Billable vs. Non-Billable Hours: Differences & Calculation

- What are Billable Hours?

- What are Non-Billable Hours?

- Why is it Important to Track Billable and Non-Billable Hours?

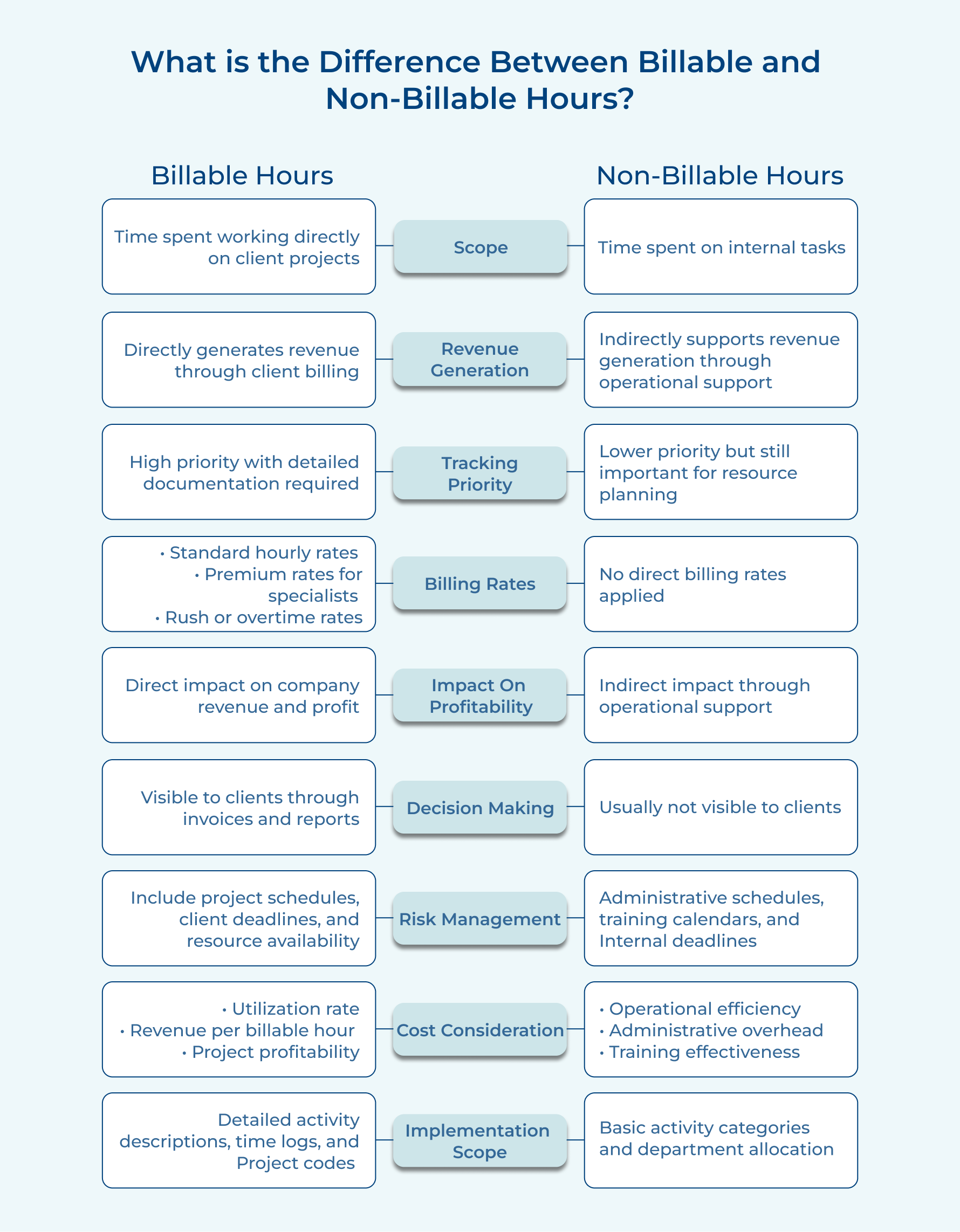

- What is the Difference Between Billable and Non-Billable Hours?

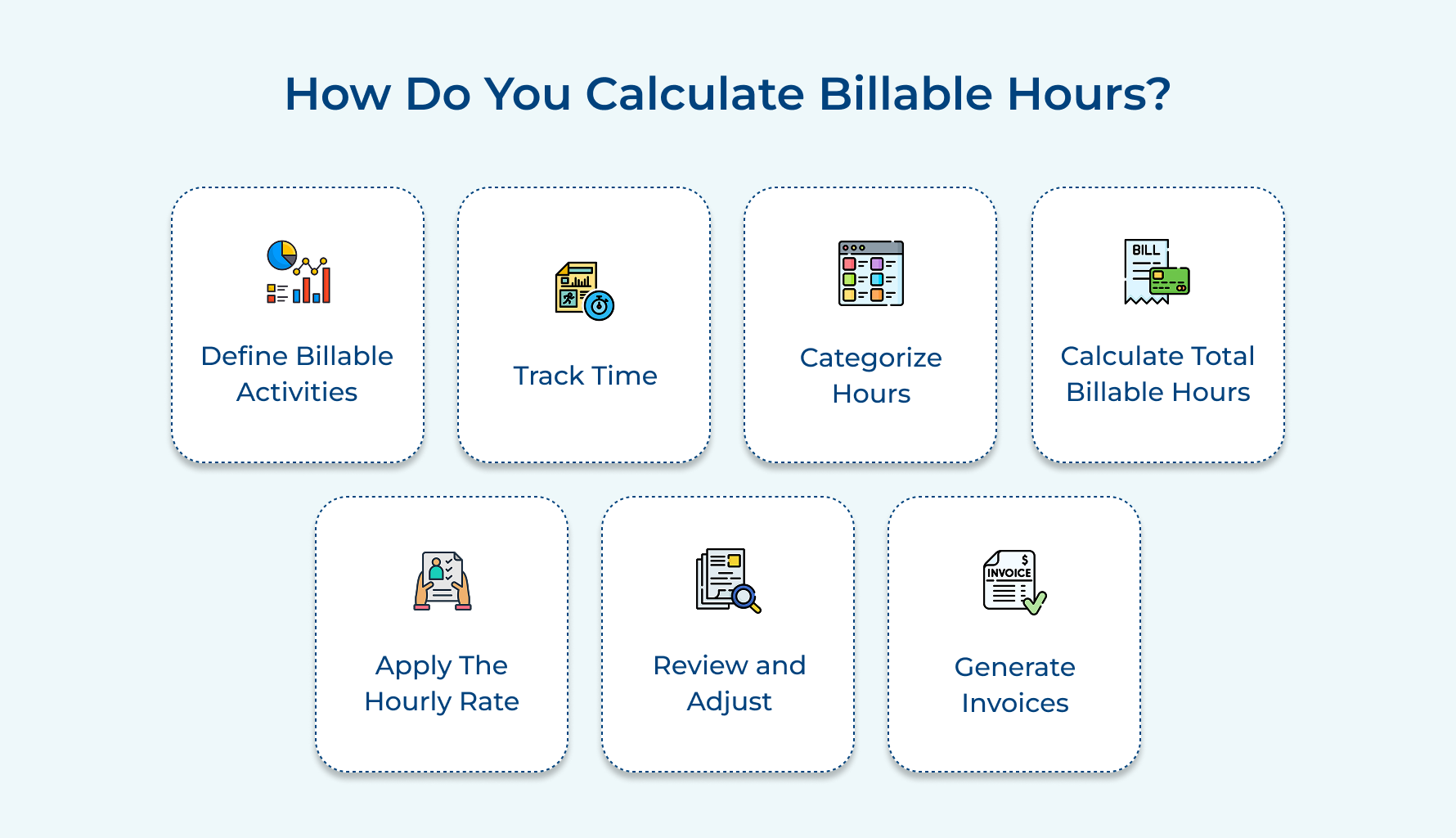

- How do you Calculate Billable Hours?

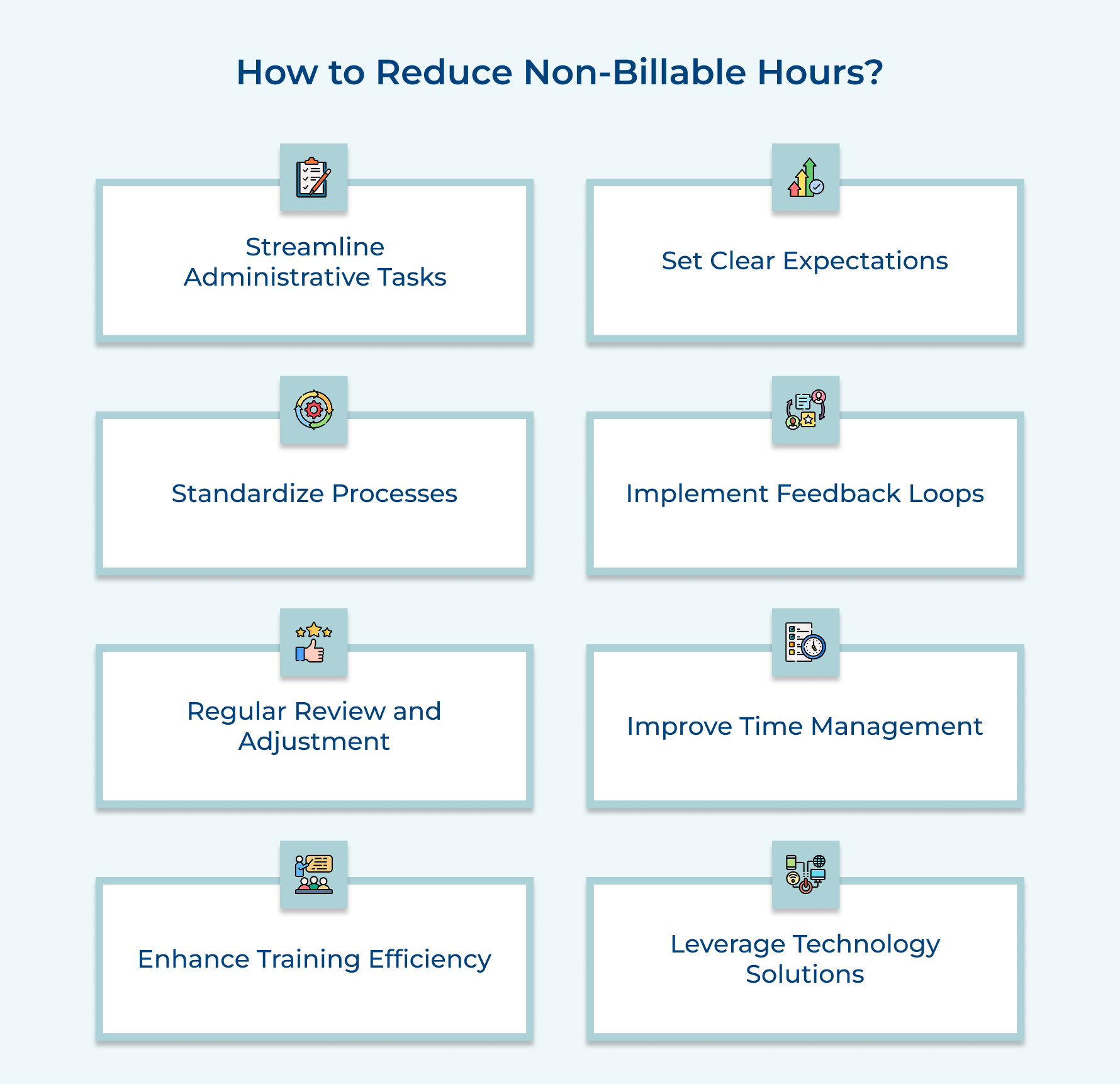

- How to Reduce Non-Billable Hours?

- Challenges in Tracking Billable and Non-Billable Hours

- Striking the Right Balance: Billable and Non-Billable Hours

- FAQs about Billable vs Non-Billable Hours

Key Highlights:

- Billable hours generate revenue; non-billable hours support operations but aren’t client-billed.

- Track tasks apply hourly rates, review for accuracy and invoice appropriately.

- Automate administrative tasks and standardize processes to focus on revenue-generating work.

Ever feel like your day is a blur of tasks, but not all of them seem to directly bring in the bucks? That’s where the concept of billable vs non-billable hours comes in.

Billable hours are the time you spend working on tasks that directly earn you money, while non-billable hours cover the behind-the-scenes essentials—like meetings, planning, or training—that keep the wheels turning.

The trick is finding a balance that keeps your productivity high and your profits higher. We’ll dive into what these hours mean, why they matter and how you can make the most of every minute.

Without much further ado, let’s jump right in!

What are Billable Hours?

Billable hours represent the time a professional spends working directly on client-related tasks that can be charged to the client.

The time-tracking system is commonly used in service-based industries such as law firms, consulting companies, accounting firms, and creative agencies to measure as well as monetize the work performed for clients. For many service-based businesses, these hours serve as a primary revenue source.

Key objectives:

- Revenue generation: Billable hours directly contribute to a firm’s income, making accurate tracking essential for financial sustainability.

- Resource allocation: Understanding how time is spent helps agencies allocate resources effectively, ensuring that the right personnel are assigned to the right projects.

- Performance measurement: Tracking billable hours enables agencies to evaluate employee productivity and identify areas for improvement.

- Client transparency: Detailed billing based on tracked hours enhances transparency, allowing clients to see how their funds are utilized and building trust in the service provider.

What are Non-Billable Hours?

Non-billable hours represent time spent by professionals on tasks that cannot be directly charged to clients. Such activities remain essential for business operations and professional development across organizations. Hours allocated to administrative work, internal meetings, and training sessions fall under non-billable categories.

Direct revenue might not stem from non-billable hours, yet their role proves vital for long-term business sustainability. Management teams recognize such hours as crucial investments in future projects’ success.

Key objectives:

- Professional development: Enhance team skills and knowledge through training activities to deliver higher-quality services.

- Business growth: Focus on marketing initiatives to secure new clients and expand service offerings.

- Operational excellence: Streamline internal processes to maintain organizational efficiency.

- Team building: Strengthen company culture through mentoring programs and collaborative activities.

Why is it Important to Track Billable and Non-Billable Hours?

Tracking both billable and non-billable hours helps you understand productivity, resource allocation, overall business profitability, etc. Here are the key reasons why this practice matters.

Enables accurate budget forecasting: Keeping tabs on both billable and non-billable hours gives you the insights you need for smart financial planning. By understanding the ratio between the two, you can create realistic budgets, allocate resources wisely, and keep cash flow steady.

Spots capacity constraints: Time tracking shows you how your team is doing. Through monitoring workloads, you can see when your teams are stretched thin and step in with the support they need.

Pinpoints efficiency bottlenecks: Ever feel like some tasks take way longer than they should? Tracking time helps uncover areas where processes can be streamlined or automated, saving everyone time and hassle.

Tracks ROI on marketing efforts: Spending time on marketing is important, but is it paying off? By tracking non-billable hours spent on business development, you can see which strategies bring in clients and which need a tweak.

Sets realistic productivity goals: A good balance between billable and non-billable hours makes it easier to set fair, achievable goals for your team. This way, you’re looking at the bigger picture, not just the revenue-driving tasks.

Supports smart hiring decisions: Wondering if it’s time to grow the team? Comprehensive-time data gives you hard evidence to justify hiring when workloads stay consistently high across both types of tasks.

What is the Difference Between Billable and Non-Billable Hours?

Differentiating billable from non-billable hours is crucial for accurate financial reporting. Here are the key distinctions between these two types of hours.

1. Definition and Scope

Billable Hours:

These are the hours spent directly working on client projects—whether it’s crafting deliverables, attending client meetings, or conducting project-specific research. Essentially, it’s any work you can charge for based on the agreed-upon rates. Billable hours are the backbone of revenue generation and are usually detailed in contracts or service agreements.

Non-Billable Hours:

These hours cover the behind-the-scenes work that keeps the business running, like team meetings, training, proposal writing, or marketing. While they don’t directly bring in revenue, they’re crucial for maintaining and growing your business.

2. Impact on Revenue

Billable Hours:

They’re your direct revenue drivers. These hours translate into invoices and profitability, making them key indicators of team productivity as well as project success.

Non-Billable Hours:

These represent investments—necessary but indirect. If it’s admin work or business development, they impact profit margins and need careful management to balance costs along with growth.

3. Tracking and Management

Billable Hours:

Accurate tracking is non-negotiable here. Detailed time entries with task descriptions as well as project specifics ensure clients are billed correctly, and budgets stay on track.

Non-Billable Hours:

While not billed, these hours still need monitoring to spot inefficiencies and streamline workflows. Tracking them helps improve operations and manage workloads better.

4. Employee Performance Metrics

Billable Hours:

They’re often the gold standard for evaluating employee productivity. Hitting billable hour targets can affect bonuses, raises, or promotions.

Non-Billable Hours:

Here, it’s more about quality over quantity. Contributing to business growth and operational efficiency matters, even if these hours don’t directly tie to performance rewards.

5. Client Relationship Impact

Billable Hours:

Clients see these hours in their invoices, so transparency is key. Clear communication about how time is spent builds trust and satisfaction.

Non-Billable Hours:

Though invisible to clients, these hours enhance service quality. Activities like training or industry research lead to better results and stronger client relationships.

6. Resource Allocation

Billable Hours:

These get top priority in scheduling. Meeting deadlines and delivering quality work is critical to keeping clients happy as well as revenue flowing.

Non-Billable Hours:

These are planned around client commitments. The goal is to minimize disruptions while ensuring essential internal tasks get done.

7. Cost Structure

Billable Hours:

They’re revenue generators, covering both project costs and business overhead. Pricing strategies often hinge on these hours to ensure profitability.

Non-Billable Hours:

These are your operational costs. Managing them efficiently is vital since they’re covered by the revenue your billable hours bring in.

8. Growth and Development

Billable Hours:

They’re focused on keeping clients satisfied and projects running smoothly. These hours drive short-term revenue and maintain existing relationships.

Non-Billable Hours:

These are your investments in the future—regardless if it’s innovation, training, or marketing. They’re essential for long-term growth and staying competitive in the market.

How do you Calculate Billable Hours?

Calculating billable hours involves tracking time spent on client-related tasks and applying the appropriate hourly rate. Here are the steps to ensure accurate calculations.

1. Define Billable Activities

Let’s start by defining what qualifies as billable work—this ensures everyone’s on the same page from day one. Include things like direct project tasks, client meetings, research, and strategy sessions. Just as important, let’s draw the line between billable and non-billable activities so there’s no guesswork involved.

Activity classification: Not all work is billed the same way, right? Define different rates based on the type of work and the team member handling it.

For example, senior staff might have a higher rate than junior staff. Don’t forget to tackle specifics like handling partial employee time, travel time, and overtime. And to avoid any awkward conversations later, document what isn’t billable so it’s crystal clear to everyone.

Special considerations: Develop policies for unique situations like emergency requests, weekend work, and rush jobs. Create clear documentation for how to handle revisions, client-caused delays, and additional scope requests.

2. Track Time

Implement robust time-tracking systems that capture start and end times for each billable task. Add project codes, client categories, and task types to keep things organized, while making sure there’s room for detailed notes.

Daily management: Encourage real-time or end-of-day logging to keep things accurate, and enable mobile tracking for on-the-go work. Automated reminders can help everyone stay consistent.

Quality control: Regularly review time entries for accuracy and completeness. Run audits now and then to ensure billing stays on point, as well as give team members constructive feedback to improve their tracking habits.

3. Categorize Hours

Sort recorded hours into appropriate project and client categories. Separate billable hours from non-billable activities like internal meetings or administrative work. Maintain detailed notes for each time entry.

Rate application: Apply different billing rates based on staff seniority or task complexity. Consider minimum time increments for billing purposes. Account for special rate agreements or volume discounts.

Documentation: Create detailed activity descriptions that justify the billing category. Maintain records of any rate variations or special billing arrangements. Document any exceptions or special circumstances.

4. Calculate Total Billable Hours

At the end of each billing period, sum up all billable hours for each project and client with detailed reports. Cross-check totals with project budgets, milestones, and any approved overtime or weekend work to ensure everything aligns.

Adjustment review: Review any contractual limits on hours and adjust entries as needed—like rounding time according to your policies or sticking to minimum billing increments.

Verification process: Verify everything against the project scope and plans. Look out for unusual patterns or errors, and make sure hours match the team’s capacity/availability. A thorough check ensures accurate and fair billing every time!

5. Apply the Hourly Rate

Multiply the total billable hours by each staff member’s agreed hourly rate. If there are volume discounts or special pricing deals, factor those in as you go. Break it down further by calculating subtotals for each project component.

Special considerations: For special cases, don’t forget to apply surcharges for rush jobs or specialized services. Use the right rates for different work types or timeframes, and include any pre-negotiated adjustments.

Final review: Double-check everything—make sure rates, discounts, as well as surcharges are correctly applied and in line with client contracts. A final review ensures the billing is spot on.

6. Review and Adjust

Take a close look at the calculated billable hours to make sure they’re accurate and reasonable. Cross-check them against the project scope and deliverables to ensure everything lines up. It’s also a good idea to review past billing patterns—this helps spot any anomalies or inconsistencies before finalizing the invoice.

Adjustment process: Make adjustments for any pre-approved write-offs or client concessions. Consider any value-based billing adjustments that might apply. Document reasons for any modifications made.

Final validation: Conduct a final review of all adjustments. Ensure all changes are properly documented. Verify that final amounts align with client expectations and agreements.

7. Generate Invoices

Create detailed invoices showing hours worked by person, task, and date. Include clear descriptions of work performed for each time entry. Organize information in a client-friendly format.

Documentation: Attach any required supporting documentation or deliverables. Format invoices according to client preferences and requirements. Include all necessary billing details and payment terms.

Quality assurance: Review invoices for completeness and accuracy. Ensure compliance with client billing requirements. Maintain backup documentation for all billed hours.

How to Reduce Non-Billable Hours?

Implementing effective strategies can minimize non-billable hours. Here are the best practices to help your teams focus on high-value tasks.

1. Streamline Administrative Tasks

Use automation tools for routine paperwork, invoice generation, and email responses. Implement project management software to reduce time spent on coordination. Create templates for common documents and reports. Delegate administrative tasks to specialized support staff, allowing professionals to focus on billable work.

2. Set Clear Expectations

Establish precise guidelines for time allocation between billable and non-billable activities. Create detailed role descriptions that outline expected billable hour targets. Communicate specific metrics for success in managing non-billable time. Develop clear policies for meeting durations and frequencies.

3. Standardize Processes

Develop standardized workflows for common project types and deliverables. Create repeatable methodologies for client onboarding and project initiation. Implement quality control checklists to reduce revision time. Establish uniform documentation procedures across teams. Build a knowledge base of templates and resources for quick access.

4. Implement Feedback Loops

Monitor time tracking data regularly to identify inefficient processes. Gather team input on time-consuming non-billable activities. Conduct periodic assessments of workflow effectiveness. Create channels for sharing efficiency improvements across departments. Establish regular check-ins to address productivity challenges.

5. Regular Review and Adjustment

Analyze time-tracking reports monthly to spot trends and inefficiencies. Assess the impact of process changes on non-billable hours. Review resource allocation across projects and teams. Evaluate the effectiveness of current tools and systems. Adjust workflows based on performance data and team feedback.

6. Improve Time Management

Try time-blocking to carve out focused work periods and stay on track. When it’s time for internal meetings, keep them efficient with clear agendas and strict time limits. Encourage the team to explore productivity tools and techniques that fit their workflow. Finally, set some ground rules for handling interruptions and distractions, so everyone can stay in the zone as well as get more done without unnecessary disruptions.

7. Enhance Training Efficiency

Design concise, targeted training programs that minimize time away from billable work. Utilize microlearning modules for skill development during downtime. Create self-paced learning resources accessible on demand. Record common training sessions for future reference. Implement mentor systems for efficient knowledge transfer.

8. Leverage Technology Solutions

Invest in integrated software solutions that reduce manual data entry. Implement project management tools with time-tracking capabilities. Use automated reporting systems to reduce administrative overhead. Deploy AI-powered tools for routine tasks. Utilize cloud-based solutions for improved accessibility and collaboration.

Challenges in Tracking Billable and Non-Billable Hours

Tracking both billable and non-billable hours presents several challenges. Here are the common obstacles organizations face in this process.

Inaccurate Time Tracking

Accurate time tracking can be challenging due to human error or inconsistent logging practices. Employees may forget to log hours or misestimate time spent on tasks.

How to Overcome:

- Implement user-friendly time-tracking software that prompts employees to log hours regularly.

- Conduct training sessions to emphasize the importance of accurate timekeeping and demonstrate how to use the tools effectively.

Complexity in Tracking Non-Billable Hours

Distinguishing between billable and non-billable tasks can be complex, leading to confusion as well as inconsistencies.

Strategies to Fix:

- Clearly define what constitutes billable versus non-billable hours in employee handbooks and during training.

- Use project management tools that categorize tasks, making it easier to track and report on both types of hours.

Lack of Management Oversight

Without regular oversight, employees may neglect to log their hours consistently, resulting in incomplete data.

Solve it Through:

- Schedule periodic audits of time logs to ensure compliance and accuracy.

- Encourage managers to check in regularly with their teams about time tracking and offer support as needed.

Difficulty Analyzing Data

Collecting data on billable and non-billable hours can generate large volumes of information that may be hard to analyze effectively.

Strategies to Overcome:

- Utilize analytics tools integrated with time-tracking software to simplify data analysis and reporting.

- Establish key performance indicators (KPIs) to focus on essential metrics, making it easier to derive actionable insights from the data collected.

Lack of Standardization

Different departments or team members following varied tracking methods create inconsistent data. The absence of uniform categories and codes for activities makes it difficult to analyze patterns or compare performance across teams.

How to Solve:

- Create a company-wide standardized system for categorizing and coding different types of activities

- Implement quality control checks and regular reviews to maintain consistency in time tracking

Striking the Right Balance: Billable and Non-Billable Hours

Understanding the distinction between billable and non-billable hours is essential for the success of service-oriented businesses. Billable hours directly impact revenue, while non-billable hours, though necessary for operations, can affect profitability if not managed effectively.

Accurate tracking of both types of hours allows organizations to optimize resource allocation, improve productivity, and enhance client relationships. Implementing clear processes for logging and analyzing time helps ensure that teams focus on high-value tasks, driving growth and sustainability.

Emphasizing this balance enables businesses to thrive in a competitive market while maintaining transparency and accountability with clients.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Ronak Shah is part of the marketing team at Kooper, where he specializes in crafting strategic content that supports business growth and brand visibility. With a strong interest in digital marketing, performance strategy, and customer engagement, he turns complex ideas into clear, actionable insights for agencies and growing businesses.