Smart Project Budget Management for Better Control & ROI

- What is Project Budget Management?

- Why Does Project Budget Management Matter?

- How to Implement Project Budget Management?

- Different Methods of Project Budget Management

- Mistakes to Avoid in Project Budget Management

- Best Practices for Tight Project Budget Management

- Budget Management: A Foundation for Project Success

- FAQs about Project Budget Management

Key Highlights:

- Master project budget management techniques to optimize budget efficiency from detailed planning to real-time monitoring.

- Discover how engaging stakeholders and regular reviews ensure transparency as well as project success.

- Explore bottom-up, top-down, and other estimation processes to tailor your budget strategy.

Are you managing a small startup initiative? or steering a multi-million dollar enterprise project? Then you must also understand that effective budget management can mean the difference between spectacular success and costly failure.

As project complexities continue to evolve, understanding the nuances of budget management has become more crucial than ever. From initial estimation to final reconciliation, each step demands careful attention, strategic thinking, as well as proactive management.

Let’s explore essential strategies, common pitfalls, and proven best practices that can transform your approach to project budget management.

What is Project Budget Management?

Project budget management is a critical discipline within project management that involves planning, estimating, allocating, and controlling financial resources throughout a project’s lifecycle. It encompasses the processes required to ensure that a project is completed within its approved budget while meeting all objectives and deliverables.

At its core, project budget management is the systematic approach to planning and tracking the project’s costs (including initial cost estimation, budget allocation, expenditure monitoring, as well as financial reporting). It requires careful consideration of all resources needed, from labor and materials to equipment along with overhead costs.

Key objectives:

- Cost estimation and forecasting: Develop accurate initial cost estimates and ongoing forecasts to guide project planning as well as execution.

- Resource optimization: Ensure efficient allocation and utilization of financial resources across all project activities.

- Cost control and monitoring: Track actual expenses against planned costs and implement corrective actions when deviations occur.

- Financial compliance: Maintain adherence to organizational financial policies, accounting standards, and regulatory requirements while managing project finances.

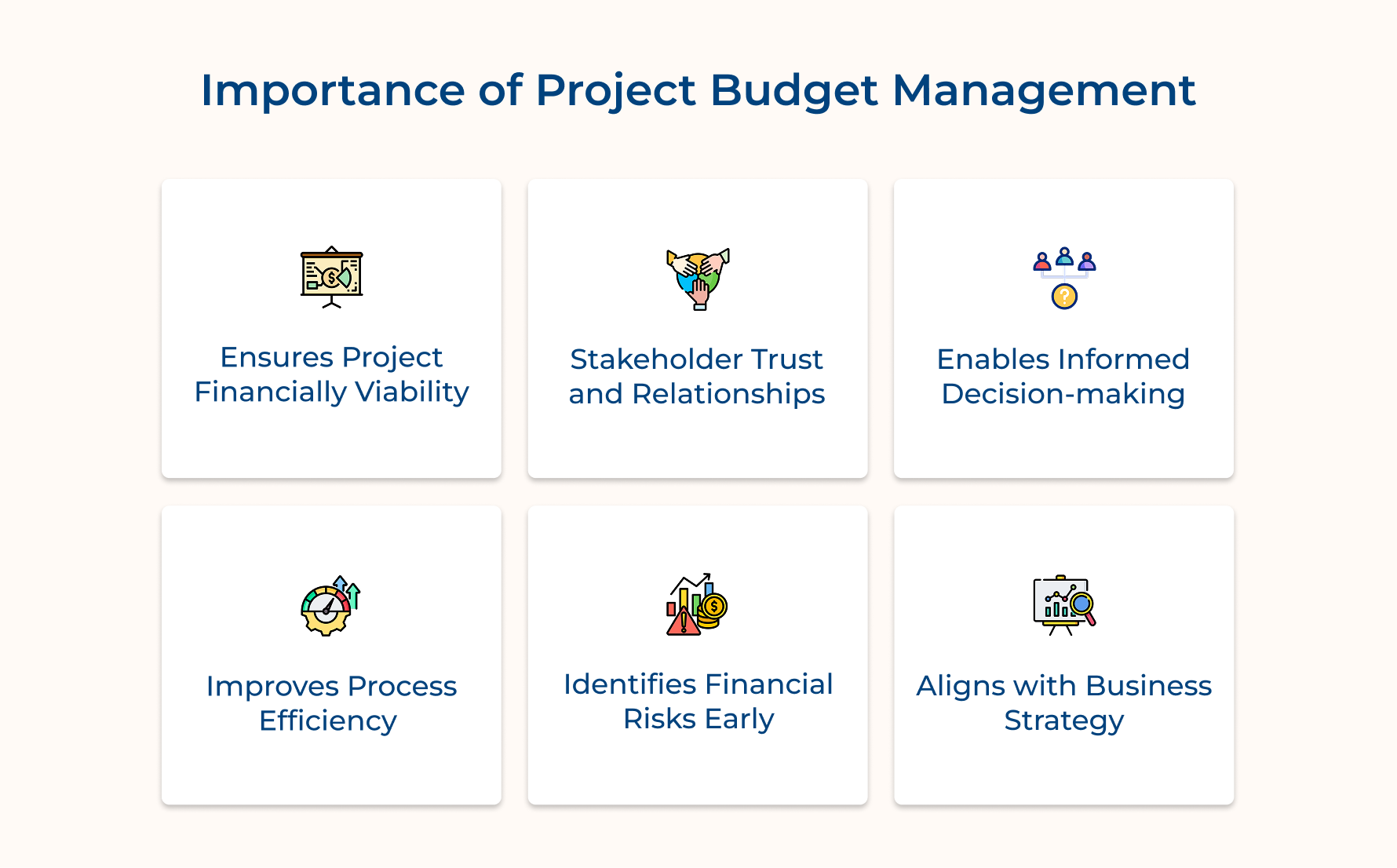

Why Does Project Budget Management Matter?

Managing a project without a budget is nothing less than chaos. A well-planned budget keeps your project on track, avoiding surprises and ensuring every dollar is put to good use.

- Keeps the Project Financially Healthy

Project budget management ensures resources are used wisely and costs are kept in check. With everything under control, you can complete the project without blowing the budget or compromising its success.

- Builds Stakeholder Trust

When you manage budgets responsibly, stakeholders notice. Regular updates and transparent spending show you’re on top of things, earning trust from clients, investors, as well as your team while strengthening those crucial relationships.

- Supports Smart Decision-making

A well-managed budget gives you the numbers you need to make informed decisions. Whether it’s prioritizing project tasks or reallocating resources, the financial insights you gain help steer the project in the right direction.

- Boosts Efficiency

Budget management isn’t just about cutting costs; it’s about working smarter. By eliminating wasteful spending and making the most of resources, your team can streamline processes as well as get more done.

- Catches Financial Risks Early

Spotting financial red flags early can save a project from derailing. With a solid budget in place, you can address potential risks before they escalate, keeping the project on track and stress levels low.

- Keeps You Aligned with Business Goals

Every dollar spent should support the bigger picture. Effective budget management helps ensure your project aligns with organizational objectives, driving long-term success and maximizing ROI.

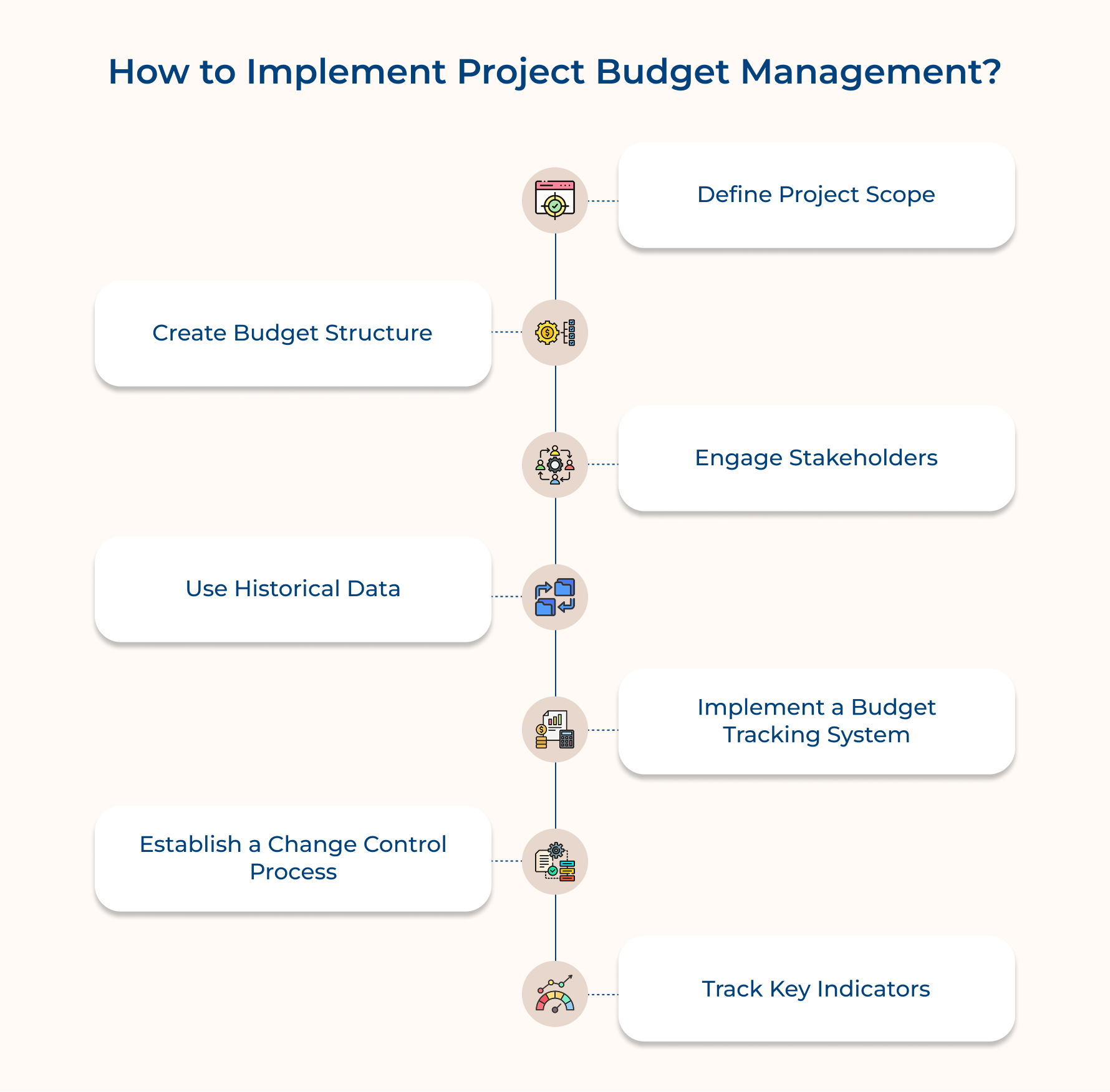

How to Implement Project Budget Management?

Ready to take control of your project’s finances? Implementing budget management might sound like a complex project, but with the right steps, it’s easier than you think.

1. Define Project Scope

Think of your project scope as the blueprint for your budget—it sets clear boundaries and prevents surprise costs from creeping in. Without it, managing finances can feel like chasing shadows!

For example, if you’re building a website, defining the scope means listing features like e-commerce, a blog, or contact forms, along with technical requirements like hosting and security. With this clarity, you can estimate developer hours, software expenses, and testing needs accurately.

Pro Tips to Nail Your Scope:

- Break everything into bite-sized tasks with a Work Breakdown Structure (WBS) to simplify planning.

- Use a WBS dictionary to define each task’s details and avoid confusion.

- Host scope definition workshops with project stakeholders to ensure everyone’s on the same page.

With a robust scope, your project budget becomes more predictable and easier to control.

2. Create a Detailed Budget Structure

Your budget helps you track, allocate, and control costs with precision. A well-structured budget ensures every expense is accounted for, so you can plan and monitor effectively.

For instance, create a cost breakdown aligned with your Work Breakdown Structure (WBS). Cover everything—direct/indirect costs, fixed & variable expenses, as well as contingency reserves. This makes sure no cost sneaks up on your mid-project.

Use standardized cost codes for easy tracking across projects. Clearly document all assumptions and calculations to avoid confusion later.

3. Engage Stakeholders

Budgeting isn’t a one-person show—it’s a team effort. Involving stakeholders ensures their buy-in, helps spot risks early, and keeps your budget realistic as well as achievable. Their input can make all the difference!

Hold regular meetings or workshops during budget planning to gather feedback and align expectations. Keep stakeholders in the loop with updates on the budget’s status and get their approval for big decisions through clear communication channels.

Tips to Keep Stakeholders in Sync:

- Use a communication matrix to outline who needs budget updates and how often.

- Schedule regular budget review meetings to keep everyone aligned and engaged.

4. Use Historical Data

Historical data provides realistic benchmarks for cost estimation as well as helps identify potential risks and opportunities. It reduces uncertainty in budgeting and improves the accuracy of financial forecasts.

Analyze similar past projects to identify cost patterns and lessons learned. Adjust historical data for current conditions and project-specific factors when creating estimates.

Actionable Tips:

- Maintain a centralized database of historical project costs with detailed categorization

- Document lessons learned specifically related to budget variances and their causes

5. Implement a Budget Tracking System

A tracking system enables real-time monitoring of expenses and early detection of variances. It provides the data needed for informed decision-making and timely corrective actions.

Set up automated systems to track actual costs against planned expenses. Implement regular reporting cycles and variance analysis procedures for monitoring budget performance.

Use project management software with integrated cost-tracking capabilities. Establish clear procedures for expense recording and approval workflows

6. Establish a Change Control Process

Change control processes prevent unauthorized budget modifications and ensure proper assessment of financial impacts. They maintain budget integrity while allowing necessary adjustments through controlled procedures.

Create a formal change request system with clear approval levels. Document all changes and their impact on the budget baseline, ensuring proper authorization before implementation.

7. Track Key Indicators

Key indicators provide early warning signs of potential budget issues and measure project financial health. They enable proactive management and informed decision-making based on quantitative data.

Implement earned value management metrics (CPI, SPI). Monitor and report on key financial indicators regularly, using dashboard reports for visibility.

Create automated dashboards showing real-time budget performance metrics while establishing thresholds for key indicators that trigger review and action.

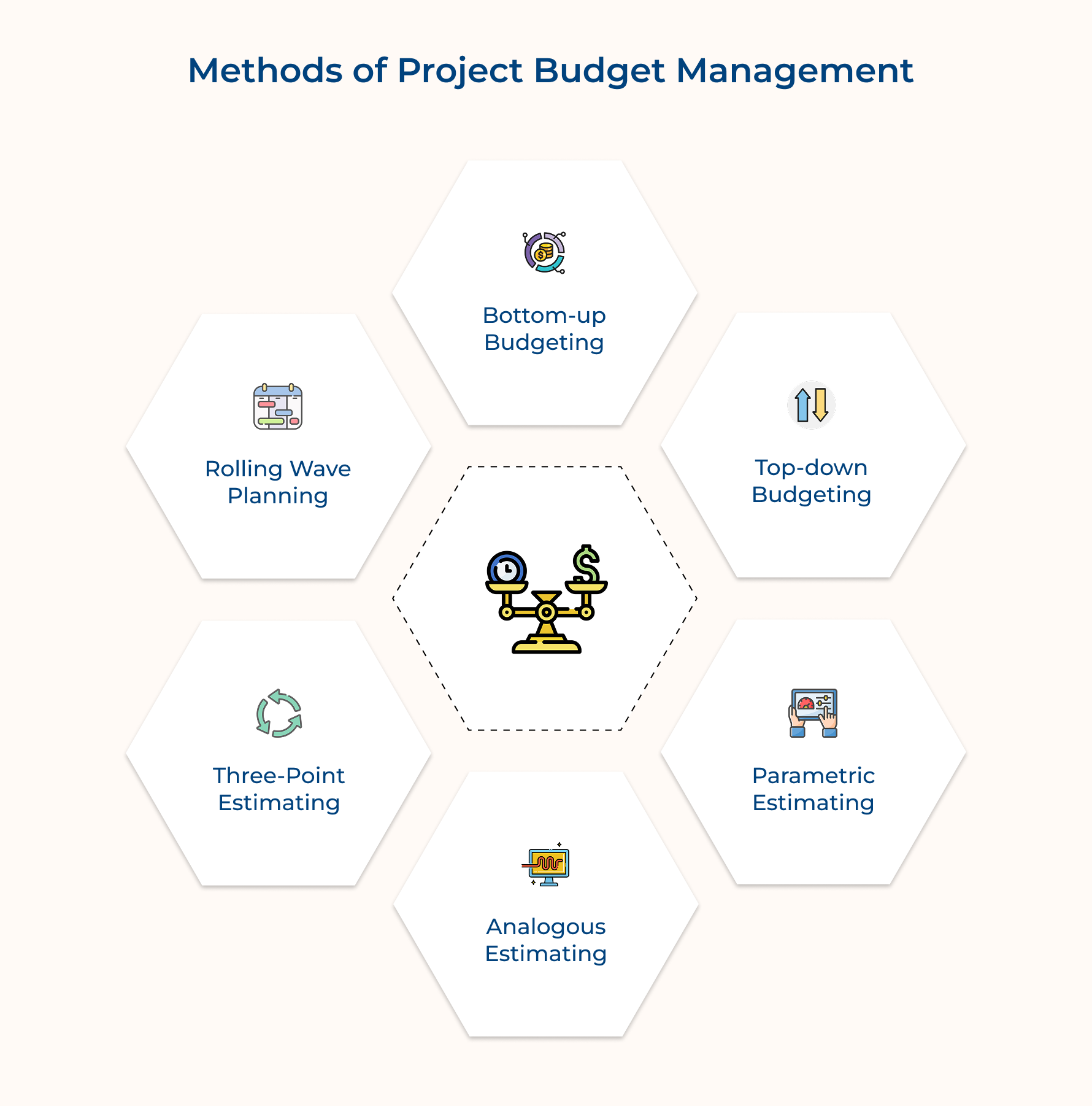

Different Methods of Project Budget Management

When it comes to managing project budgets, there’s no one-size-fits-all approach. Let’s dive into some effective methods that can help you keep your finances in check and your project on track!

Bottom-up Budgeting

The method starts with the smallest tasks, estimating costs for each one, then adding them up through the work breakdown structure (WBS) to get the total project budget.

It’s perfect for projects with well-defined tasks, like technical projects, where each team member can estimate their costs, ensuring accuracy and ownership.

Top-down Budgeting Process

Here, you begin with an overall budget set by management or historical data and then allocate funds across the project.

The given budgeting process is a great option when there are fixed budget limits or during strategic planning, ensuring spending stays aligned with organizational goals.

Parametric Estimating Process

Parametric estimation uses historical data to calculate costs based on variables like quantity and complexity.

The estimation works well for projects like construction or manufacturing, where you can apply cost-per-unit data to estimate the budget, adjusting for specific project needs.

Analogous Estimating Process

When you don’t have detailed data for a new project, look at similar past projects to estimate your budget.

By adjusting for differences in scope, complexity, or market conditions, this method helps you come up with a solid estimate based on what worked before.

Three-Point Estimating Process

Generate three estimates – optimistic (O), most likely (M), and pessimistic (P). Calculate the weighted average using the formula (O + 4M + P)/6 to determine a final estimate.

Implement when uncertainty exists. Calculate probability-based estimates considering best-case, worst-case, and most likely scenarios to create more realistic budgets.

Rolling Wave Planning Process

The rolling wave approach focuses on budgeting in stages—create detailed estimates for the near term and leave high-level estimates for future phases.

As the project progresses, you refine the budgets for future stages. It’s especially helpful for long-term projects with uncertain requirements.

Mistakes to Avoid in Project Budget Management

Managing a project budget can be tricky, and a few missteps can lead to costly setbacks. Let’s look at some common mistakes to avoid to keep your finances and your project on track.

Poor Initial Estimation

If your initial cost estimates are off, it can lead to major budget overruns and project delays. Underestimating expenses like labor, materials, or time can leave you with unrealistic financial expectations. This often happens when the analysis is rushed or outdated data is used.

Get your team involved in the estimation process to get diverse insights. Use detailed breakdowns and historical data to create more accurate projections. Always validate your estimates before locking in the final budget.

Scope Creep Mismanagement

Scope creep happens when the project’s requirements expand without adjusting the budget. This can quickly lead to extra costs and delays, especially when there’s poor communication around the changes.

Set up a formal change control process as it is an essential step to ensure all scope changes are documented and approved. Keep regular communication with stakeholders to stay aligned on project goals and what’s included in the scope.

Insufficient Monitoring

Failing to keep a close eye on your budget throughout the project can result in overspending. Small variances can snowball into major issues if you don’t catch them early.

Track expenses regularly and use project management software to monitor the budget in real time. Set alerts to notify your team whenever there’s a deviation from the plan.

Overlooking Hidden Costs

Sometimes, hidden costs like maintenance, training, or compliance fees can pop up and blow your budget. If you miss these during planning, they can lead to financial shortfalls and disrupt the project.

Do a thorough risk assessment in the budgeting phase and consult with stakeholders to identify hidden costs. Include these in the initial budget to ensure you’re fully prepared.

Poor Resource Management

If resources aren’t managed properly, it can lead to wasted resources, added costs, and delays in your project timeline.

Use resource management tools to monitor usage and availability. Regularly reassess resource allocation to make sure everything is in place when you need it.

Failing to Learn from Past Projects

Not taking the time to review past projects can mean you miss valuable lessons. Overlooking what worked—and what didn’t—can lead to repeating the same mistakes.

After each project, take time to analyze the budget performance. Document lessons learned and create a knowledge base that you can refer to for future projects, helping you avoid repeating the same issues.

Best Practices for Tight Project Budget Management

When it comes to managing a tight project budget, every penny counts. Let’s explore some best practices that will help you keep things efficient.

- Detailed Planning and Estimation

Create comprehensive project plans with detailed work breakdown structures. Use multiple estimation techniques, gather expert opinions, and analyze historical data. Include contingency reserves and document all assumptions carefully while considering potential risks as well as market conditions.

- Implement Real-time Monitoring

Utilize project management software for continuous budget tracking. Set up automated alerts for variances, monitor cash flow daily, and implement earned value management metrics. Create dashboards for instant visibility into financial performance and spending patterns.

- Optimize Resource Allocation

Carefully plan and track resource utilization across all project activities. Balance workloads, avoid overbooking, and maintain flexibility in resource scheduling. Regularly assess resource efficiency and make adjustments to prevent unnecessary costs.

- Time Tracking and Billing Accuracy

Implement precise time-tracking systems for all project activities. Ensure accurate billing processes, verify all invoices against deliverables, and maintain detailed records of all expenses. Regular reconciliation prevents billing errors and budget leaks.

- Schedule Regular Budget Reviews

Conduct weekly or bi-weekly budget review meetings with key stakeholders. Analyze variances, discuss potential risks, and make necessary adjustments. Keep detailed meeting minutes and track action items for continuous improvement.

- Document Lessons Learned

Record successes, failures, and insights throughout the project lifecycle. Maintain a centralized database of lessons learned, share knowledge across teams, and use insights to improve future project budgeting processes.

- Provide Training and Resources

Ensure team members understand budget management processes and tools. Offer regular training sessions, provide access to necessary resources, and maintain updated documentation of procedures as well as best practices.

- Limit Resource Overhead

Minimize non-essential expenses and carefully evaluate all resource requests. Implement approval workflows for new expenditures, regularly review recurring costs, and identify opportunities for cost optimization without compromising quality.

Budget Management: A Foundation for Project Success

Project budget management is essential for achieving project success, ensuring financial control, optimizing resource use, and mitigating risks. Implementing best practices such as thorough planning, regular monitoring, and clear communication with stakeholders helps teams maintain budget integrity as well as avoid common pitfalls.

A well-managed budget not only supports project goals but also builds trust among clients and stakeholders. Transparent financial practices contribute to smoother collaborations and clearer expectations throughout the project lifecycle.

Mastering budget management ultimately enhances project outcomes, boosts organizational efficiency, and builds sustainable growth.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Pooja Deshpande is a content contributor at Kooper, focused on creating insightful resources that help agencies and service providers scale efficiently. Passionate about SaaS trends, content strategy, and operational excellence, she delivers practical, easy-to-implement guidance for modern business leaders.