What is Project Accounting? A Complete Guide

Key Highlights

In project management, staying on budget is make-or-break—and yet, plenty of projects still run into financial hiccups that lead to costly overruns and wasted resources.

That’s where project accounting steps in!

The specialized approach zeroes in on the financial side of projects, offering a structured way to plan budgets, track expenses, and control costs.

We’ll dive into the key elements of project accounting and explore how it can reshape your approach to managing project finances.

With the right strategies in place, you can stay on track, reduce financial risks, and achieve greater project success.

What is Project Accounting?

Project accounting refers to the practice of tracking financial metrics specifically related to individual projects. It encompasses the detailed recording of costs, revenues, and profitability associated with each project, allowing organizations to manage their resources effectively as well as make informed decisions.

Project accounting enables these firms to maintain financial clarity, ensuring that all expenses are accounted for and that projects remain profitable. It also facilitates better client communication, as firms can provide accurate financial reports and updates, reinforcing trust along accountability.

Key objectives:

- Budget management: Ensuring that project budgets are adhered to, minimizing the risk of overruns that can jeopardize profitability.

- Resource allocation: Optimizing the use of resources across projects, helping firms allocate staff and capital efficiently based on project needs.

- Performance evaluation: Measuring project outcomes against financial forecasts, enabling firms to assess the effectiveness and profitability of their services.

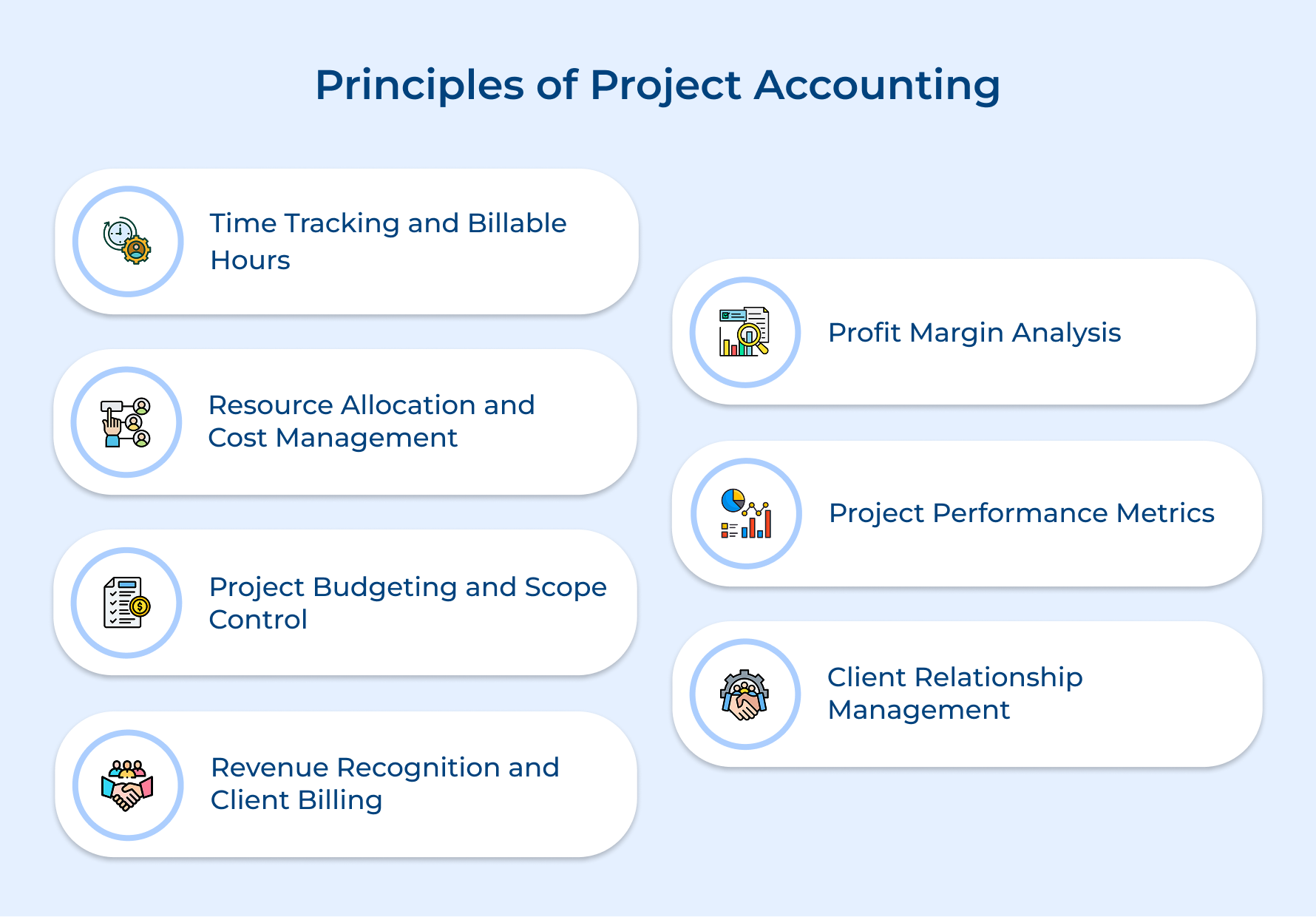

What Are The Key Principles Project Accounting?

Project accounting ensures precise financial tracking for individual projects that emphasizes budgeting, cost control, and profitability. Let’s explore key principles and how they help.

- Time Tracking and Billable Hours

Keeping careful track of time is essential for agency project accounting—it’s what makes accurate billing and solid profitability possible.

Every minute a team member spends on client work needs to be logged, with details on the project, client, and type of task.

The detailed time tracking isn’t just for show; it’s what allows agencies to bill clients accurately and to see how well their team’s time is being used. The billable and non-billable hours give a clear understanding of the overall agency’s efficacy.

- Resource Allocation

Successful agencies keep a close eye on both human and material resource costs across their client projects.

From tracking employee costs with different billing rates to managing software licenses and overhead allocations, resource management helps ensure clients get great service without agencies sacrificing their profit margins.

- Project Budgeting and Scope Control

Creating precise project budgets means considering all possible costs while staying competitive.

Regularly comparing actual costs to the budget and keeping track of any scope changes helps manage client expectations as well as avoid unpleasant surprises.

Clear documentation and proper billing for any additional work protect profitability as well as keep both sides on the same page.

- Revenue Recognition

Establishing clear revenue recognition policies is crucial, especially for projects that extend across multiple time periods.

Consistent billing schedules, managing retainers, handling milestone payments, and reconciling work-in-progress accounts build a solid financial foundation.

- Profit Margin Analysis

By regularly reviewing project profit margins, agencies can identify which clients, projects, and services bring the best returns.

It usually involves looking at direct costs (like labor & materials) and indirect costs (like overhead & admin) while comparing them against revenue. These insights enable better decision-making for future projects.

- Project Performance Metrics

Tracking agency-specific performance indicators offers key insights for smoother operations.

Metrics like utilization rates, project realization, average billable rates, and client profitability shed light on areas for improvement. Analyzing this data guides better pricing, staffing, and resource management.

- Client Relationship Management

Detailed invoices, regular budget updates, and clear communication about costs build trust as well as prevent misunderstandings.

Documenting project financials, change orders, and approvals thoroughly protects both the agency as well as the client, ensuring a smooth process from start to finish.

How to Implement Project Accounting?

Implementing project accounting involves setting up systems to monitor financial performance and ensure accuracy. Learn how to implement it effectively.

1: Define Project Structure and Chart of Accounts

Without clear organization, tracking costs, revenues, and profitability per project would be chaotic.

Project managers as well as accountants use codes to tag every transaction, which makes it easy to sort, filter, and report on specific projects.

Consistent coding also enables automated reporting and cost allocation, streamlining tracking across the organization.

How to have a reliable project coding system?

- Create a logical numbering system: Develop a scalable format, like Department-Year-Project Number, that can grow with your organization. Test it with past data to ensure it fits before fully implementing it.

- Document guidelines and provide examples: Ensure consistency by creating a clear guide for code usage, complete with examples, so team members can apply codes correctly.

- Set up validation checks: Implement checks in your accounting system to catch any incorrect code entries and regularly audit coding practices to maintain accuracy.

2: Select Project Accounting Software

Modern project accounting thrives with robust software that handles complex calculations, multi-project tracking, and real-time insights. Here’s why it’s essential and some tips for smooth implementation:

- Streamlined daily tasks: Software makes it easy to track time, record expenses, generate invoices, and create reports.

- Real-time dashboards let project managers keep tabs on project health, while accountants get consolidated financial views.

Here is why it is important to choose the right project accounting software,

- Document your requirements: Bring in all stakeholders and list must-have features based on your team’s specific needs. It helps in picking genuinely useful software.

- Start small with a pilot program: Test it with a small group to spot any issues early and figure out what training might be needed before a full rollout.

- Hold regular review meetings: Schedule regular check-ins to discuss how it’s going, optimize usage, and address any challenges users might be facing.

3: Establish Project Budgeting Process

Imagine a marketing agency planning a new client campaign. The project manager creates the budget by looking at past campaign costs with current rates for things like ad spending, creative hours, and software fees.

As the project rolls out, they review this budget weekly to see if they’re sticking to the plan.

If ad costs suddenly spike or hours go over, they can quickly adjust or alert the client before it impacts the final bill.

Pro tips:

- Use a standardized budget template: Make sure it covers all direct and indirect costs with automatic calculations. This keeps everyone on the same page and reduces errors.

- Hold weekly check-in meetings: Set up a quick weekly review to compare budgeted vs. actual costs, so you can tackle any variances right away.

- Build a historical budget database: Save past budgets to refine your estimates on future projects and get better at predicting real costs over time.

With a structured budget, everyone knows what to expect financially—and you’re in a much better position to deliver results without surprises.

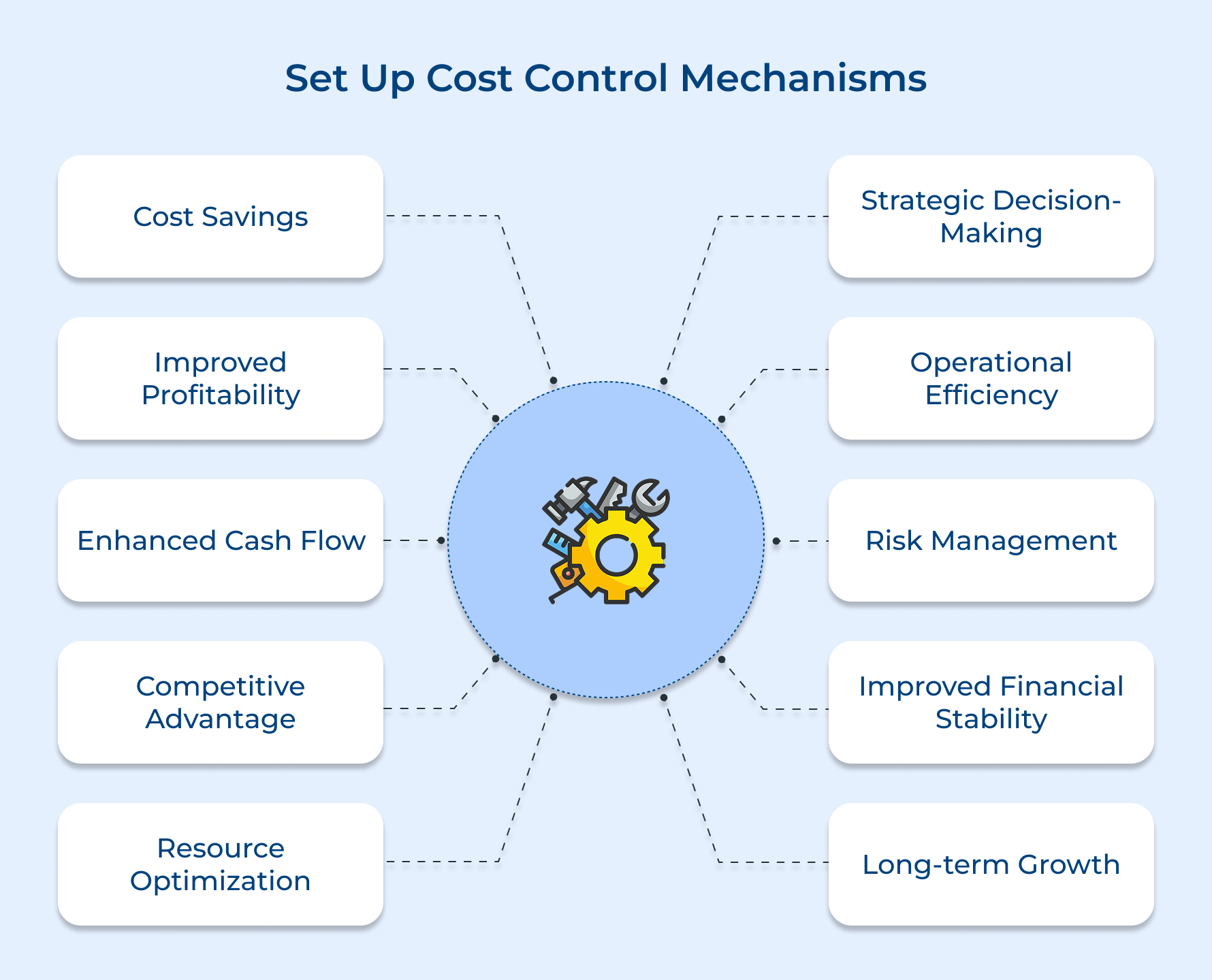

4: Set Up Cost Control Mechanisms

Instead of scrambling to fix financial issues after they pop up, cost control lets you catch warning signs early and stay proactive about managing project expenses.

Project managers keep a close eye on costs daily with automated alerts and reports that flag anything unusual. If a team member needs to make a big purchase, approval workflows ensure it’s aligned with the project budget first.

Regularly checking for any differences between the projected as well as actual costs (called variance analysis), they can quickly spot where adjustments are needed.

5: Implement Time and Expense Tracking

Accurate time and expense tracking is crucial for billing clients correctly and understanding true project costs. It provides data for resource utilization analysis and helps optimize staffing decisions.

Employees log time daily against specific project codes. Expenses are recorded with appropriate documentation. Managers review and approve entries regularly. Data feeds into billing and project cost analysis.

6: Define Revenue Recognition Rules

Let’s say your agency is working on a six-month website redesign project. Instead of waiting until the very end to recognize all revenue, you set up milestones that allow revenue recognition in stages.

So, when you hit the initial design approval, you might recognize a portion of the revenue. Then, as you complete development and launch, you recognize more, step-by-step.

The approach spreads out cash flow and shows a more accurate financial picture as the project progresses.

Finance teams follow these milestones to decide exactly when to recognize revenue.

A tracking system can help by flagging each milestone, making invoicing and reporting simpler as well as more timely.

With regular quarterly reviews, you can make sure revenue recognition remains consistent and in line with all standards.

7: Create Reporting Framework

A robust reporting framework keeps everyone updated on progress and supports quick decision-making.

Managers can keep a close eye on project health with regular reports, while executives get a quick overview through dashboards to see how the whole project portfolio is shaping up.

What about clients? They get customized progress reports based on what matters most to them.

Tips to consider:

- Standardize for simplicity: Create a core set of reports that cover most stakeholder needs, and make sure the format is consistent across all projects.

- Automate for efficiency: Set up reports to auto-generate and send out on a regular schedule, so everyone gets the updates they need, right on time.

- Get feedback: Ask stakeholders for input to keep improving the reports. This way, you’re always refining to make reports more useful and relevant.

8: Train Team Members

Training ensures all team members understand their roles in project accounting and can use the systems effectively. It reduces errors as well as improves data quality while increasing system adoption.

New employees receive initial training on systems and procedures. Ongoing training addresses updates and common issues. Refresher sessions maintain knowledge and address gaps.

How to build a robust process here?

- Develop role-specific training modules

- Create a library of quick reference guides and video tutorials

- Schedule monthly “office hours” for team members to get help

9: Monitor and Adjust

Keeping your project accounting system in top shape requires regular maintenance. Here are a few ways you can try to keep it efficient.

- Quarterly checkups: Schedule regular reviews every quarter to go over performance metrics and gather user feedback. Think of it as a tune-up to keep things smooth and responsive.

- Build a wish list: Keep a log of frequent issues and user requests for improvements. The list helps you prioritize updates that will make the biggest difference for users.

- Annual full-system check: Once a year, step back and assess the entire project accounting framework.

Does it still align with your business goals? This is your chance to make bigger adjustments to stay ahead of the curve.

Role and Responsibilities of Project Accountants in Projects

Project accountants are crucial in managing the financial aspects of a project. Their responsibilities span from budgeting and cost tracking to ensuring accurate billing and profitability.

Financial Planning and Setup

When it comes to building project budgets, project accountants go all in, creating detailed budgets that cover everything from labor costs to resource allocations and overhead.

They keep a close eye on the financial health of each project, making sure things stay on track from start to finish.

For managing costs, it’s all about clear systems. Effective tracking distinguishes between billable and non-billable work so nothing slips through the cracks.

Daily Financial Operations

Accurate time and expense tracking are essential for effective project accounting, ensuring client billing is correct as well as profit margins are maintained.

Regular checks, validated codes, and clear allocations keep projects on budget, while audits add an extra layer of compliance.

Monitoring resource costs and staff utilization helps managers make smart, data-backed decisions on team productivity, driving more efficient project outcomes.

Client Financial Management

Invoices are processed smoothly by aligning with project milestones and agreements, ensuring timely payments.

Retainer reconciliations and resolving billing queries help maintain healthy cash flow along with strong client relationships.

Revenue recognition follows clear rules, ensuring compliance and accurate financial reporting.

Work-in-progress accounts and milestone completions are tracked, while payment schedules match the agreed-upon revenue timing for consistency.

Project Financial Analysis

Regular performance monitoring helps track profitability and budget variances, spotting trends early for quick adjustments.

Realization rates provide valuable insights for proactive financial management.

Financial reporting keeps stakeholders informed with detailed reports and profitability analysis.

Executive dashboards and client reviews offer clear updates on project status, while data-driven decisions come from comprehensive financial reporting, ensuring transparency as well as alignment with project goals.

Strategic Support

Effective decision-making relies on financial analysis to guide resource allocation and pricing strategies.

Data-driven insights shape portfolio management and strategic choices, ensuring decisions align with financial goals.

Regular evaluations of financial workflows uncover opportunities for greater efficiency, while process improvements reduce administrative burdens and strengthen controls.

Future Planning

Organizational growth thrives with strategic capacity planning and system evaluations.

Pricing strategies adapt based on market trends and costs, ensuring long-term success.

As businesses expand, financial planning supports scalability, while new services are developed with solid financial backing.

Resource growth aligns with both organizational capabilities and evolving market needs, ensuring sustainable business evolution.

Benefits of Project Accounting

Project accounting offers numerous advantages, including enhanced financial insights, better budget control, and improved profitability. Let us explore all its benefits.

Greater Financial Insight

Project accounting provides granular visibility into each project’s profitability, cost structure, and revenue patterns. Agencies identify their most profitable clients and team configurations, enabling strategic decisions about which projects to pursue as well as how to price services.

Effective Budget Control

Detailed tracking of project expenses against budgets allows agencies to spot overruns early and take corrective action. Real-time monitoring of labor hours, resource usage, and external costs helps maintain profit margins as well as prevent scope creep.

Accountability Enhancement

Project accounting creates clear ownership of financial outcomes by tracking deliverables, time spent, and resources used by each team member. Transparency helps improve employee productivity and ensures everyone understands their impact on project profitability.

Optimized Resource Distribution

Through accurate tracking of resource utilization, agencies can better allocate staff across projects, prevent overbooking, and identify capacity gaps. It leads to improved workforce planning and higher billable hour ratios.

Streamlined Invoicing Process

Automated time tracking and expense recording enable faster, more accurate client billing. Detailed project accounting records support transparent invoicing, reduce billing disputes, and accelerate payment collection from clients.

Proper Revenue Timing

Project accounting enables accurate revenue recognition based on project completion stages and milestones. Agencies get to maintain consistent cash flow, predict future revenue streams, and make informed decisions about business growth.

Strengthening Project Outcomes with Financial Discipline

Embracing project accounting excellence is essential for organizations aiming for success. Prioritizing accurate financial planning, diligent cost management, and transparent reporting allows teams to navigate complexities effectively while minimizing risks.

Adopting best practices in project accounting positions organizations to achieve their objectives and drive sustainable growth. A focus on robust financial strategies builds a proactive approach to resource management, ensuring alignment with project goals.

Ultimately, cultivating a culture of project accounting excellence empowers teams to unlock their potential, leading to successful project delivery and long-term resilience in an ever-evolving environment.

Limit time — not creativity

Everything you need for customer support, marketing & sales.

Neeti Singh is a passionate content writer at Kooper, where he transforms complex concepts into clear, engaging and actionable content. With a keen eye for detail and a love for technology, Tushar Joshi crafts blog posts, guides and articles that help readers navigate the fast-evolving world of software solutions.