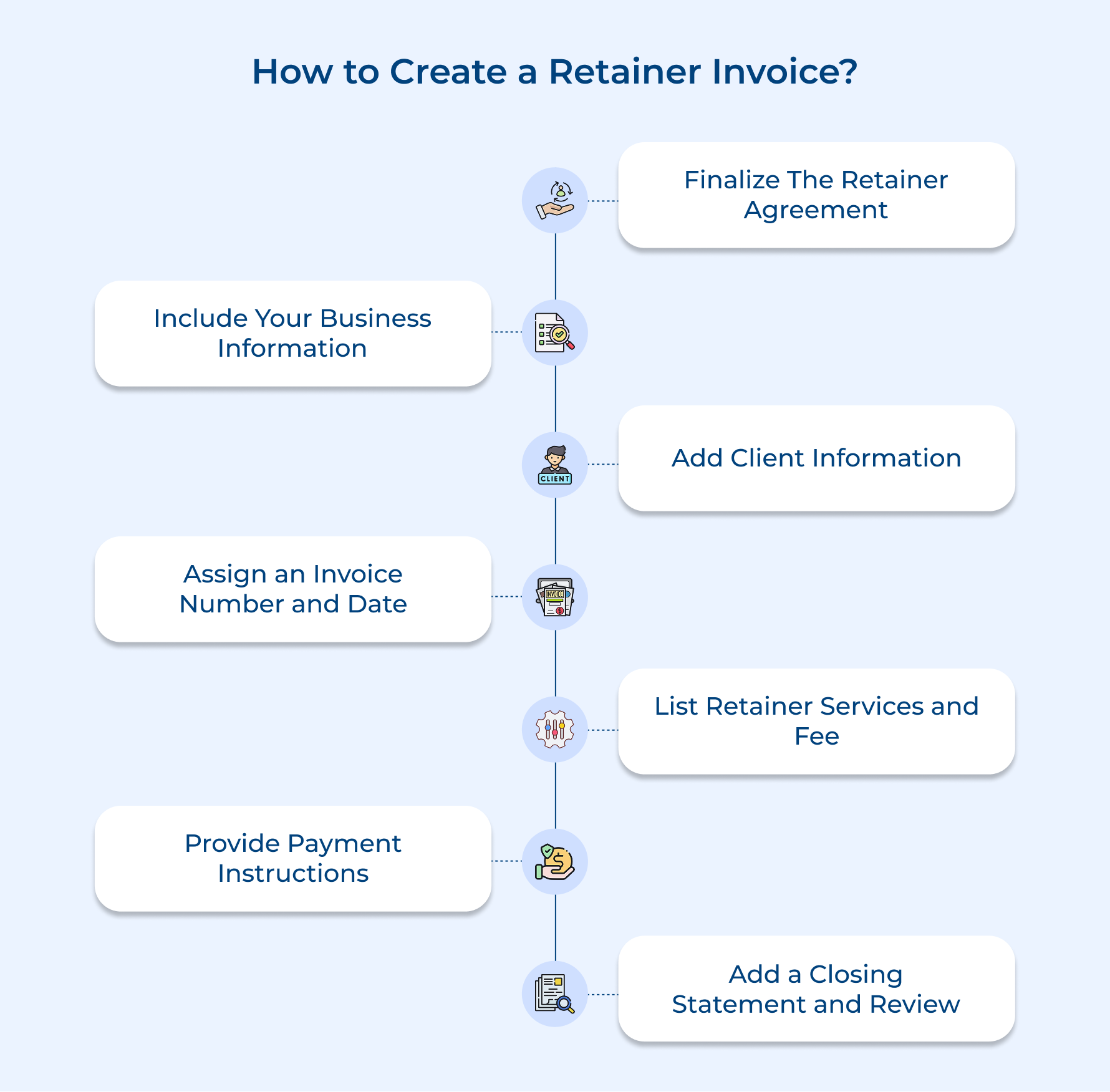

How to Create a Retainer Invoice?

Creating a retainer invoice doesn’t have to be complicated. Let’s walk through the simple steps to set up a smooth and professional billing process for your ongoing services.

1. Finalize the Retainer Agreement

Creating a retainer invoice is an essential part of managing long-term client relationships. Here’s a step-by-step guide on how to set it up, ensuring a smooth and professional process for both you as well as your client.

- Define the Retainer Agreement:

The first step is creating a detailed agreement that outlines the scope of services, terms, conditions, and fees. It forms the foundation of the retainer relationship and helps clarify the responsibilities of both parties.

- Establish Clear Terms:

Make sure the agreement includes all the key details, such as deliverables, timelines, and payment terms. It ensures that expectations are set and both parties understand their commitments.

- Customize for Each Client:

Each client is different, so tailor the agreement to suit their specific needs. A one-size-fits-all approach doesn’t work here—personalizing the details makes the agreement more effective.

- Keep it Updated:

Client needs and services can change over time, so it’s important to regularly review as well as update the agreement to keep it in line with any adjustments in the working relationship.

Tips to consider:

- Include a detailed scope of work with specific deliverables, timeframes, and exclusions to prevent scope creep.

- Create a clear escalation process and review mechanism for addressing service delivery concerns or modifications.

2. Include Your Business Information

Begin with including essential business details like your company name, address, contact information, tax identification numbers, and any relevant professional licenses or certifications. These details are important for legal compliance and help ensure smooth service delivery.

Having this professional information on the invoice adds credibility and makes it legally valid for accounting as well as tax purposes. It also helps clients maintain accurate records and process payments without any issues.

To make your invoices look consistent and professional, create a standardized header template with all your business information. Adding brand elements like your logo and color schemes will also give your invoices a cohesive look.

Pro tips:

- Design a professional letterhead template with all required business information for consistent branding.

- Include multiple contact methods and specify preferred communication channels for billing queries.

3. Add Client Information

Getting your client details right is key to smooth invoicing and payment processing. Let’s dive into why accurate information matters and how to keep everything on track.

- Make sure to include accurate client details, like their company name, billing address, contact person, department info, and any specific identifiers they require for their accounting system.

- Having the right client information ensures your invoices go to the correct person and are processed without any hiccups. It also helps with payment tracking, record-keeping, and smooth communication about billing matters.

- Keep an updated client database with current contact information and billing preferences. Before sending out each invoice, double-check the details to ensure everything is accurate.

Actionable Tips:

- Verify billing contact details and preferences during the agreement phase as well as update regularly.

- Include client-specific reference numbers or purchase order numbers if required by their systems.

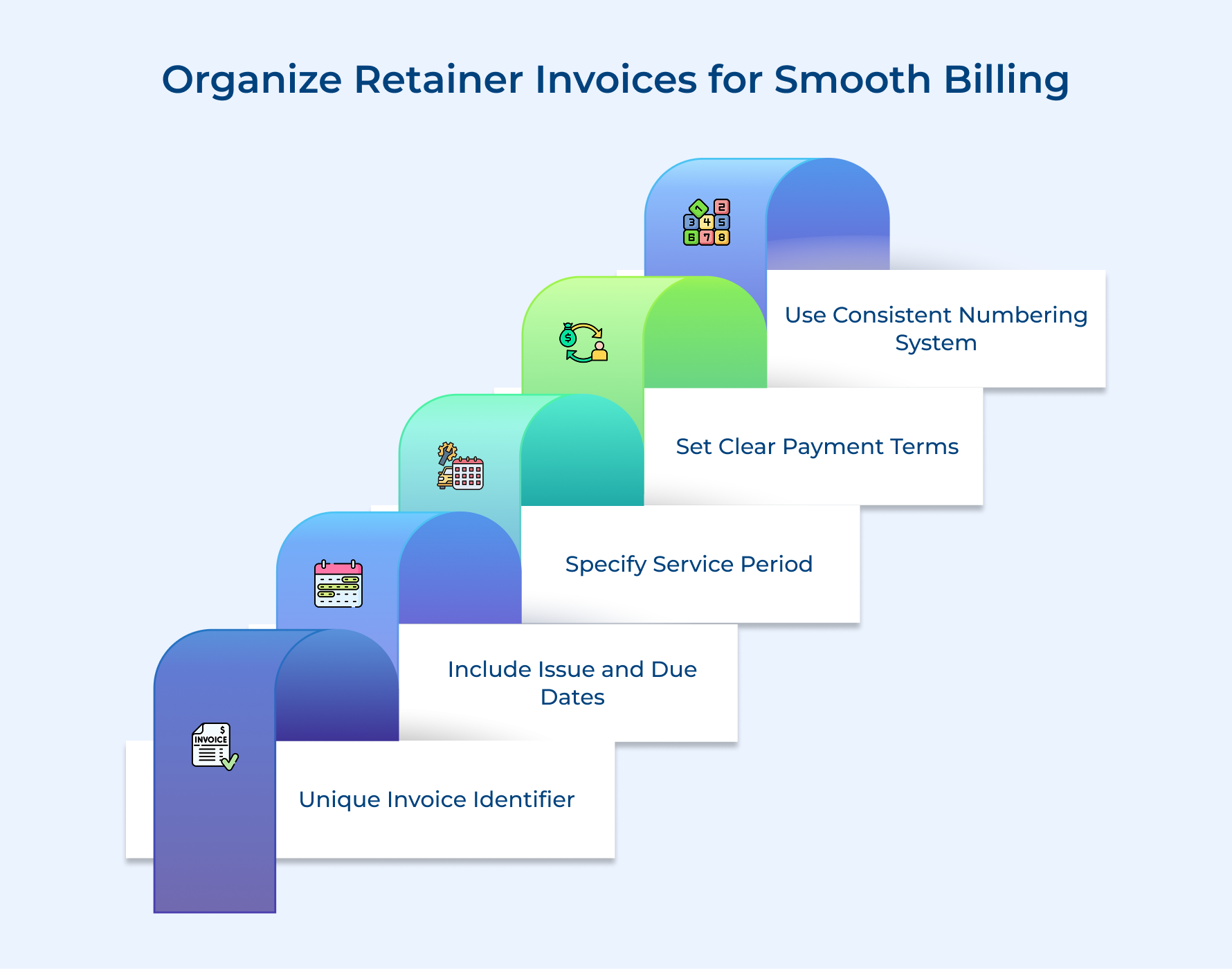

4. Assign an Invoice Number and Date

Invoice numbering and clear dates help keep everything organized, making it easier for both you and your client to track payments while also managing records. Let’s break down how this system works for smooth billing.

- Unique Invoice Identifier

Each invoice should have its unique number. It helps you track and reference invoices easily, reducing the risk of confusion while also ensuring efficient accounting.

- Important Dates

Be sure to include important dates like the issue date, due date, and the service period covered by the retainer payment. These dates help clarify payment timelines while ensuring both parties are on the same page about when the service period starts and ends.

- Clear Payment Terms

Make sure to include the agreed-upon payment terms and due dates, in line with the retainer agreement. It sets clear expectations for when payment should be made and avoids any misunderstandings.

- Consistent Numbering System

Set up a consistent invoice numbering system that includes relevant details, such as client codes, the year, or specific project references. This makes it easier to track invoices and maintain a well-organized financial record.

Pro tips:

- Create a logical invoice numbering system that scales with business growth and multiple clients.

- Clearly display service period dates and payment due dates in a prominent location.

5. List Retainer Services and Fee

Being transparent about the services you’re providing helps both you and your client stay on the same page. Let’s dive into how a clear service breakdown makes all the difference for invoicing and client understanding.

- Clear Service Descriptions

Provide a detailed breakdown of the services covered under the retainer agreement. This should include specifics like the deliverables, the number of hours allocated, and the agreed-upon fee structure. This helps clients see exactly what they’re paying for and justifies the retainer fee.

- Transparency and Tracking

Clear descriptions not only justify the cost but also help clients understand the value they’re receiving. It gives both parties a point of reference for tracking service delivery throughout the retainer period.

- Itemized Lists

Create an itemized list that includes all the services, hours, and deliverables you’ll provide. Be sure to note any additional fees or adjustments that apply to the billing period, so there are no surprises.

Tips to Consider:

- Break down complex services into clear, understandable components with specific quantities or metrics.

- Include a summary of completed work or highlights from the previous period.

6. Provide Payment Instructions

Including clear payment instructions on your retainer invoice helps prevent delays and confusion. Specify all accepted payment methods, including banking information, online options, and any specific instructions for processing the payment.

Providing these details ensures smoother transactions and consistent cash flow for your business. List each payment method with relevant details and include any early payment discounts or late payment penalties to encourage timely payments as well as maintain financial stability.

Pro tips:

- Highlight preferred payment methods and any available discounts for early or automated payments.

- Include clear instructions for different payment methods with all necessary reference information.

7. Add a Closing Statement and Review

Final notes including payment terms, late payment policies, contact information for billing questions, and any additional relevant information for the client.

A comprehensive closing statement ensures all necessary information is communicated as well as sets expectations for payment processing and issue resolution. It provides a professional finish to the invoice.

Include standard terms and conditions, thank you notes, along with clear next steps. Review the entire invoice for accuracy and completeness before sending it.

Tips:

- Create a checklist for final review including all essential elements and common error points.

- Include a personalized note or summary of upcoming work to maintain client engagement.

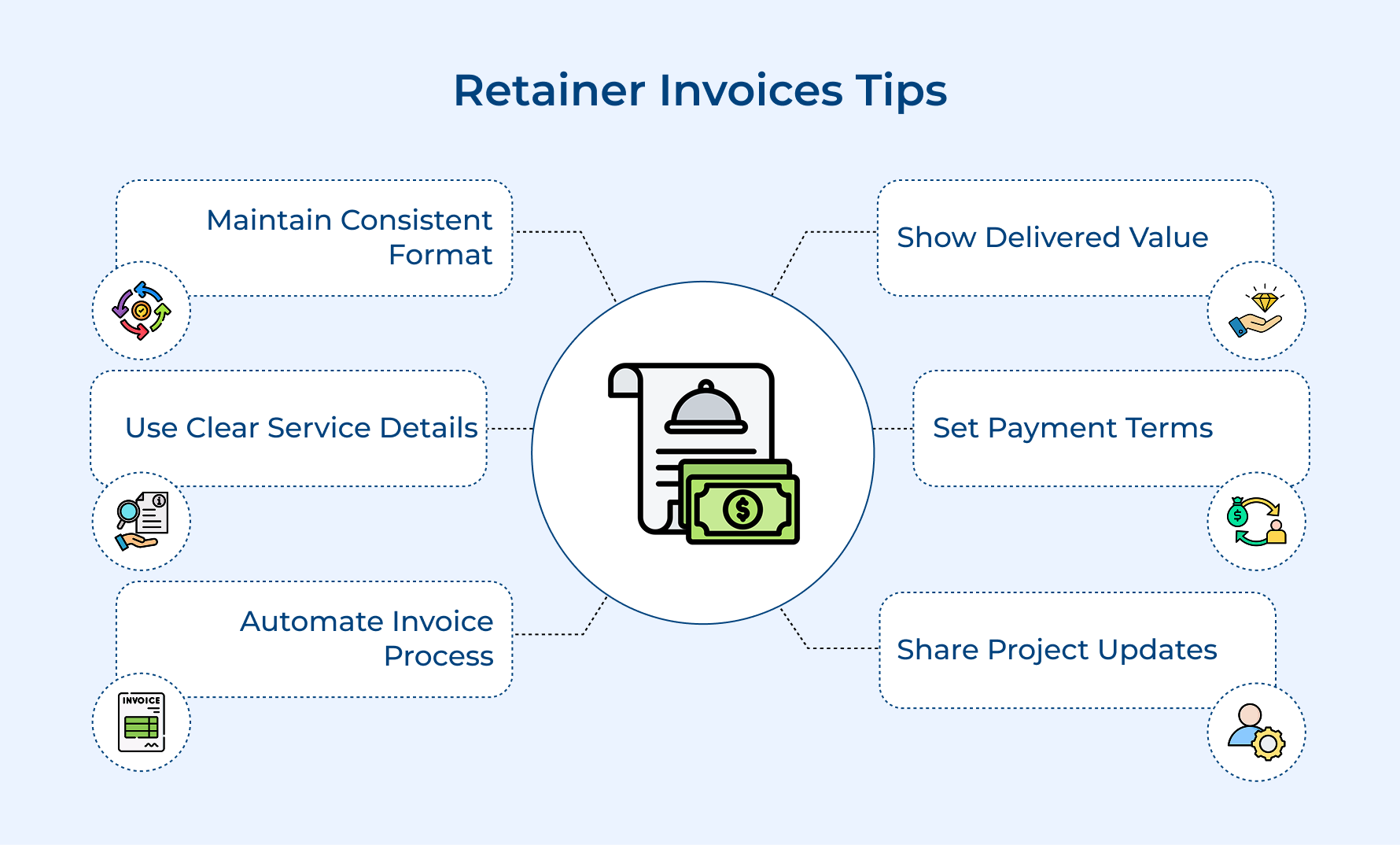

Tips for Effective Retainer Invoices

Creating retainer invoices that are clear and effective can make a huge difference in maintaining smooth client relationships. Let’s go over some tips to make your invoicing process simple and efficient.

1. Maintain Consistency

Keep your invoice format, timing, and communication consistent each month. Regular, predictable invoicing helps clients budget effectively and ensures timely payments. Use standardized templates and automated reminders to maintain professional consistency in your billing process.

2. Be Crystal Clear

Provide detailed breakdowns of services covered under the retainer. List specific deliverables, hours allocated, and any additional services. Avoid industry jargon and use clear language that clients can easily understand as well as cross-reference with the agreement.

3. Automate Where Possible

Implement invoicing software or automation tools to streamline the billing process. Set up recurring invoices, automatic reminders, and payment tracking. It reduces administrative time and minimizes errors while ensuring timely invoice delivery.

4. Track and Report Value

Include brief summaries of work completed or key achievements during the billing period. Demonstrate the value delivered through metrics, results, or milestone completions. It reinforces the retainer’s worth and justifies the ongoing investment.

5. Establish Clear Payment Terms

Define as well as communicate payment expectations. Include due dates, acceptable payment methods, and any late payment policies. Make it easy for clients to understand when and how to pay, reducing payment delays/questions.

6. Include Progress Updates

Add brief status reports with each invoice. Highlight completed work, upcoming projects, and any adjustments to service delivery. This keeps clients informed and engaged in the retainer relationship.

7. Maintain Professional Presentation

Use clean, professional formatting and branded elements. Ensure all text is easily readable and important information stands out. A well-designed invoice reflects your business’s professionalism and attention to detail.

Maintaining Professionalism with Well-Structured Retainer Invoices

Retainer invoices are a valuable tool for businesses that offer ongoing services, helping establish a predictable revenue stream and clear expectations for both parties. Clearly outlining the scope of services as well as payment terms ensures both you and your client are aligned from the start.

Clear communication around payment schedules and potential additional charges minimizes misunderstandings as well as promotes a professional, transparent working relationship.

A well-crafted retainer invoice supports timely payments, maintains steady cash flow, and builds strong, long-term client relationships for continued business success.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Neeti Singh is a passionate content writer at Kooper, where he transforms complex concepts into clear, engaging and actionable content. With a keen eye for detail and a love for technology, Tushar Joshi crafts blog posts, guides and articles that help readers navigate the fast-evolving world of software solutions.